United States Securities and Exchange Commission

Washington, D.C. 20549

NOTICE OF EXEMPT SOLICITATION

Pursuant to Rule 14a-103

United States Securities and Exchange Commission

Washington, D.C. 20549

NOTICE OF EXEMPT SOLICITATION

Pursuant to Rule 14a-103

Name of the Registrant: The Coca-Cola Company

Name of persons relying on exemption: The Shareholder Commons, Inc.

Address of persons relying on exemption: PO Box 7545, Wilmington, Delaware 19803-7545

Written materials are submitted pursuant to Rule 14a-6(g) (1) promulgated under the Securities Exchange Act of 1934. Submission is not required of this filer under the terms of the Rule but is made voluntarily in the interest of public disclosure and consideration of these important issues.

WHY SHAREHOLDERS SHOULD VOTE FOR THE

PROPOSAL ON PUBLIC HEALTH COSTS:

REBUTTAL TO THE COCA-COLA COMPANY BOARD

The Shareholder Commons urges you to vote FOR Item 4 on the proxy, the shareholder proposal requesting that the Board study the public health costs created by the food and beverage business of the Coca-Cola Company (“Coke” or the “Company”) and the manner in which such costs may affect many Coke shareholders who rely upon overall market returns to support the value of their diversified portfolios.

The Shareholder Commons is a non-profit organization that seeks to shift the paradigm of investor thinking away from a narrow and harmful focus on individual company value toward a systems-first investment approach that serves investors and their beneficiaries better.

Background

The Coca-Cola Company sells unhealthful products

As the Company acknowledges in the section of its proxy statement opposing the Proposal (the “Opposition Statement”), the Access to Nutrition Foundation (“ATNF”) is a respected independent nonprofit organization based in the Netherlands and funded by third parties such as the Bill & Melinda Gates Foundation, the Dutch Ministry of Foreign Affairs, the U.K. Department for International Development, and the Robert Wood Johnson Foundation. The organization reported on the unhealthful nature of the Company’s products in its Global Index 2021, which included the following facts:1

| · | Only 11 percent of the Company’s global sales consisted of healthful products |

| · | Only 8 percent of its sales came from products suitable to market to children |

| · | From 2018 to 2021, there was no improvement in the nutritional profile of the products the ATNF assessed |

| · | Of 25 companies assessed, Coke ranked 22 for the healthfulness of its product profile |

Sugary drinks are driving an obesity epidemic

Coke is famous for sugary drinks. The Harvard University School of Public Health says sugary drinks, such as those our Company makes, are a major public health problem:

Americans consume on average more than 200 calories each day from sugary drinks—four times what they consumed in 1965—and strong evidence indicates that our rising thirst for “liquid candy” has been a major contributor to the obesity and diabetes epidemics…

Research shows that sugary drinks are one of the major determinants of obesity and diabetes, and emerging evidence indicates that high consumption of sugary drinks increases the risk for heart disease, the number one killer of men and women in the U.S.2

The obesity crisis threatens the returns of Coke’s diversified investors

The World Health Organization quantifies the social burdens of obesity as equivalent to nearly 3 percent of global GDP.3 This cost, year after year, devastates economic growth. Thus, even if sales of sugar-laden products may benefit Coke’s financial returns, they are bad for Coke’s shareholders who don’t just own Coke but rely on a growing economy to support their diversified portfolios. As Warren Buffet, Chair of Berkshire Hathaway—our Company’s largest shareholder—has pointed out, GDP is the greatest proxy for diversified portfolio value.4

_____________________________

1 https://accesstonutrition.org/index/global-index-2021/

2 https://www.hsph.harvard.edu/nutritionsource/healthy-drinks/beverages-public-health-concerns/

3 https://www.schroders.com/en/sysglobalassets/digital/insights/2019/pdfs/sustainability/sustainex/sustainex-short.pdf

4 See, e.g., https://archive.fortune.com/magazines/fortune/fortune_archive/2001/12/10/314691/index.htm (total market capitalization to GDP “is probably the best single measure of where valuations stand at any given moment”) (quoting Warren Buffet).

| 2 |

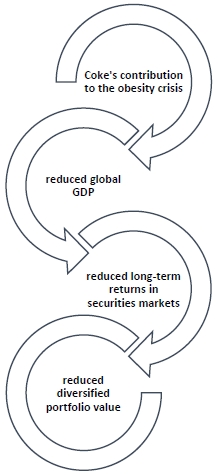

As shown in Figure 1, Company choices that permit a continued negative impact on public health, as the ATNF describes, threaten the financial returns of its diversified shareholders, even if those decisions might benefit the Company financially.

FIGURE 1

The Proposal

The Proposal asks for a report on the public health costs Coke’s food and beverage business creates and the manner in which such costs may impact the many Coke shareholders who rely upon overall market returns to support the value of their diversified portfolios:

RESOLVED, shareholders ask the Board of The Coca-Cola Company (the “Company” or “Coke”) to commission and disclose a report on the external public health costs created by the Company’s food and beverage businesses and the manner in which such costs may affect its diversified shareholders, whose ability to meet their financial goals depends primarily on overall market returns rather than the relative performance of individual companies.

| 3 |

For the diversified investors who make up a large portion of Coke shareholders, the cost of a continued obesity crisis may very well outweigh any profits Coke receives from increasing sales. The Proposal asks that the Company explain this trade-off to shareholders so they can understand the true cost of its decisions from the perspective of Coke’s owners.

We urge diversified shareholders and the asset managers and proxy-voting professionals who represent them to vote FOR Item 4. Supporting the Proposal signals that you want to understand how the Company’s focus on its own financial returns may be harmful to diversified investors.

We recognize that not all food will be healthful and that there is a legitimate business selling sweets and other indulgent products. However, when those sales become excessive and consumption of such products crowds out the consumption of healthful foods, public health—and consequently economic growth—is threatened. This threat to economic growth is a concern for diversified investors.

The existence of this trade-off between Coke’s financial performance and the performance of financial markets overall means that diversified shareholders of Coke need to understand how it strikes the balance between increasing its own profits and the public interest, because if Coke overemphasizes its own sales (as the ATNF data suggest) it may be harming the majority of its shareholders by threatening their diversified portfolios’ value.

Thus, voting FOR Item 4 does not constitute a criticism of the Company’s business decisions or products. The requested report is intended to allow shareholders to understand how the balance is being struck on their behalf between Company profits and their investment portfolios.

Without the report the Proposal requests, shareholders will not be equipped to understand the true cost of Company decisions about product mix, product formulation, and marketing. More specifically, diversified investors and the fiduciaries who vote on their behalf will not be able to understand the effect these decisions are having on their investment portfolios.

Obesity: A Global Health Crisis that Is Also an Economic Crisis

There is no question that obesity is a serious health crisis. As two observers put it:

Obesity is a grave public health threat, more serious even than the opioid epidemic. It is linked to chronic diseases including type 2 diabetes, hyperlipidemia, high blood pressure, cardiovascular disease, and cancer. Obesity accounts for 18 percent of deaths among Americans ages 40 to 85, according to a 2013 study challenging the prevailing wisdom among scientists, which had placed the rate at around 5 percent. This means obesity is comparable to cigarette smoking as a public health hazard; smoking kills one of five Americans and is the leading preventable cause of death in the United States.5

| 4 |

The World Health Organization provides the following salient facts with respect to the crisis:

| · | Worldwide obesity has nearly tripled since 1975. |

| · | In 2016, more than 1.9 billion adults 18 years and older were overweight. Of these, more than 650 million were obese. |

| · | Thirty-nine percent of adults aged 18 years and above were overweight in 2016, and 13 percent were obese. |

| · | Most of the world’s population lives in countries where overweight and obesity kill more people than underweight. |

| · | Thirty-nine million children younger than 5 were overweight or obese in 2020. |

| · | More than 340 million children and adolescents aged 5-19 were overweight or obese in 2016. |

| · | Obesity is preventable.6 |

Numerous studies link the crisis to diet,7 and a wave of new science has emerged on sugar’s role in disease causation. As The Harvard School of Public Health states plainly with respect to the sugary drinks for which Coke is known:

Beyond weight gain, routinely drinking these sugar-loaded beverages can increase the risk of type 2 diabetes, heart disease, and other chronic diseases. Furthermore, higher consumption of sugary beverages has been linked with an increased risk of premature death.8

In addition to the human toll of this crisis, obesity drags down GDP, impoverishing the globe. One survey of the literature noted:

Obesity also imposes a large economic burden on the individual, and on families and nations. In 2014 the global economic impact of obesity was estimated to be US $2.0 trillion or 2.8% of the global gross domestic product (GDP). Besides excess health care expenditure, obesity also imposes costs in the form of lost productivity and foregone economic growth as a result of lost work days, lower productivity at work, mortality and permanent disability. It has been described in recent studies and reviews that there is a gradient between increasing BMI and costs attributable to obesity.9

_____________________________

5 David Blumenthal and Shanoor Seervai, Rising Obesity in the United States Is a Public Health Crisis, The Commonwealth Fund (April 24, 2018) available at https://www.commonwealthfund.org/blog/2018/rising-obesity-united-states-public-health-crisis

6 World Health Organization, Obesity and Overweight, (June 9, 2021) available at https://www.who.int/news-room/fact-sheets/detail/obesity-and-overweight.

7 See Harvard School of Medicine, Food and Diet: Beyond Willpower: Diet Quality and Quantity Matter, available at https://www.hsph.harvard.edu/obesity-prevention-source/obesity-causes/diet-and-weight/

8 https://www.hsph.harvard.edu/nutritionsource/healthy-drinks/sugary-drinks/

9 Maximilian Tremmel, Ulf-G. Gerdtham, Peter M. Nilsson, and Sanjib Saha. Economic Burden of Obesity: A Systematic Literature Review, Int J Environ Res Public Health. 2017 Apr; 14(4): 435.

| 5 |

The McKinsey Global Institute has published research expressing the economic challenge in more dire terms:

The global economic impact of obesity is roughly $2 trillion, or 2.8 percent of global GDP, according to our analysis, which reflects the fact that obesity places a burden on developed and developing economies alike. This is equivalent to the GDP of Italy or Russia. Obesity today has the same impact on the global economy as armed violence, war, and terrorism, and only a shade less than smoking. These three are far and away the largest global economic impact areas driven by human behavior.10

Why you should support the Proposal

| · | Coke’s products contribute to the obesity crisis. |

| · | As the ATNF detailed, Coke has not improved the health profile of its products over the last three years. |

| · | Exacerbating and extending the obesity epidemic has dire consequences for public health and economic growth. |

| · | The loss in economic growth caused by an extended obesity epidemic threatens Company shareholders’ diversified portfolios, and that threat may outweigh any benefit those shareholders receive from Coke incrementally increasing its profitability by continuing to market and sell products that contribute to the epidemic. |

| · | Fiduciaries and advisors should understand whether their diversified clients and beneficiaries are at risk from Coke trading off economic growth for its own financial performance. |

| · | Company decision-makers are heavily compensated in equity, so that they do not share the same broad market risk as Coke’s diversified shareholders. |

| · | Voting FOR will signal that shareholders want to understand whether Coke is putting the global economy at risk in order to improve financial performance. |

| · | The Proposal only asks for an analysis, not a change in practice. Any trade-offs of public interest for financial gain must be explained, so that shareholders can make educated decisions about the balance between promoting internal financial return and maintaining the economic health that supports their diversified portfolios. |

_____________________________

10 Richard Dobbs and James Manyika, The Obesity Crisis (July 15, 2015), McKinsey Global Institute, available at https://www.mckinsey.com/mgi/overview/in-the-news/the-obesity-crisis.

| 6 |

The Company’s Opposition Statement misses the point

Experts estimate global GDP losses of almost 3 percent due to the obesity epidemic. This could directly harm the interests of Coke’s diversified shareholders, as a healthy economy is a far greater value-driver for diversified portfolios than the profits of any one company within those portfolios. Indeed, a number of studies have shown systematic factors, rather than individual company performance, explain 75-94 percent of average portfolio return.11

The Company’s Opposition Statement recommending that shareholders vote against the Proposal does not address this issue at all. It simply argues that Coke and third parties disclose information about attempts to improve the nutritional profile of its products. This disclosure does not address the fundamental question of the trade-offs the Company is making.

If anything, the unearned self-congratulations and distortions included in the Opposition Statement demonstrate the need for Coke to reckon honestly with a difficult issue, which is all the Proposal asks.

The Company claims it is “already addressing the overarching issues raised in the Proposal”

Coke describes product reformulations, low- and no-calorie beverage sales, portion size reduction, investment in zero-calorie beverages, and participation in calorie/sugar reduction initiatives. But patting itself on the back for these efforts does not address the question at the heart of the Proposal, which asks Coke to report on the impact of its decision not to do more, leaving it with a score of 3.4 out of 10 and ranking 22 among the 25 companies the ATNF examined. This decision, which may harm a majority of Coke’s own shareholders, remains unexamined.

For example, neither the Opposition Statement nor any other Company disclosure explains how Coke decided:

| · | Not to improve the overall healthfulness of its product line over three years |

| · | Not to extend Coke’s responsible marketing programs beyond the United States and Europe |

| · | Not to operate in a manner so that healthful products accounted for more than 11 percent of sales |

| · | Not to extend it lobbying disclosures beyond the United States.12 |

These decisions create trade-offs for diversified shareholders, who are entitled to more information about those trade-offs.

The Company claims its work in addressing these issues “is already disclosed by the Company and is further analyzed and reported on by numerous credible third parties.”

This just is not true. Coke and third parties such as the ATNF simply report on whether Coke is addressing its impact on public health. Coke has not cited a single source (nor have we found one) that addresses the impact of Coke’s continuing contribution to the obesity epidemic on economic growth or diversified portfolios.

_____________________________

11 Lukomnik, Jon and James P. Hawley. Moving Beyond Modern Portfolio Theory: Investing that Matters. (Routledge, 2021).

12 The ATNF identifies each of these failures, see n.1.

| 7 |

In short, trumpeting a reduction in package size or grams of sugar in certain products is simply non-responsive to the question the Proposal poses: would global health be improved if Coke significantly altered the health profile of its products, and would that alteration benefit diversified shareholders by slowing the obesity epidemic? Coke simply does not address the question the Proposal raises.

The Opposition Statement continues the Company’s practice of obscuring the relationship between its products and global health

The Opposition Statement also implies that the problem of added sugar consumption is unsettled.

First, it presents a graph showing obesity continuing to rise, even after added sugar consumption in the United States peaked, stating that obesity is “complex” and that “diet is one of many risk factors.” Yet a statistical analysis of these data shows that they support the relationship between sugar consumption and obesity:

First, sugar consumption’s drastic rise from the 1970’s to the 1990’s is followed by the subsequent exponential growth in obesity prevalence from the late 1970’s to the 2000’s, and, even more indicative of this association, the drop in sugar consumption from the 1990’s to 2010’s preceding a slowing of the annual increase in obesity prevalence in the 2000’s. Second, this general trend observed shows that over time, obesity prevalence may change as a response to changes in sugar consumption per capita, indicating a positive correlation between sugar consumption and obesity prevalence qualitatively observed.13

Second, Coke presents a quote from a report from the International Monetary Fund ostensibly to show that “direct externalities for public health cannot be solely attributed to food and beverage consumption.” Of course, the fact that the production, marketing, and sales of calorie-laden beverages is not the only factor contributing to the obesity epidemic is not relevant to the question the Proposal presents, which is how much of it is attributable to Coke, and how much economic value is being sacrificed to increase the Company’s bottom line?

_____________________________

13 Samir Faruque, Janice Tong, Vuk Lacmanovic, Christiana Agbonghae, Dulce M. Minaya, and Krzysztof Czaja The Dose Makes the Poison: Sugar and Obesity in the United States – a Review, Pol J Food Nutr Sci. 2019; 69(3): 219–233.

| 8 |

Unfortunately, Coke has a history of trying obscure the clear science relating sugar consumption to the obesity epidemic. A 2020 Cambridge University Press analysis showed that Coke had engaged in a strategy to use researchers to mix science and public relations strategy, reaching the following results and conclusions:

Results:

Emails identified two main strategies, regarding information and messaging and constituency building, associated with a series of practices and mechanisms that could influence public health nutrition. Despite publications claiming independence, we found evidence that Coca-Cola made significant efforts to divert attention from its role as a funding source through diversifying funding partners and, in some cases, withholding information on the funding involved. We also found documentation that Coca-Cola supported a network of academics, as an ‘email family’ that promoted messages associated with its public relations strategy, and sought to support those academics in advancing their careers and building their affiliated public health and medical institutions.

Conclusions:

Coca-Cola sought to obscure its relationship with researchers, minimise the public perception of its role and use these researchers to promote industry-friendly messaging. More robust approaches for managing conflicts of interest are needed to address diffuse and obscured patterns of industry influence.14

There is not a serious question whether over-consumption of sugar is a public health issue. Coke’s continued attempts to obscure this fact is further evidence of the need for the report the Proposal requests.

* * * * *

Coke has failed to make any argument that is responsive to the request for a report that would help shareholders understand whether the Company’s decision not to address the obesity crisis more directly threatens public health and, by extension, the economic health that is the single greatest value driver of its diversified shareholders’ portfolios. Shareholders should let the Board and management know that investors do care about the potential trade-offs Coke is making that would put global public health at risk.

Conclusion

Please vote FOR Item 4

By voting FOR Item 4, shareholders can urge Coke to account directly for its effect on public health, upon which a thriving economy depends. Such a report can aid the Board and management in authentically addressing the public need for more healthful diets while supporting the interests of its diversified shareholders and others.

The Shareholder Commons urges you to vote FOR Item 4 on the proxy, the shareholder proposal requesting a report on external public health costs at the Coke Annual Meeting on April 26, 2022.

_____________________________

14 Paulo Serodio, Gary Ruskin, Martin McKee and David Stuckler, Evaluating Coca-Cola’s attempts to influence public health ‘in their own words’: analysis of Coca-Cola emails with public health academics leading the Global Energy Balance Network (August 3, 2020), published online by Cambridge University Press.

| 9 |

For questions regarding Item 4 submitted by Elizabeth Herbert, Corwin Fergus, and Jason Wardenburg, please contact Sara E. Murphy, The Shareholder Commons at +1.202.578.0261 or via email at sara@theshareholdercommons.com.

THE FOREGOING INFORMATION MAY BE DISSEMINATED TO SHAREHOLDERS VIA TELEPHONE, U.S. MAIL, E-MAIL, CERTAIN WEBSITES, AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE OR AS A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY.

PROXY CARDS WILL NOT BE ACCEPTED BY FILER

NOR BY THE SHAREHOLDER COMMONS.

TO VOTE YOUR PROXY, PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

10