UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||

| ☑ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

2023

PROXY STATEMENT

NOTICE OF ANNUAL

MEETING OF

SHAREOWNERS

Tuesday, April 25, 2023

8:30 A.M. Eastern Time

Table of Contents

QUESTIONS AND ANSWERS Please see Questions and Answers in Annex A beginning on page 116 for important information about the 2023 Annual Meeting of Shareowners, proxy materials, voting, Company documents, communications, and the deadlines to submit shareowner proposals and Director nominees for the 2024 Annual Meeting of Shareowners. Additional questions may be directed to Shareowner Services at (404) 676-2777 or shareownerservices@coca-cola.com. |

Links to websites included in this Proxy Statement are provided solely for convenience purposes. Content on the websites, including content on our Company website, is not, and shall not be deemed to be, part of this Proxy Statement or incorporated herein or into any of our other filings with the Securities and Exchange Commission (the “SEC”).

This Proxy Statement contains information that may constitute “forward-looking statements.” Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which generally are not historical in nature. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future, including statements expressing general views about future operating results, are forward-looking statements. Management believes that these forward-looking statements are reasonable as and when made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Our Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause our Company’s actual results to differ materially from historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to, those described in Part I, “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 (the “Form 10-K”) and those described from time to time in our future reports filed with the SEC.

| 1 | ||||||||||||||

| 1 | Notice of 2023 Annual Meeting of Shareowners |

Meeting Information

DATE AND TIME

Tuesday, April 25, 2023

8:30 a.m. Eastern Time

ANNUAL MEETING WEBSITE

Access links to vote in advance, listen to video messages from certain of our Directors, submit questions in advance of the meeting

and learn more about our Company at

www.coca-colacompany.

com/annual-meeting-of-

shareowners.

VIRTUAL MEETING

LOCATION

The 2023 Annual Meeting of Shareowners will be held exclusively online. Visit https://meetnow.global/

KO2023 to attend the

meeting.

Holders of record of our Common Stock as of February 24, 2023 are entitled to notice of, and to vote at, the meeting.

An electronic list of shareowners of record as of the record date will be available for inspection by shareowners for any purpose germane to the meeting from April 14 through April 24, 2023. To access the electronic list during this time, please send your request, along with proof of ownership, by email to shareownerservices@coca-cola.com. You will receive confirmation of your request and instructions on how to view the electronic list. Please see question 23 on page 122 for more information.

Voting Methods

Please vote using one of the following advance voting methods. Make sure to have your proxy card or voting instruction form in hand and follow the instructions.

Shareowners may also vote during the meeting by accessing the virtual meeting according to the instructions in question 2 on page 116.

| Shareowners of Record |

Beneficial Owners | |||

| ADVANCE VOTING |

(shares registered on the books of the Company via Computershare) | (shares held through your bank or brokerage account) | ||

Internet |

www.investorvote. com/coca-cola | www.proxyvote.com | ||

Telephone |

Call 1-800-652- VOTE or the telephone number on your proxy card | Call 1-800-454-8683 or the telephone number on your voting instruction form | ||

|

Sign, date and return your proxy card | Sign, date and return your voting instruction form |

Not all beneficial owners may vote at the web address and phone number provided above. If your control number is not recognized, please refer to your voting instruction form for specific voting instructions.

Items of Business

| COMPANY PROPOSALS | OUR BOARD’S RECOMMENDATION |

PAGE | ||||

| 1 | Elect as Directors the 13 Director nominees named in the attached Proxy Statement to serve until the 2024 Annual Meeting of Shareowners. |  |

FOR

each Director Nominee |

12 | ||

| 2 | Conduct an advisory vote to approve executive compensation. |  |

FOR | 50 | ||

| 3 | Conduct an advisory vote on the frequency of future advisory votes to approve executive compensation. |  |

For ONE YEAR | 91 | ||

| 4 | Ratify the appointment of Ernst & Young LLP as Independent Auditors of the Company to serve for the 2023 fiscal year. |  |

FOR | 95 | ||

| SHAREOWNER PROPOSALS | ||||||

| 5 | Vote on a shareowner proposal requesting an audit of the Company’s impact on nonwhite stakeholders. |  |

AGAINST | 99 | ||

| 6 | Vote on a shareowner proposal requesting a global transparency report. |  |

AGAINST | 105 | ||

| 7 | Vote on a shareowner proposal regarding political expenditures values alignment. |  |

AGAINST | 108 | ||

| 8 | Vote on a shareowner proposal requesting an independent Board chair policy. |  |

AGAINST | 111 | ||

| 9 | Vote on a shareowner proposal requesting a report on risks from state policies restricting reproductive rights. |  |

AGAINST | 114 | ||

Shareowners will also transact such other business as may properly come before the meeting and at any adjournments or postponements of the meeting.

Your vote is important to us. Whether or not you plan to participate in the 2023 Annual Meeting, we urge you to vote and submit your proxy in advance of the meeting by one of the methods described in the attached Proxy Statement.

The 2023 Annual Meeting will be held entirely online via live webcast. We are continuing with a virtual format for our 2023 Annual Meeting by leveraging the latest technology to provide expanded access, while remaining committed to ensuring that shareowners will be afforded the same rights and opportunities participating in the virtual meeting as they would at an in-person meeting. For the last three years, we have received positive feedback about the virtual format which allows shareowners to participate in more public company annual meetings from any location around the world, at no cost to them. While you will not be able to attend the meeting at a physical location, as a Coca-Cola shareowner, you will be able to attend the meeting online, vote your shares electronically and submit questions during the meeting.

To attend the 2023 Annual Meeting, visit https://meetnow.global/KO2023. For more information on how to participate in the 2023 Annual Meeting, please see Annex A of the attached Proxy Statement beginning on page 116.

We are making the Proxy Statement and the form of proxy first available on or about March 10, 2023.

March 10, 2023

By Order of the Board of Directors

JENNIFER D. MANNING

Associate General Counsel and Corporate Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2023 ANNUAL MEETING OF SHAREOWNERS TO BE HELD ON APRIL 25, 2023:

The Notice of Annual Meeting, Proxy Statement and Annual Report on Form 10-K for the year ended December 31, 2022 are available at www.edocumentview.com/coca-cola.

| 2 | ||||||||

“

Our vision as a Company is to achieve top-quartile growth and to pursue a total beverage company ambition.

”

| 2 | Letter from Our Chairman and Chief Executive Officer |

TO MY FELLOW SHAREOWNERS:

On behalf of the Board of Directors and the Coca-Cola team, thank you for your investment. In 2022, we delivered strong results. We were able to do this because we focused intensely on the needs of our consumers. Whether times are good or difficult, staying close to consumers is vital to our success. We faced many challenges during 2022, from the ongoing impact of the pandemic to war to global inflationary pressures. We begin 2023 focused on what we can control, including providing great products for consumers. This focus has guided us successfully through our long history. And it will guide us into the future. The opportunities we see The Coca-Cola Company’s purpose is to refresh the world and make a difference. This clear purpose has helped us navigate challenges these past few years. Our vision as a Company is to achieve top-quartile growth and to pursue a total beverage company ambition. Our ambition is unchanging, as it rests on optimism about our industry and the Company’s future. Developed markets account for about 20% of the world’s population. About two-thirds of what people in those markets drink is a commercially made beverage. |

But our market share of those beverages is in the mid-teens. This means we have an enormous opportunity to develop more commercial drinks in developed markets and to continue gaining share. Developing and emerging markets represent about 80% of the world’s population. There, only about a third of beverage consumption is in commercial beverages, and our market share is only in the mid-single digits. Simply put, we see vast, long-term potential to build our business, no matter where we operate. The relevance of our brands You probably know some of the cornerstones of Coke’s history. Coca-Cola was introduced in 1886 at a soda fountain in Atlanta and has grown to become a global brand available in more than 200 countries and territories. So why does Coke remain Coke? Importantly, each generation of our Company has worked to make Coke relevant to the next generation of consumers. If they hadn’t done this, some other brand might have supplanted Coke as the market leader. The work of maintaining and building brand relevancy is never-ending, and that is because consumers are constantly changing. Marketing must change with them, whether in tone and style or because of the evolution of media. |

| |

| 3 | ||||||||||||||

“We are now faster with innovations,

faster in

stopping things that don’t work, and faster

in breaking down barriers to progress.”

Not so long ago, Diet Coke was bold, even outrageous – an idea introduced via a stage show and television commercials. Today, our marketing – including for Diet Coke – is far different but no less bold in its ambitions. We are driving the most radical marketing transformation in our history. We’ve shaped a focused portfolio. Our engagement with consumers is digital-first. We’ve moved away from focusing on broadcast TV ads to creating immersive experiences, which includes working with influencers to reach consumers. Innovation is essential, but it’s not merely about expansion – it is about discipline. We ask: What interests the consumer? What is the growth potential of a product for our business? Can we be competitive, including creating value for our bottling system and customers? Sometimes, we move beyond our traditional boundaries. For example, we’ve launched Jack Daniel’s & Coca-Cola as a ready-to-drink cocktail through a relationship with Brown-Forman. While it’s early days, this stands out as one example of our ongoing journey to seek ways to bring Coke to consumers in new and dynamic ways. Sustainability and our business As we shape our enterprise for the future, we do so with sustainability as a foundation. And I use the term sustainability in the broadest sense – it includes all the ways we build resilience into our business to bolster our growth and create positive changes in the world. |

We focus on water, packaging and climate challenges in our business and communities. These are interconnected issues, and so are the solutions we support. While there is much we can do as a Company, we can do even more by working with industry partners, nonprofits, governments and other stakeholders. Collective action creates a more significant impact. We start with water because it’s essential to people and ecosystems and is also the main ingredient in our products. We aspire to give back more water to nature and communities than we use in manufacturing our beverages. We’re focused on remaining water-neutral and improving water security where it’s needed most. We design our packaging to enable a circular economy. Our World Without Waste strategy – which is now five years old – includes a goal to recover a bottle or can for every one we sell by 2030 and then to recycle and reuse it. We are focused on reaching 100% collection rates and increasing recycled content in our packaging toward a 50% goal by 2030, as well as striving to make at least 25% of our packaging reusable by 2030. Our work in water and packaging also has impacts on our climate goals. We’ve used a science-based approach to set targets and actions to reduce our carbon footprint significantly. For example, our investments in water replenishment create benefits in ecosystem biodiversity, carbon sequestration and resilience, which help our business and communities adapt to climate change. |

What we’re doing in sustainability is centered on what consumers care about and also on our business priorities. We will have a great business if we help fix some of the problems the world faces. Leadership for the future Finally, I want to thank the people of our Company and system. They successfully worked to navigate many challenges in 2022, and they will continue to do so in 2023 and beyond. We’ve announced a number of changes in our leadership teams over the past six months to support the Company’s continued growth. This is an evolution – our business has been successful because we continue to change. There’s never going to be a perfect organization. It is wrong to expect an organizational structure to solve everything. Culture matters, mindset matters, and having the right incentive system matters. We will always make tweaks, but we’re in a good place today. We are now faster with innovations, faster in stopping things that don’t work, and faster in breaking down barriers to progress. We are at our best when we are at our boldest. And our Company is taking bold steps to thrive in the future.

JAMES QUINCEY Chairman and Chief Executive Officer The Coca-Cola Company |

| 4 | THE COCA-COLA COMPANY 2023 PROXY STATEMENT |

|||||||

| 3 | Refresh the World. Make a Difference. |

Our Company

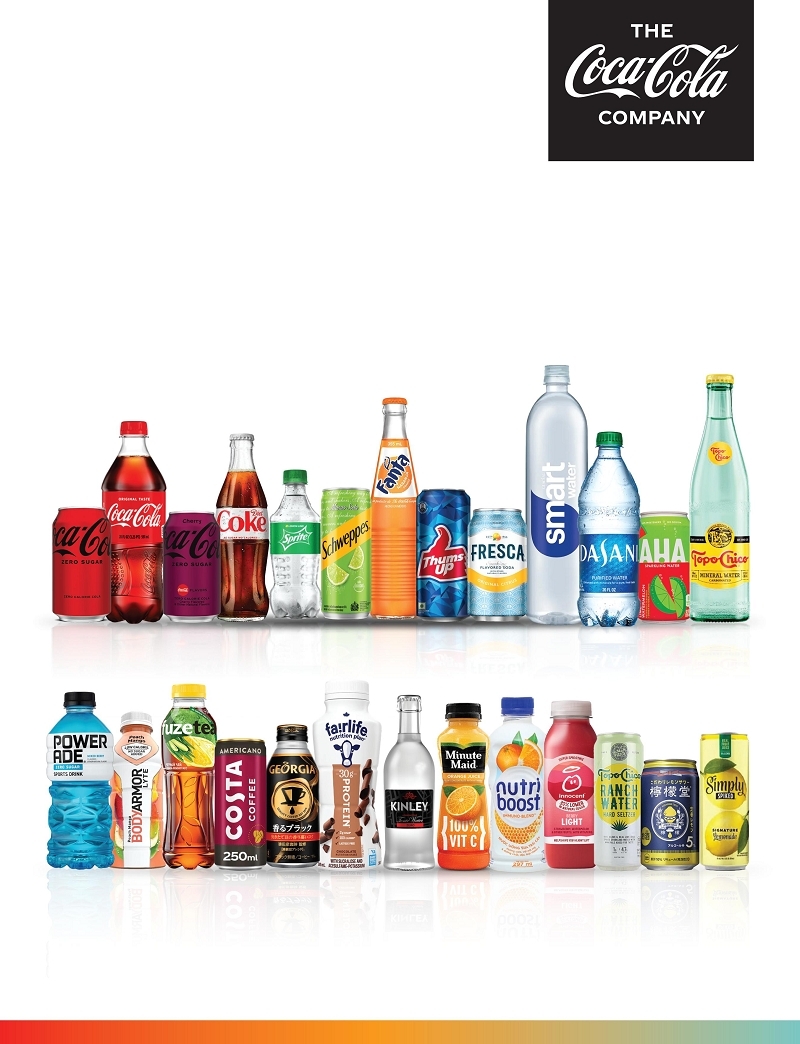

The Coca-Cola Company (the “Company”) is a total beverage company with products sold in more than 200 countries and territories. Our Company’s purpose is to refresh the world and make a difference. Our brands include:

|

| |

| SPARKLING SOFT DRINKS | WATER, SPORTS, COFFEE AND TEA | |

| Coca-Cola, Diet Coke/Coca-Cola Light, Coca-Cola Zero Sugar, Fanta, Fresca, Schweppes*, Sprite and Thums Up | Aquarius, Ayataka, BODYARMOR, Ciel, Costa, doğadan, Dasani, FUZE TEA, Georgia, glacéau smartwater, glacéau vitaminwater, Gold Peak, Ice Dew, I LOHAS, Powerade and Topo Chico | |

|

| |

| JUICE, VALUE-ADDED DAIRY AND PLANT-BASED BEVERAGES | EMERGING | |

| AdeS, Del Valle, fairlife, innocent, Minute Maid, Minute Maid Pulpy and Simply | Fresca Mixed**, Jack Daniel’s & Coca-Cola, Lemon-Dou, Schweppes Premium Drinks, Simply Spiked** and Topo Chico Hard Seltzer** |

| * | Schweppes is owned by the Company in certain countries outside the United States. |

| ** | In the United States and Canada, the Company authorizes third parties to use certain Topo Chico Hard Seltzer, Simply Spiked and Fresca Mixed trademarks and related intellectual property in the production, distribution, marketing and sale of Topo Chico Hard Seltzer, Simply Spiked and Fresca Mixed, as applicable. |

| THE COCA-COLA SYSTEM | LEARN

MORE ABOUT OUR COMPANY |

||||

We are a networked global organization designed to combine the power of scale with the deep knowledge required to win locally. We are able to create global reach with local focus because of the strength of the Coca-Cola system, which comprises our Company and our approximately 200 bottling partners worldwide. OUR GLOBAL REACH Beverage products bearing our trademarks, sold in the United States since 1886, are now sold in more than 200 countries and territories. ● We make our branded beverage products available to consumers throughout the world through our network of independent bottling partners, distributors, wholesalers and retailers as well as our consolidated bottling and distribution operations. ● Consumers enjoy finished beverage products bearing trademarks owned by or licensed to us at a rate of 2.2 billion servings per day. |

You

can learn more about the Company by visiting our website, We also encourage you to read our latest Form 10-K, available at www.coca-colacompany.com/annual-meeting-of-shareowners. The Company’s principal executive offices are located at One Coca-Cola Plaza, Atlanta, Georgia 30313. | ||||

| PORTFOLIO | STRATEGY | STRUCTURE | ||

| Investing to capture every consumption occasion |

Investing in key enablers to spin our flywheels faster |

Investing in our networked organization to support future growth | ||

|

|

|

| SYSTEM PARTNERS | |||

| ~200 | ~950 | ~30M | ~2.2B |

| Bottling Partners | Production Facilities | Customer Retail Outlets | Servings a Day |

| 5 | ||||||||||||||

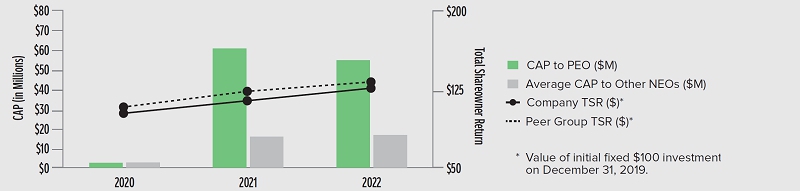

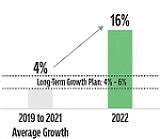

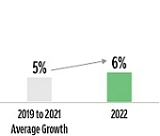

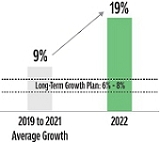

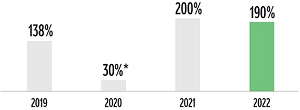

2022 Financial Highlights

| REVENUE GROWTH | OPERATING

INCOME GROWTH |

EARNINGS PER SHARE | CASH FLOW | TOTAL DIVIDENDS PAID | ||||||||

| 11% | 16% | 6% | 19% | $2.19 | $2.48 | $11.0 | $9.5 | $7.6 | ||||

| Reported Net Operating Revenues vs. 2021 | Organic Revenues vs. 2021 (Non-GAAP) | Reported Operating Income vs. 2021 | Comparable Currency Neutral Operating Income vs. 2021 (Non-GAAP) | Reported EPS | Comparable EPS (Non-GAAP) | BILLION Cash Flow from Operations |

BILLION Free Cash Flow (Non-GAAP) |

BILLION | ||||

| Organic revenues is a non-GAAP financial measure that excludes or has otherwise been adjusted for the impact of acquisitions, divestitures and structural changes, as applicable, and the impact of fluctuations in foreign currency exchange rates. Comparable currency neutral operating income is a non-GAAP financial measure that excludes or has otherwise been adjusted for items impacting comparability and the impact of fluctuations in foreign currency exchange rates. Comparable EPS is a non-GAAP financial measure that excludes or has otherwise been adjusted for items impacting comparability. Free cash flow is a non-GAAP financial measure that represents net cash provided by operating activities less purchases of property, plant and equipment. See Annex C on page 127 for reconciliations of non-GAAP financial measures to our results as reported under generally accepted accounting principles in the United States (“GAAP”). | ||||||||||||

2022 Business Highlights

Throughout 2022, we faced an operating environment that was dynamic due to inflation, geopolitical tensions and macroeconomic volatility. Despite these challenges, our strong capabilities and system alignment allowed us to deliver robust growth. We also continued to invest to enhance our capabilities. We executed more efficiently and effectively on a local level, while maintaining flexibility on a global level. We remained committed to driving growth across our business and delivering on our purpose to refresh the world and make a difference through three connected pillars. Highlights of these pillars from 2022 include the following:

|

|

|

| LOVED BRANDS | DONE SUSTAINABLY | FOR

A BETTER SHARED FUTURE |

● We gained value share in nonalcoholic ready-to-drink beverages, driven by share gains in both at-home and away-from-home channels ● We delivered robust unit case volume growth of 5%, balanced across developed, developing and emerging markets as well as across categories ● We grew Coca-Cola Zero Sugar unit case volume by double digits, driven by strong growth across developed, developing and emerging markets ● We have continued our test-and-learn approach since entering the ready-to-drink alcohol category in 2018 with Lemon-Dou in Japan. Our portfolio of brands in this category now includes Topo Chico Hard Seltzer, Schweppes premium drinks, Simply Spiked and Fresca Mixed. In November 2022, we debuted Jack Daniel’s & Coca-Cola in Mexico |

● We set a new, industry-leading goal to have at least 25% of our volume globally sold in refillable or reusable packaging by 2030 ● We joined industry groups to advocate for government authorization in various markets of food grade standards for recycled plastic and to support well-designed plastic recycling programs and infrastructure ● We returned more than 100% of the water used in our finished beverages to nature and communities ● We drove growth of our low- and no-calorie beverages and provided smaller package choices to enable consumers to manage sugar intake. Approximately two-thirds of the products in our portfolio have less than 100 calories per 12-ounce serving ● We released our fourth combined Business & ESG Report, continuing our history of assuring select sustainability metrics while also providing key public disclosures against the Task Force on Climate-Related Disclosures recommendations, as well as other reporting frameworks such as the Sustainability Accounting Standards Board, the Global Reporting Initiative and the UN Global Compact |

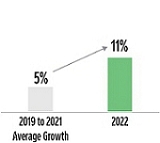

● We demonstrated effective execution of our strategy across operating segments, with strong net operating revenue growth of 11% ● We leveraged our networked structure to be more agile and more efficiently invest resources, leading to an increase in gross profit per advertising spend ● We continued to build a fit-for-purpose balance sheet. We completed the refranchising of Company-owned bottling operations in Cambodia and announced the refranchising of Company-owned bottling operations in Vietnam, both to Swire Coca-Cola Limited. We also sold our equity stake in the bottler in Egypt to Coca-Cola HBC AG ● We remained disciplined with respect to capital allocation priorities as we balanced increased reinvestment in our business while growing our dividend by approximately 5% in 2022 |

| 6 | THE COCA-COLA COMPANY 2023 PROXY STATEMENT |

|||||||

Human Capital

Our people and culture agendas are critical business priorities, and we strive to be a global employer of choice that attracts and retains high-performing talent with the passion, skills and mindsets to drive us on our journey to refresh the world and make a difference. We are committed to building an equitable and inclusive culture that inspires and supports the growth of our employees, serves our communities and shapes a strong and more sustainable business.

OUR HUMAN CAPITAL PILLARS

|

Leadership, Talent and Development | |

| Our strategy is anchored in helping all employees grow and thrive within, and beyond, the Coca-Cola system. We are prioritizing development, increasing transparency, and introducing more flexibility and choice to help employees achieve their career aspirations and to build a more agile, productive and empowered workforce. We focus on hiring and developing capable and diverse talent that mirrors the markets we serve, along with investing in inspirational leadership, providing learning opportunities, and building capabilities that equip our global workforce with the skills they need, all of which enhance and improve engagement and retention. We support all employees as leaders to be role models, to set the agenda for themselves and their teams, and to help people develop and grow – creating an environment for everyone to thrive. | ||

|

Diversity, Equity and Inclusion | |

| We believe that a diverse, equitable and inclusive workplace that mirrors the markets we serve is a strategic business priority that is critical to the Company’s success. We take a comprehensive view of diversity and inclusion across different races, ethnicities, tribes, religions, socioeconomic backgrounds, generations, abilities and expressions of gender and sexual identity. We continue to invest our resources into strategies and initiatives that create a more equitable and inclusive environment. | ||

|

Human Rights | |

| Respect for human rights is a fundamental value of our Company. We strive to align our policies and practices with the UN Guiding Principles on Business and Human Rights across our value chain. We aim to meaningfully improve the lives we touch around the world. | ||

|

Culture and Engagement | |

| Each employee, leader and function across our Company contributes to our growth culture, which is grounded in our Company’s purpose. Our leaders are the stewards of culture change. We focus on four key growth behaviors –being curious, empowered, inclusive and agile – and we value how we work as much as what we achieve. Through our behaviors, actions and outcomes, we embody and shape the culture of the Company. We believe our culture enables our Company’s business strategy and shapes employee experiences. | ||

|

Business Integrity | |

| Our Codes of Business Conduct are grounded in our commitment to do the right thing. They serve as the foundation of our approach to ethics and compliance, and our anti-corruption compliance program is focused on conducting business in a fair, ethical and legal manner. |

| 2022 NOTABLE ACCOLADES |

Ranked 26th in Fortune’s annual ranking of the World’s Most Admired Companies Included in the Bloomberg 2022 Gender-Equality Index as a company committed to supporting gender equality through policy development, representation and transparency Earned a 100% score on the Human Rights Campaign’s Corporate Equality Index for the 16th consecutive year Ranked in the 90th percentile for disability inclusion by Disability:IN Ranked in Newsweek’s 2023 America’s Greatest Workplaces for Diversity Ranked in Forbes annual Best Employers for Women for companies that support women inside and outside the workforce |

|

Our people and culture agendas are key priorities of the Board of Directors (the “Board”). Through the Talent and Compensation Committee, the Board provides oversight of the Company’s policies and strategies relating to talent, leadership and culture, including diversity, equity and inclusion (“DEI”). See page 31 for information regarding the Board’s oversight of human capital. |

| 7 | ||||||||||||||

GLOBAL DIVERSITY, EQUITY AND INCLUSION STRATEGY

We believe that a diverse, equitable and inclusive workplace that mirrors the markets we serve is a strategic business priority and critical to the Company’s success. We continue to advance our DEI initiatives inside our Company as well as in the communities we call home. We have developed our DEI plans with permanence in mind, while being open to evolving our plans as we continue to make progress toward our aspirations.

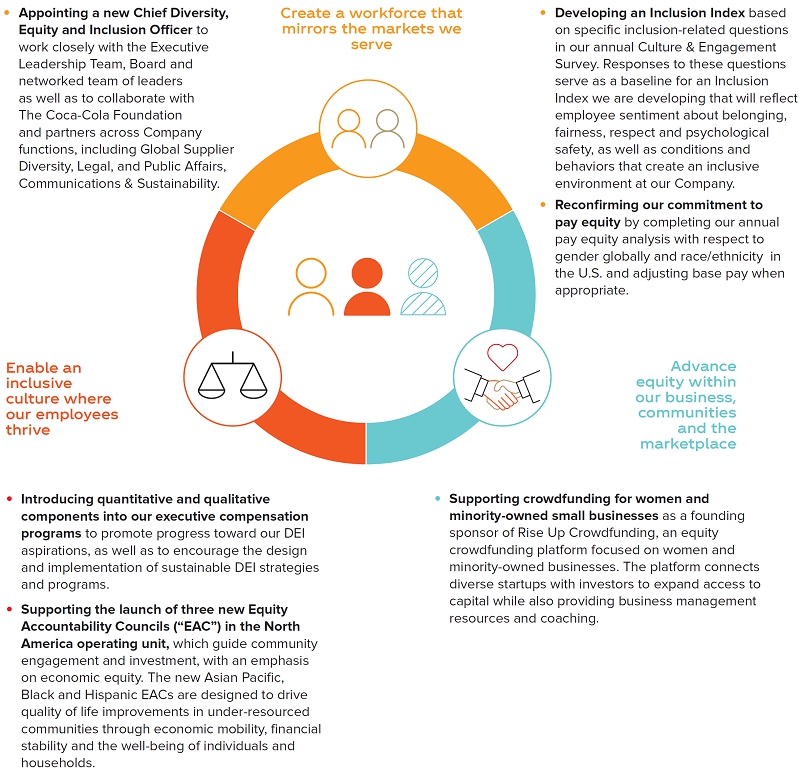

Our DEI strategy comprises three long-term ambitions:

|

1 Create a workforce that mirrors the markets we serve |

|

2 Enable an inclusive culture where our employees thrive |

|

3 Advance equity within our business, communities and the marketplace |

In 2022, we continued to pursue these ambitions by:

| 8 | THE COCA-COLA COMPANY 2023 PROXY STATEMENT |

|||||||

Sustainability

Our sustainability goals are embedded in how we operate as a business. Our sustainability strategies enable the Company to proactively respond to consumer preferences and address emerging challenges, building greater resilience in our business to withstand future changes. In everything we do, we aim to create a more sustainable business and better shared future that make a difference in people’s lives, the communities we serve and the planet. We recognize that the sustainability of our business is directly linked to the communities and ecosystems in which we operate, and that is why our approach is guided by our purpose: to refresh the world and make a difference.

Our sustainability priorities cover the following areas: water stewardship; reducing added sugar; packaging; climate; sustainable agriculture; and people and communities. Through internal and external stakeholder engagement, we have identified the highest-priority issues for the Company, allowing us to grow our business while mitigating risk. Working collaboratively with our bottling partners and stakeholders at every stage of our value chain, we look to integrate sustainability considerations into our daily actions.

|

Water Stewardship | We strive to replenish water back to nature and communities, improve efficiency and treat wastewater to high standards. Our ability to grow our business as well as communities’ capacity to thrive depends on access to clean water resources. We know local water resources are impacted by changing weather patterns and climate change. That is why our 2030 Water Security Strategy seeks to build greater resilience in the watersheds where scarcity impacts our business, supply chain and communities. | ||

|

Reducing Added Sugar | We are building a total beverage company, which includes offering more choices with less sugar, reducing packaging sizes and providing clear nutrition information. We are listening to consumers, and we understand that people around the world have an increased interest in managing the foods and beverages they consume. Within our portfolio of brands, we are taking action to reduce added sugar by offering consumers more choices with less added sugar, reducing packaging sizes to enable portion control, and promoting our low- and no-calorie beverages, all while responsibly marketing our products and providing clear nutrition information so our consumers can make informed choices. | ||

|

Packaging | Our vision is to make packaging part of a circular economy, thereby keeping it out of landfills and our environment. Our World Without Waste program focuses on creating a circular economy for our packaging materials, which means designing waste out and ensuring that our packages are reused and recycled. By using more recycled content, developing plant-based materials, lightweighting our packages and expanding our refillable business model while increasing collection of empty bottles, we are reducing emissions and delivering against both our climate and waste reduction goals since packaging accounts for approximately 30% of our overall carbon footprint. | ||

|

Climate | We look for ways to reduce carbon emissions across the Coca-Cola value chain. We are reducing carbon emissions across our system by interconnecting our sustainability goals across the Coca-Cola system and value chain. After achieving our 2020 “drink in your hand” goal to reduce relative carbon emissions by 25% against a 2010 baseline, we have taken it a step further and set a science-based target to reduce greenhouse gas emissions by 25% across the entire value chain by 2030 as compared to a 2015 baseline. | ||

|

Sustainable Agriculture | Our goal is to source our priority ingredients sustainably. The agricultural ingredients we use to produce our beverages require significant water resources, produce greenhouse gases, and involve millions of farmers in their value chains. By working with our suppliers to reduce water use, implement regenerative farm practices that protect land and watersheds and ensuring that our Supplier Guiding Principles are being respected, we are enabling the natural ecosystem to sequester carbon – all while building resilience to temperature changes and enabling economic empowerment for rural communities. | ||

|

People & Communities | We aim to improve people’s lives and create a better shared future for our communities and the planet. From ingredient sourcing to packaging recovery to creating local economic opportunities, we strive to create shared value through growth, with an ongoing focus on building inclusion and increasing people’s access to equal opportunities. |

To learn more about the Company’s sustainability efforts, including our comprehensive goals, please view our Business & Sustainability Report on the Company’s website, by visiting www.coca-colacompany.com/sustainability.

|

The Board, through the Corporate Governance and Sustainability Committee, oversees the Company’s sustainability strategies and initiatives, including the Company’s short- and long-term goals. See page 31 for information regarding the Board’s oversight of sustainability matters. |

| 9 | ||||||||||||||

| 4 | Voting Roadmap |

1 |

Election of

Directors |

|||

| The Board of Directors and the Corporate Governance and Sustainability Committee believe that the 13 Director nominees possess the necessary qualifications and experiences to provide quality advice and counsel to the Company’s management and effectively oversee the business and the long-term interests of shareowners. | ||||

|

Our Board recommends a vote FOR each Director nominee See page 12 for further information | |||

2 |

Advisory Vote to Approve Executive Compensation |

|||

| The Company seeks a non-binding advisory vote to approve the compensation of its Named Executive Officers as described in the Compensation Discussion and Analysis beginning on page 53 and the Compensation Tables beginning on page 70. | ||||

|

Our Board recommends a vote FOR this item See page 50 for further information | |||

3 |

Advisory Vote on the

Frequency of Future Advisory Votes to Approve Executive Compensation |

|||

| Shareowners are being provided the opportunity to vote on how often they believe we should hold an advisory vote to approve executive compensation in the future. The frequency options are to hold the advisory vote to approve executive compensation each year, every two years or every three years. The Board believes that an annual advisory vote on executive compensation is the most appropriate policy for our shareowners and the Company at this time, which is consistent with current practice. | ||||

|

Our Board recommends a vote for ONE YEAR See page 91 for further information | |||

4 |

Ratification of the

Appointment of Ernst & Young LLP as Independent Auditors |

|||

| The Board of Directors and the Audit Committee believe that the retention of Ernst & Young LLP to serve as the Independent Auditors for the fiscal year ending December 31, 2023 is in the best interests of the Company and its shareowners. As a matter of good corporate governance, shareowners are being asked to ratify the Audit Committee’s selection of the Independent Auditors. | ||||

|

Our Board recommends a vote FOR this item See page 95 for further information | |||

5-9 |

Shareowner Proposals |

||

Five proposals were submitted by shareowners: ● Proposal requesting an audit of the Company’s impact on nonwhite stakeholders ● Proposal requesting a global transparency report ● Proposal regarding political expenditures values alignment ● Proposal requesting an independent Board chair policy ● Proposal requesting a report on risks from state policies restricting reproductive rights If a shareowner proponent, or a representative who is qualified under state law, is present and submits a proposal for a vote, then the proposal will be voted on at the 2023 Annual Meeting. | |||

Our Board recommends a vote AGAINST each of the shareowner proposals

See page 98 for further information | |||

| 10 | THE COCA-COLA COMPANY 2023 PROXY STATEMENT |

|||||||

“

We value the input

you provide to us

throughout the

year through our

ongoing shareowner

engagement efforts.

”

| 5 | Governance |

Letter from Our Lead

Independent Director

DEAR FELLOW SHAREOWNERS:

On behalf of our entire Board of Directors, I am pleased to present our annual Proxy Statement and to report on some of the key issues you’ll find in this document.

|

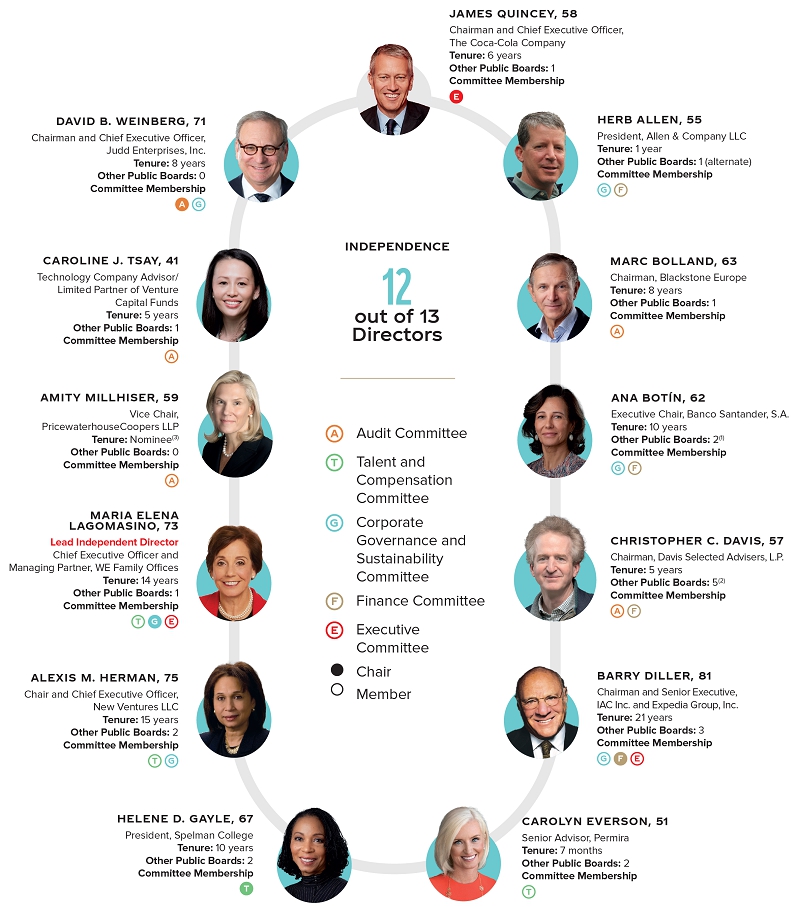

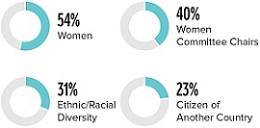

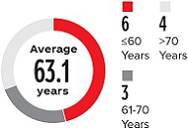

Our business had a successful year in 2022. We have once again demonstrated delivering value to shareowners, as we recently announced our 61st consecutive dividend increase. Our Board is here to help oversee the ongoing success of our business. As our business evolves, so does the Board. Through our ongoing Board refreshment process, we continue to maintain a balance of skills, tenure and diversity among our Directors. This year, we continued this process by welcoming Carolyn Everson to the Board and nominating Amity Millhiser for election at the upcoming Annual Meeting of Shareowners, who, if elected, will join the Board in July after her retirement from her current role. Carolyn and Amity each bring valuable skills and perspective to the Board and I am excited for their contributions. In the past five years, assuming the election of Ms. Millhiser, five new Directors have joined the Board, and six Directors have rolled off. Our Director nominees’ average tenure is 8 years, the average age is 63.1, and 31% of the |

Board is racially or ethnically diverse. I am extremely proud that we also achieved gender parity in 2022, with six women on our 12-member Board. The Directors standing for election have deep and varied experiences related to matters that are key to our business success. These include experience in finance, risk oversight, executive leadership, government, our industry, marketing, innovation, technology, emerging markets, strategy development and sustainability. Their profiles begin on page 18. We also prioritize a focus on the Board’s processes and structures to ensure they remain effectively designed to help us meet our objectives. To this end, we have made changes to our Board committee structure to streamline oversight responsibilities. Effective February 2023, the work of the ESG and Public Policy Committee and the Committee on Directors and Corporate Governance was merged into a single committee, which was renamed the “Corporate Governance and Sustainability Committee.” |

| |

| 11 | ||||||||||||||

|

Our Board believes that

ensuring strong, independent Board leadership is a crucial requirement to build long-term shareowner

value.

|

||

| |||

|

As your Lead Independent Director, I am actively engaged with James Quincey in a partnership to ensure we remain strategically positioned to successfully grow our business. We value the input you provide to us throughout the year through our ongoing shareowner engagement efforts. I look forward to continuing to serve as a key point of contact at the Board level for shareowners. One of the important ways shareowners provide feedback is through the annual advisory vote on compensation. We take this vote seriously. Last year we had an outcome that was significantly lower than what we’ve typically received, and the Board oversaw important investor outreach to ensure we understood and responded to your feedback. We report on this more fully in the Compensation Discussion and Analysis section of this Proxy Statement, which begins on page 53. |

Finally, we recognize that Board leadership structure is an important issue for many shareowners. Our Board believes that ensuring strong, independent Board leadership is a crucial requirement to build long-term shareowner value. Every year, I lead an executive session of non-management Directors to consider whether the position of Chair should be held by the CEO or by a separate individual. Today, we believe the Company’s Board leadership structure with a combined Chair and CEO, balanced by a strong Lead Independent Director, will deliver the best results. We discuss this more fully on page 33 of this Proxy Statement. |

Thank you for your support and for your interest and investment in The Coca-Cola Company.

MARIA ELENA LAGOMASINO, |

| 12 | THE COCA-COLA COMPANY 2023 PROXY STATEMENT |

|||||||

|

Election of Directors

|

|||||

1 |

WHAT AM I VOTING ON?

The Board of Directors,

upon the recommendation of the Corporate Governance and Sustainability Committee, has nominated the following 13 individuals

for election to the Board for a one-year term. If elected, each Director nominee will hold office until the 2024 Annual Meeting

of Shareowners and until his or her successor is elected and qualified.

• Herb Allen • Marc Bolland • Ana Botín • Christopher C. Davis • Barry Diller • Carolyn Everson • Helene D. Gayle • Alexis M. Herman • Maria Elena Lagomasino • Amity Millhiser • James Quincey • Caroline J. Tsay • David B. Weinberg |

||||

The Board of Directors recommends a vote FOR each nominee | |||||

| |

| * Ms. Millhiser not pictured. |

The Board currently has 12 members. Upon recommendation of the Corporate Governance and Sustainability Committee, the Board has nominated the 13 individuals named above for election at the 2023 Annual Meeting of Shareowners.

Each of the Director nominees was elected by the shareowners at the 2022 Annual Meeting of Shareowners, except for Ms. Everson and Ms. Millhiser. Mses. Everson and Millhiser were identified as potential Directors by the former Committee on Directors and Corporate Governance, which determined that each was qualified under the committee’s criteria. Ms. Everson joined the Board in July 2022, and Ms. Millhiser, subject to election at the 2023 Annual Meeting, will join the Board effective July 1, 2023, after her retirement from her current role. All nominees are independent under the New York Stock Exchange (the “NYSE”) corporate governance rules, except for James Quincey, our Chairman and Chief Executive Officer (see Director Independence and Related Person Transactions beginning on page 45).

We have no reason to believe that any of the nominees will be unable or unwilling to serve, if elected. However, if any nominee should become unable for any reason or unwilling for good cause to serve, proxies may be voted for another person nominated as a substitute by the Board, or the Board may reduce the number of Directors.

| 13 | ||||||||||||||

Our 2023 Director Nominees

| (1) | Includes Banco Santander, S.A. and its wholly owned subsidiary, Santander Holdings USA, Inc. |

| (2) | Includes investment company directorships in Selected Funds, Davis Funds and Clipper Funds Trust, three fund complexes which are advised by Davis Selected Advisers, L.P. and other entities controlled by Davis Selected Advisers, L.P. |

| (3) | If elected, Ms. Millhiser will join the Board on July 1, 2023 after her retirement from her current role, at which time she will join the Audit Committee. |

| 14 | THE COCA-COLA COMPANY 2023 PROXY STATEMENT |

|||||||

Snapshot of 2023 Director Nominees*

| BUILDING THE RIGHT BOARD FOR THE COCA-COLA COMPANY | |||||

| Nominee Demographics | |||||

| The Board strives to maintain an appropriate balance of tenure, diversity and skills on the Board. In 2022, the Board achieved a significant milestone by achieving gender parity. | |||||

| DIVERSITY | AGE | TENURE | |||

|

|

|

|||

| Nominee Attributes and Skills | |||||

| THE RIGHT ATTRIBUTES TO OVERSEE THE BUSINESS | THE RIGHT SKILLS TO GUIDE OUR BUSINESS STRATEGY AND CONSTRUCTIVELY CHALLENGE MANAGEMENT | ||||||||||

|

All Director nominees exhibit: ● High integrity ● An appreciation of multiple cultures ● A commitment to sustainability and to dealing responsibly with social issues ● Innovative thinking ● A proven record of success ● Knowledge of corporate governance requirements and practices |

13 out

of 13 High Level of Strategic and Financial Experience |

8 out of 13 Marketing Experience |

7 out

of 13 Innovation/ Technology Experience |

||||||||

11 out of 13 Broad International Exposure/Emerging Market Experience |

8

out of 13 Sustainability Experience |

7 out

of 13 Governmental or Geopolitical Expertise |

|||||||||

13 out of 13 Risk Oversight/ Management Expertise |

5 out

of 13 Extensive Knowledge of the Company’s Business and/or Industry |

13 out

of 13 Relevant Senior Leadership/Chief Executive Officer Experience |

|||||||||

| * | Director data assumes election of all Director nominees. Age and tenure measured as of this Proxy Statement, March 10, 2023. |

Governance Highlights

We are committed to good corporate governance, which promotes the long-term interests of shareowners, strengthens Board and management accountability, and helps build public trust in the Company. Our governance framework includes the following highlights:

| BOARD PRACTICES | SHAREOWNER MATTERS | ||||

● 12 of 13 Director nominees independent ● Demonstrated commitment to Board refreshment (in past five years, assuming election of all current nominees, five new Directors have joined and six Directors have rolled off the Board) ● Demonstrated commitment to periodic committee refreshment and committee chair succession (since 2019, new chairs have been appointed on four of our committees) ● Robust Director nominee selection process ● Regular Board, committee and Director evaluations ● Annual election of Directors with majority voting standard ● Lead Independent Director elected by the independent Directors, with robust duties and oversight responsibilities ● Independent Audit, Compensation, Governance and Finance Committees ● Regular executive sessions of non-employee Directors ● Strategy and risk oversight by full Board and committees ● Regular review and assessment of committee responsibilities |

● Long-standing, active shareowner engagement ● Annual “say-on-pay” advisory vote ● Majority voting with resignation policy for Directors in uncontested elections ● Proxy access right ● Shareowner right to call special meetings OTHER BEST PRACTICES

● Long-standing commitment to sustainability matters ● Board oversight of human capital management, including culture and DEI ● Transparent public policy engagement ● Stock ownership guidelines for executive officers and stock holding requirements for Directors ● Anti-hedging, anti-short sale and anti-pledging policies ● Clawback policy for incentive awards | ||||

| 15 | ||||||||||||||

Board Membership Criteria

The Board and the Corporate Governance and Sustainability Committee believe that there are general qualifications that all Directors must exhibit and other key qualifications and experiences that should be represented on the Board as a whole but not necessarily by each individual Director.

QUALIFICATIONS REQUIRED OF ALL DIRECTORS

The Board and the Corporate Governance and Sustainability Committee require that each Director be a recognized person of high integrity with a proven record of success in his or her field and be able to devote the time and effort necessary to fulfill his or her responsibilities to the Company. Each Director must demonstrate innovative thinking, familiarity with and respect for corporate governance requirements and practices, an appreciation of multiple cultures, and a commitment to sustainability and to dealing responsibly with social issues. In addition, potential Director candidates are interviewed to assess intangible qualities, including the individual’s ability to ask difficult questions and, simultaneously, to work collegially.

KEY QUALIFICATIONS AND EXPERIENCES TO BE REPRESENTED ON THE BOARD

The Board has identified key qualifications and experiences that are important to be represented on the Board as a whole, in light of the Company’s business strategy and expected future business needs. The table below summarizes how these key qualifications and experiences are linked to our Company’s core business needs and priorities.

| Core Business Needs and Priorities | Key Qualifications and Experiences | ||

| The Company’s business is multifaceted and involves complex financial transactions in many countries and in many currencies. |  |

High level of strategic and financial experience | |

|

Relevant senior leadership/Chief Executive Officer experience | ||

| Marketing and innovation are focus areas of the Company’s business, and the Company seeks to develop and deploy the world’s most effective marketing and innovative products and technology. |  |

Marketing experience | |

|

Innovation/technology experience | ||

The Company’s business is truly global and multicultural, with its products sold in more than 200 countries and territories around the world. The Company’s business requires compliance with a variety of regulatory requirements across a number of countries and the ability to maintain relationships with various governmental entities and nongovernmental organizations. |

|

Broad international exposure/ emerging market experience | |

|

Governmental or geopolitical expertise | ||

| The Company’s business is a complicated global enterprise, and most of the Company’s products are manufactured and sold by bottling partners around the world. |  |

Extensive knowledge of the Company’s business and/or industry | |

| The Board’s responsibilities include understanding and overseeing the various risks facing the Company and ensuring that appropriate policies and procedures are in place to effectively manage risk. |  |

Risk oversight/management expertise | |

| As a foundational step in how we conduct business and develop our corporate strategy, our Company focuses on advancing high-priority sustainability initiatives, including key initiatives around such issues as sustainable packaging; climate; water stewardship; health and nutrition; human rights; and people and communities, including DEI. |  |

Sustainability experience | |

CONSIDERATION OF DIVERSITY

The Board does not have a specific diversity policy but fully appreciates the value of Board diversity. Diversity is important because having a variety of points of view improves the quality of dialogue, contributes to a more effective decision-making process and enhances overall culture in the boardroom.

| 16 | THE COCA-COLA COMPANY 2023 PROXY STATEMENT |

|||||||

In evaluating candidates for Board membership, the Board and the Corporate Governance and Sustainability Committee consider many factors based on the specific needs of the business and what is in the best interests of the Company’s shareowners. This includes diversity of professional experience, race, ethnicity, gender, age and cultural background. In addition, the Board and the Corporate Governance and Sustainability Committee focus on how the experiences and skill sets of each Director nominee complement those of fellow Director nominees to create a balanced Board with diverse viewpoints and deep expertise.

Director Nomination Process

The Corporate Governance and Sustainability Committee is responsible for recommending to the Board a slate of nominees for election at each Annual Meeting of Shareowners. The Corporate Governance and Sustainability Committee considers a wide range of factors when assessing potential Director nominees. This assessment includes a review of the potential nominee’s judgment, experiences, independence, understanding of the Company’s business or other related industries, and such other factors as the Committee concludes are pertinent in light of the current needs of the Board. A potential nominee’s qualifications are considered to determine whether they meet the qualifications required of all Directors and the key qualifications and experiences to be represented on the Board, as described above. Further, the Corporate Governance and Sustainability Committee assesses how each potential nominee would impact the skills and experiences represented on the Board as a whole in the context of the Board’s overall composition and the Company’s current and future needs.

BOARD COMPOSITION AND REFRESHMENT

When recommending to the Board the slate of Director nominees for election at the Annual Meeting of Shareowners, the Corporate Governance and Sustainability Committee strives to maintain an appropriate balance of tenure, diversity and skills on the Board.

The Board believes that refreshment, including periodic committee rotation, is important to help ensure that Board composition is aligned with the needs of the Company and the Board as our business evolves over time, and that fresh viewpoints and perspectives are regularly considered. The Board also believes that over time Directors develop an understanding of the Company and an ability to work effectively as a group. Because this provides significant value, a degree of continuity year-over-year is beneficial to shareowners and generally should be expected.

Directors are elected each year, at the Annual Meeting of Shareowners, to hold office until the next Annual Meeting of Shareowners and until their successors are elected and qualified. Because term limits could cause the loss of experience or expertise important to the optimal operation of the Board, there are no absolute limits on the length of time that a Director may serve, but the Corporate Governance and Sustainability Committee and the Board consider the tenure of Directors as one of several factors in nomination decisions. In addition, the Corporate Governance and Sustainability Committee evaluates the qualifications and performance of each incumbent Director before recommending the nomination of that Director for an additional term. Furthermore, pursuant to our Corporate Governance Guidelines, Directors whose job responsibilities change or who reach the age of 74 are asked to submit a letter of resignation to the Board. These letters are considered by the Board and, if applicable, annually thereafter. The Corporate Governance and Sustainability Committee has reviewed the Director nominees who were 74 years of age or older and determined to recommend them for reelection based on their skills, qualifications and experiences.

| 17 | ||||||||||||||

SHAREOWNER-RECOMMENDED DIRECTOR CANDIDATES

Shareowners who would like the Corporate Governance and Sustainability Committee to consider their recommendations for nominees for the position of Director should submit their recommendations in writing by mail to the Corporate Governance and Sustainability Committee in care of the Office of the Secretary, The Coca-Cola Company, P.O. Box 1734, Atlanta, Georgia 30301 or by email to asktheboard@coca-cola.com. Recommendations by shareowners that are made in accordance with these procedures will receive the same consideration by the Corporate Governance and Sustainability Committee as other suggested nominees.

SHAREOWNER-NOMINATED DIRECTOR CANDIDATES

We have a “Proxy Access for Director Nominations” by-law. The proxy access by-law permits a shareowner, or a group of up to 20 shareowners, owning 3% or more of the Company’s outstanding Common Stock continuously for at least three years to nominate and include in the Company’s proxy materials Director nominees constituting up to two individuals or 20% of the Board (whichever is greater), provided that the shareowner(s) and the nominee(s) satisfy the requirements specified in Article I, Section 12 of our By-Laws. See question 30 on page 123 for more information.

MAJORITY VOTING STANDARD AND DIRECTOR RESIGNATION POLICY

Our By-Laws provide that, in an election of Directors where the number of nominees does not exceed the number of Directors to be elected, each Director must receive the majority of the votes cast with respect to that Director. If a Director does not receive a majority vote, he or she has agreed that he or she would submit a letter of resignation to the Board. The Corporate Governance and Sustainability Committee would make a recommendation to the Board on whether to accept or reject the resignation, or whether other action should be taken. The Board would act on the resignation taking into account the recommendation of the Corporate Governance and Sustainability Committee, which would include consideration of the vote and any relevant input from shareowners. The Board would publicly disclose its decision and its rationale within 100 days of the certification of the election results. The Director who tenders his or her resignation would not participate in the decisions of the Corporate Governance and Sustainability Committee or the Board that concern the resignation.

| 18 | THE COCA-COLA COMPANY 2023 PROXY STATEMENT |

|||||||

Biographical Information

About Our Director Nominees

Included in each Director nominee’s biography that follows is a description of five key qualifications and experiences of such nominee. Many of our Director nominees have more than five qualifications, and the aggregate number for all Director nominees is reflected on page 14. The Board and the Corporate Governance and Sustainability Committee believe that the combination of the various qualifications and experiences of the Director nominees would contribute to an effective and well-functioning Board and that, individually and as a whole, the Director nominees possess the necessary qualifications to provide effective oversight of the business and quality advice and counsel to the Company’s management.

|

|||||

| Herb Allen INDEPENDENT | Age: 55 Director since: 2021 Committees: |  | |||

|

CAREER HIGHLIGHTS

PUBLIC BOARD MEMBERSHIPS

|

KEY QUALIFICATIONS AND EXPERIENCES | ||||

|

High Level of Strategic and Financial Experience Extensive experience supervising business operations, including providing strategic and financial advisory and investment banking services to public and private companies at Allen & Company LLC. Supervises Allen & Company LLC’s principal financial and accounting officers on all matters related to the firm’s financial position and results of operations as well as the presentation of its financial statements. | ||||

|

Relevant Senior Leadership/Chief Executive Officer Experience President of Allen & Company LLC, a privately held investment banking firm, and its affiliate, Allen Investment Management LLC, a privately held investment advisory firm, since 2002. | ||||

|

Innovation/Technology Experience Extensive entrepreneurial experience overseeing investments by Allen & Company LLC into early-stage companies focusing on technologies, including e-commerce, data analytics, cybersecurity, artificial intelligence, biotechnology and SaaS technologies. | ||||

|

Broad International Exposure/Emerging Market Experience Considerable international experience as President of Allen & Company LLC working with international clients on mergers and acquisitions, capital markets and other advisory assignments with a focus on European and Latin American clients. | ||||

|

Risk Oversight/Management Expertise Extensive risk and management experience as President of Allen & Company LLC, including overseeing and assessing the performance of companies and public accountants with respect to matters related to the preparation, audit and evaluation of financial statements. | ||||

|

Chair |  |

Audit Committee |  |

Talent and Compensation Committee |  |

Corporate Governance and Sustainability Committee |

|

Member |  |

Finance Committee |  |

Executive Committee |

| 19 | ||||||||||||||

|

|||||

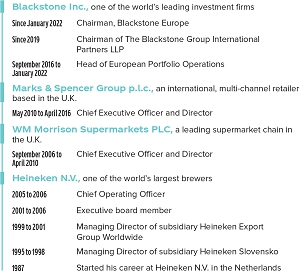

| Marc Bolland INDEPENDENT | Age: 63 Director since: 2015 Committees: |  | |||

|

CAREER HIGHLIGHTS

PUBLIC BOARD MEMBERSHIPS

|

KEY QUALIFICATIONS AND EXPERIENCES | ||||

|

High Level of Strategic and Financial Experience Extensive operational, strategic and financial experience as Chief Executive Officer of Marks & Spencer Group p.l.c., Chief Executive Officer of WM Morrison Supermarkets PLC, Chief Operating Officer of Heineken N.V. and Head of European Portfolio Operations of Blackstone Inc., all public companies, including as current Chairman of Blackstone Europe. | ||||

|

Broad International Exposure/Emerging Market Experience Served as lead non-executive director of the U.K. Department for International Development from 2018-2020; led international expansion of Marks & Spencer Group p.l.c.; and held several international management positions while at Heineken N.V. | ||||

|

Extensive Knowledge of the Company’s Business and/or Industry Nineteen years in the global beverage industry, with significant operations experience, including service as Chief Operating Officer of Heineken N.V. Ten years of experience in the retail industry, including service as Chief Executive Officer of a supermarket chain in the U.K. | ||||

|

Risk Oversight/Management Expertise Extensive experience overseeing risk as Chief Executive Officer of Marks & Spencer Group p.l.c. and WM Morrison Supermarkets PLC, as Chief Operating Officer of Heineken N.V. and as a Director of International Consolidated Airlines Group, S.A., which offers international and domestic air passenger and cargo transportation services. Additional risk management experience as head of European Portfolio Operations of Blackstone Inc., one of the world’s leading investment firms, as Chairman of The Blackstone Group International Partners LLP, a subsidiary, which acts as a sub-advisor to Blackstone U.S. affiliates in relation to the investment and re-investment of Europe, Middle East and Africa-based assets of Blackstone funds, and as Chairman of Blackstone Europe. | ||||

|

Sustainability Experience Chair of Polymateria, a privately owned British company specializing in breakthrough plastic biotransformation technology, since September 2019. Won “World Sustainable Retailer of the Year” three times while CEO of Marks & Spencer Group p.l.c. Founder of the Movement to Work charity, which has provided over 100,000 underprivileged young people with work experience. | ||||

|

Chair |  |

Audit Committee |  |

Talent and Compensation Committee |  |

Corporate Governance and Sustainability Committee |

|

Member |  |

Finance Committee |  |

Executive Committee |

| 20 | THE COCA-COLA COMPANY 2023 PROXY STATEMENT |

|||||||

|

|||||

| Ana Botín INDEPENDENT | Age: 62 Director since: 2013 Committees: |  | |||

|

CAREER HIGHLIGHTS

PUBLIC BOARD MEMBERSHIPS

|

KEY QUALIFICATIONS AND EXPERIENCES | ||||

|

High Level of Strategic and Financial Experience Internationally recognized expert in the investment banking industry with knowledge of global macroeconomic issues. Over 40 years of experience in investment and commercial banking. | ||||

|

Relevant Senior Leadership/Chief Executive Officer Experience Executive Chair of Banco Santander, S.A. since September 2014 and Chief Executive Officer of Santander UK plc from 2010 to September 2014. | ||||

|

Broad International Exposure/Emerging Market Experience Executive Chair of Banco Santander, S.A., a global financial institution with operations in Europe, North America, Latin America and Asia. Board member of the Institute of International Finance, a global association of the financial industry, since 2015 and Chair since January 2023. Co-founder and Chair of Fundación Empresa y Crecimiento, which finances small and medium-sized companies in Latin America. Founder and President of Fundación Empieza Por Educar, the Spanish member of the global Teach for All network. | ||||

|

Governmental or Geopolitical Expertise Extensive experience with the regulatory framework applicable to banking institutions throughout the globe. President of the European Banking Federation from 2021 to February 2023. From 2020 to 2022, Vice Chair of the Executive Committee of the World Business Council of Sustainable Development, a CEO-led community of over 200 of the world’s leading sustainable businesses that works closely with a number of non-governmental organizations. | ||||

|

Risk Oversight/Management Expertise Extensive experience from her work with Banco Santander, S.A., Santander UK plc and Banco Español de Crédito, S.A. in the oversight and management of risk associated with retail and commercial banking activities. Experience with the regulated insurance industry as director of Assicurazioni Generali S.p.A., a global insurance company based in Italy, from 2004 to 2011. | ||||

|

|||||

| Christopher C. Davis INDEPENDENT | Age: 57 Director since: 2018 Committees: |  | |||

|

CAREER HIGHLIGHTS

PUBLIC BOARD MEMBERSHIPS

|

KEY QUALIFICATIONS AND EXPERIENCES | ||||

|

High Level of Strategic and Financial Experience More than 30 years of experience in investment management and securities research at Davis Advisors. Also serves as a portfolio manager for the Davis Large Cap Value Portfolios and a member of the research team for other portfolios. | ||||

|

Relevant Senior Leadership/Chief Executive Officer Experience Serves as Chairman of Davis Selected Advisers, L.P. (“Selected Advisers”), and as a Director and officer of several mutual funds advised by Selected Advisers, as well as other entities controlled by Selected Advisers. | ||||

|

Marketing Experience Under the leadership of Mr. Davis, Selected Advisers is widely recognized as a premier investment manager serving individual investors worldwide, identifying investment opportunities both within and outside the United States in developed and developing markets and providing investors access to these investment opportunities. | ||||

|

Broad International Exposure/Emerging Market Experience Under the leadership of Mr. Davis, Selected Advisers seeks investment growth opportunities and diversification potential that international companies in both developed and developing markets provide. | ||||

|

Risk Oversight/Management Expertise Extensive experience evaluating strategic investments and transactions and managing risk against the volatility of equity markets during his more than 30-year career at Davis Advisors. Serves on the Audit Committee and as lead independent director of Graham Holdings Company and serves on the Audit Committee of Berkshire Hathaway Inc. | ||||

|

Chair |  |

Audit Committee |  |

Talent and Compensation Committee |  |

Corporate Governance and Sustainability Committee |

|

Member |  |

Finance Committee |  |

Executive Committee |

| 21 | ||||||||||||||

|

|||||

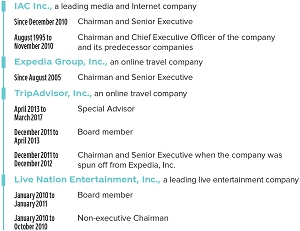

| Barry Diller INDEPENDENT | Age: 81 Director since: 2002 Committees: |  | |||

|

CAREER HIGHLIGHTS

PUBLIC BOARD MEMBERSHIPS

|

KEY QUALIFICATIONS AND EXPERIENCES | ||||

|

High Level of Strategic and Financial Experience Extensive experience in financings, mergers, acquisitions, investments and strategic transactions, including transactions with Silver King Broadcasting, QVC, Inc., Ticketmaster Entertainment, Inc. and Home Shopping Network, Inc. Served on the Finance Committee of Graham Holdings Company. | ||||

|

Relevant Senior Leadership/Chief Executive Officer Experience Serves as Chairman and Senior Executive of IAC Inc. Served as Chief Executive Officer of Fox, Inc. from 1984 to 1992, responsible for the creation of Fox Broadcasting Company, and Fox’s motion picture operations. Prior to Fox, served for ten years as Chief Executive Officer of Paramount Pictures Corporation. | ||||

|

Marketing Experience Serves as Chairman and Senior Executive at IAC Inc., comprised of category-leading businesses including Angi Inc., Dotdash Meredith and Care.com, and at Expedia Group, Inc., which markets a variety of leisure and business travel products. | ||||

|

Innovation/Technology Experience Extensive experience in the media and Internet sectors, including experience at IAC Inc., with businesses in the marketing and technology industries, at Expedia Group, Inc., which empowers travelers through technology with tools to efficiently research, plan, book and experience travel, and at TripAdvisor, Inc., which operates the flagship TripAdvisor-branded websites and numerous other travel brands. | ||||

|

Broad International Exposure/Emerging Market Experience Service at IAC Inc., a leading media and Internet company that is home to dozens of popular digital brands and services used by millions of consumers each day, and at online travel company Expedia Group, Inc., and a member of The Business Council. | ||||

|

Chair |  |

Audit Committee |  |

Talent and Compensation Committee |  |

Corporate Governance and Sustainability Committee |

|

Member |  |

Finance Committee |  |

Executive Committee |

| 22 | THE COCA-COLA COMPANY 2023 PROXY STATEMENT |

|||||||

|

|||||

| Carolyn Everson INDEPENDENT | Age: 51 Director since: 2022 Committees: |  | |||

|

CAREER HIGHLIGHTS

PUBLIC BOARD MEMBERSHIPS

|

KEY QUALIFICATIONS AND EXPERIENCES | ||||

|

Marketing Experience Extensive experience and understanding of marketing and innovation strategies. As President of Instacart, oversaw Instacart’s Retail, Business Development and Advertising businesses. As Vice President of Global Business Solutions at Facebook, Inc. (now known as Meta), led the global marketing solutions team focused on top strategic accounts and global agencies and oversaw media strategy, advertising sales and account management. As Vice President of Global Advertising Sales, Strategy and Marketing at Microsoft, led the advertising business across Bing, MSN, Windows Live, Mobile, Gaming Atlas and the Microsoft Media Network. As Executive Vice President and Chief Operating Officer of MTV Networks, oversaw strategic planning, operations and finance for its U.S. Ad Sales department. Prior to MTV, served in roles of increasing responsibility with respect to business development and advertising at Primedia Inc., Zagat Surveys LLC and Walt Disney Imagineering. Serves as a Board member of The Walt Disney Company. Served as Chairman of the Board of Directors of Effie Worldwide, a nonprofit that champions the practice and practitioners of marketing effectiveness globally. In 2015, named to the top of Business Insider’s list of the Most Powerful Women in Advertising. Former Director of Creative Artists Agency. | ||||

|

Innovation/Technology Experience Extensive experience in senior operating roles in consumer-facing technology and media companies, including at two of the world’s largest technology companies. As Vice President of Global Business Solutions at Facebook, led the company’s relationships with top marketers and agencies for its family of apps, including Facebook, Instagram, Messenger and WhatsApp and oversaw the Creative Shop, offering creative guidance on mobile marketing. At MTV Networks, oversaw strategic planning and was responsible for its Direct Response businesses and for Generator, a cross-platform, cross-brand strategic sales and marketing group. Served on the Technology Committee of Hertz Global Holdings, Inc., a global vehicle rental business. | ||||

|

Broad International Exposure/Emerging Market Experience Extensive experience leading at-scale, global consumer technology teams with a focus on growing global partnerships, global agencies and industry-leading business development. As Vice President of Global Business Solutions at Facebook, led a team of over 4,000 people in over 55 countries and was responsible for over $80 billion in revenue. Served as Vice President of Global Advertising Sales, Strategy and Marketing at Microsoft. Member of the Council on Foreign Relations and member of the 2017 Class of Henry Crown Fellows within the Aspen Global Leadership Network at the Aspen Institute. Served as a board member of Hertz Global Holdings, Inc., which, through its subsidiary The Hertz Corporation, operates a global vehicle rental business. | ||||

|

Risk Oversight/Management Expertise Extensive experience overseeing risk associated with leading the development of business, marketing and innovation strategies as Vice President of Global Business Solutions at Facebook, Vice President of Global Advertising Sales, Strategy and Marketing at Microsoft and Executive Vice President and Chief Operating Officer of MTV Networks. | ||||

|

Sustainability Experience Served as Chair of We Day, New York, which encourages and supports young people who are creating transformational social change. At Facebook, oversaw the development of an employee program that prioritized overall well-being to improve employee engagement and performance. Member of the Board of Advisors of Columbia University Irving Medical Center since 2022. | ||||

|

Chair |  |

Audit Committee |  |

Talent and Compensation Committee |  |

Corporate Governance and Sustainability Committee |

|

Member |  |

Finance Committee |  |

Executive Committee |

| 23 | ||||||||||||||

|

|||||

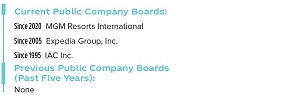

| Helene D. Gayle INDEPENDENT | Age: 67 Director since: 2013 Committees: |  | |||

|

CAREER HIGHLIGHTS

PUBLIC BOARD MEMBERSHIPS

|

KEY QUALIFICATIONS AND EXPERIENCES | ||||

|

Relevant Senior Leadership/Chief Executive Officer Experience President of Spelman College. Former Chief Executive Officer of The Chicago Community Trust, former Chief Executive Officer of McKinsey Social Initiative and former President and Chief Executive Officer of CARE USA. | ||||

|

Broad International Exposure/Emerging Market Experience Implemented the McKinsey Social Initiative’s Generation program. Experience managing international operations at CARE USA. Helped develop global health initiatives in leadership roles at the CDC and the Bill & Melinda Gates Foundation. Director of Organon & Co., a global health care company whose focus is on women’s health as its primary therapy area. Serves on the Board of Trustees of the Center for Strategic and International Studies and the Brookings Institution. Member of the National Academy of Medicine and of the Council on Foreign Relations. | ||||

|

Governmental or Geopolitical Expertise Extensive leadership experience in the global public health and development fields. Served as Chair of the Obama administration’s Presidential Advisory Council on HIV/AIDS. Member of the U.S. Department of State’s Advisory Committee on International Economic Policy and the Secretary of State’s Advisory Committee on Public-Private Partnerships. Served on the President’s Commission on White House Fellowships. Achieved the rank of Assistant Surgeon General and Rear Admiral in the U.S. Public Health Service. Serves as a Director of New America and ONE. | ||||

|

Risk Oversight/Management Expertise Extensive risk oversight and management experience with the delivery of emergency relief and long-term international development projects in the global public health field. Former Director of the Federal Reserve Bank of Chicago, which participates in the formulation of monetary policy, one of 12 regional reserve banks across the United States that, together with the Board of Governors in Washington, D.C., serves as the central bank for the United States. Director of Palo Alto Networks, Inc., a global cybersecurity provider. Former Director of GoHealth, Inc., a leading health insurance marketplace and Medicare-focused digital health company. | ||||

|

Sustainability Experience As CEO of The Chicago Community Trust, led the Trust’s efforts to close the racial and ethnic wealth gap in the Chicago region. Significant experience in public health initiatives and humanitarian efforts from over 20 years of leadership positions at various nonprofit organizations. | ||||

|

Chair |  |

Audit Committee |  |

Talent and Compensation Committee |  |

Corporate Governance and Sustainability Committee |

|

Member |  |

Finance Committee |  |

Executive Committee |

| 24 | THE COCA-COLA COMPANY 2023 PROXY STATEMENT |

|||||||

|

|||||

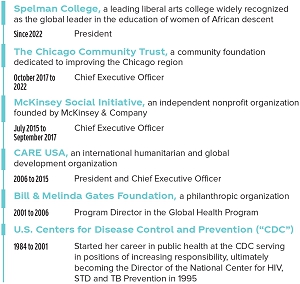

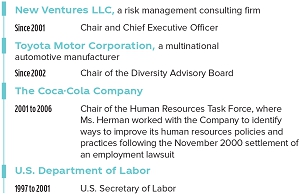

| Alexis M. Herman INDEPENDENT | Age: 75 Director since: 2007 Committees: |  | |||

|

CAREER HIGHLIGHTS

PUBLIC BOARD MEMBERSHIPS

|

KEY QUALIFICATIONS AND EXPERIENCES | ||||

|

High Level of Strategic and Financial Experience Significant strategic and financial experience as Chief Executive Officer of New Ventures LLC and as Chair of the Working Party for the Role of Women in the Economy for the Organisation for Economic Co-operation and Development (“OECD”), an intergovernmental economic organization. Additional financial experience through former service on the Audit Committee of MGM Resorts International, a global hospitality company. | ||||

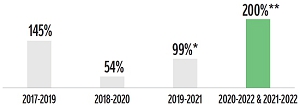

|