Governance” and then “Documents.” To view the Company’s Codes of Business Conduct, go to www.coca-colacompany.com, click “Investors” then “Corporate Governance” and then “Code of Conduct.” To view the Company’s SEC filings, including Forms 3, 4 and 5 filed by the Company’s Directors and executive officers, go to www.coca-colacompany.com, click on “Investors,” then “Filings & Reports” and then “All SEC Filings.”

We will promptly deliver free of charge, upon request, a copy of the Corporate Governance Guidelines, committee charters or Codes of Business Conduct to any shareowner requesting a copy. Requests should be directed to the Office of the Secretary as described in the response to question 28.

The Form 10-K includes our consolidated financial statements for the year ended December 31, 2023. We have furnished the Form 10-K to all shareowners. The Form 10-K does not form any part of the material for the solicitation of proxies. We will promptly deliver free of charge, upon request, a copy of the Form 10-K to any shareowner requesting a copy. Requests should be directed to the Office of the Secretary as described in the response to question 28.

27. How Can I Communicate with the Company’s Directors?

The Board has established a process to facilitate communication by shareowners and other interested parties with Directors. Communications can be addressed to Directors in care of the Office of the Secretary, The Coca-Cola Company, P.O. Box 1734, Atlanta, Georgia 30301 or by email to asktheboard@coca-cola.com.

Communications may be distributed to all Directors, or to any individual Director, as appropriate. At the direction of the Board, all mail received may be opened and screened for security purposes. In addition, items that are unrelated to the duties and responsibilities of the Board shall not be distributed. Such items include, but are not limited to: spam; junk mail and mass mailings; product complaints or inquiries; new product suggestions; resumes and other forms of job inquiries; surveys; and business solicitations or advertisements. In addition, material that is trivial, obscene, unduly hostile, threatening or illegal, or similarly unsuitable items, shall not be distributed. However, any communication that is not distributed will be made available to any independent, non-employee Director upon request.

To answer the many questions we receive about our Company and our products, we offer detailed information about common areas of interest on our “FAQs” page of our website, www.coca-colacompany.com/faqs.

28. What Is the Contact Information for the Office of the Secretary?

Materials may be sent to the Office of the Secretary (i) by mail to the Office of the Secretary, The Coca-Cola Company,

P.O. Box 1734, Atlanta, Georgia 30301, or (ii) by email to shareownerservices@coca-cola.com.

29. What Is the Deadline to Propose Actions for Consideration at the 2025 Annual Meeting of Shareowners?

Shareowners may present proper proposals for inclusion in our 2025 Proxy Statement and for consideration at the 2025 Annual Meeting of Shareowners by submitting their proposals in writing to the Company in a timely manner. Proposals should be addressed to the Office of the Secretary as specified in question 28. For a shareowner proposal other than a director nomination to be considered for inclusion in our 2025 Proxy Statement for our 2025 Annual Meeting of Shareowners, we must receive the written proposal on or before November 18, 2024. In addition, shareowner proposals must otherwise comply with the requirements of Rule 14a-8 promulgated under the 1934 Act.

Under certain circumstances, shareowners may also submit nominations for directors for inclusion in our proxy materials by complying with the requirements in our By-Laws. For more information regarding proxy access, please see question 30.

Our By-Laws also establish an advance notice procedure for shareowners who wish to present a proposal, including the nomination of Directors, before an annual meeting of shareowners, but do not intend for the proposal to be included in our proxy materials. Pursuant to our By-Laws, in order for business to be properly presented before an annual meeting by a shareowner, the shareowner must have complied with the notice procedures specified in our By-Laws and such business must be a proper matter for shareowner action under the Delaware General Corporation Law. To be timely for our 2025 Annual Meeting of Shareowners, we must receive the written notice between December 2, 2024 and January 1, 2025. In addition to satisfying the requirements under our By-Laws, to comply with the universal proxy rules under the 1934 Act, shareowners who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the 1934 Act, no later than March 3, 2025. Notice should be addressed to the Office of the Secretary as specified in question 28.

In addition, the shareowner proponent, or a representative who is qualified under state law, must attend the 2025 Annual Meeting of Shareowners to present such proposal or nomination.

30. How Do I Nominate a Director Using the Proxy Access Provisions of the Company’s By-Laws?

Our Board has adopted a “Proxy Access for Director Nominations” by-law. The proxy access by-law permits a shareowner, or a group of up to 20 shareowners, owning 3% or more of the Company’s outstanding Common Stock continuously for at least three years to nominate and include in the Company’s proxy materials director nominees constituting up to two individuals or 20%

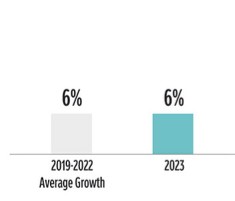

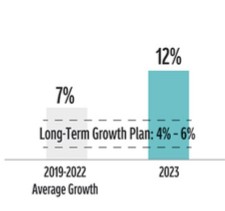

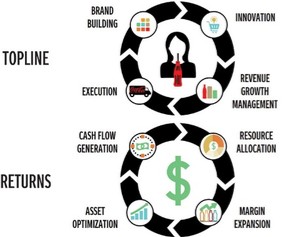

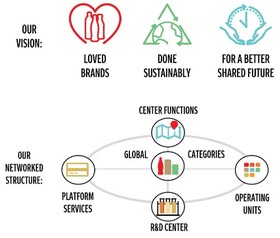

We relentlessly pursue growth. We work to exceed the expectations of our consumers, customers, communities and employees.

We relentlessly pursue growth. We work to exceed the expectations of our consumers, customers, communities and employees. We’re rapidly and more effectively engaging directly with consumers through experiences focused on passion points.

We’re rapidly and more effectively engaging directly with consumers through experiences focused on passion points.

We believe we best accomplish our duties as Directors when we proactively listen to, seek to understand and consider the opinions of our shareowners.

We believe we best accomplish our duties as Directors when we proactively listen to, seek to understand and consider the opinions of our shareowners.