UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if Other Than the Registrant)

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | |||

| ☑ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| 1) Title of each class of securities to which transaction applies: | |||

| 2) Aggregate number of securities to which transaction applies: | |||

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) Proposed maximum aggregate value of transaction: | |||

| 5) Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials: | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

| 1) Amount previously paid: | |||

| 2) Form, Schedule or Registration Statement No.: | |||

| 3) Filing Party: | |||

| 4) Date Filed: | |||

|

THE

COMPANY |

2021 PROXY STATEMENT

NOTICE OF ANNUAL MEETING OF SHAREOWNERS

TUESDAY, APRIL 20, 2021

|

|

QUESTIONS AND ANSWERS

Please see Questions and Answers in Annex A beginning on page 90 for important information about the proxy materials, voting, the 2021 Annual Meeting of Shareowners, Company documents, communications, and the deadlines to submit shareowner proposals and Director nominees for the 2022 Annual Meeting of Shareowners. Additional questions may be directed to Shareowner Services at (404) 676-2777 or shareownerservices@coca-cola.com. |

Links to websites included in this Proxy Statement are provided solely for convenience purposes. Content on the websites, including content on our Company website, is not, and shall not be deemed to be, part of this Proxy Statement or incorporated herein or into any of our other filings with the Securities and Exchange Commission (the “SEC”).

This Proxy Statement contains information that may constitute “forward-looking statements.” Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which generally are not historical in nature. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future, including statements expressing general views about future operating results, are forward-looking statements. Management believes that these forward-looking statements are reasonable as and when made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Our Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause our Company’s actual results to differ materially from historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to, those described in Part I, “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2020 (“Form 10-K”) and those described from time to time in our future reports filed with the SEC.

1

LETTER FROM OUR CHAIRMAN AND

CHIEF EXECUTIVE OFFICER

TO MY FELLOW SHAREOWNERS:

“In 2020, we remained steadfastly focused on shaping our enterprise for the future. Our efforts have set the stage to emerge stronger and drive growth in 2021 and beyond.”

|

On behalf of the Board of Directors and the people of The Coca-Cola Company, thank you for your investment. As I look back on 2020, I feel tremendous pride in what the Coca-Cola system accomplished during times of huge uncertainty and challenges worldwide. I look forward – as I’m sure we all do – to emerging from the global pandemic in an even stronger position.

In part, I’m encouraged by our history. Our Company has weathered many difficult times, from world wars to depressions to financial crises to pandemics, each time turning adversity into opportunity.

More than that, I’m confident because in 2020 we remained steadfastly focused on shaping our enterprise for the future. Our efforts have set the stage to emerge stronger and drive growth in 2021 and beyond. We’ve taken away learnings that make us better – better at serving customers, consumers and stakeholders. Ultimately, I believe this will make us better at creating value for you, our shareowners.

Our resilience in 2020 gives me renewed confidence that our best years remain ahead. Optimism continues to drive us and our business.

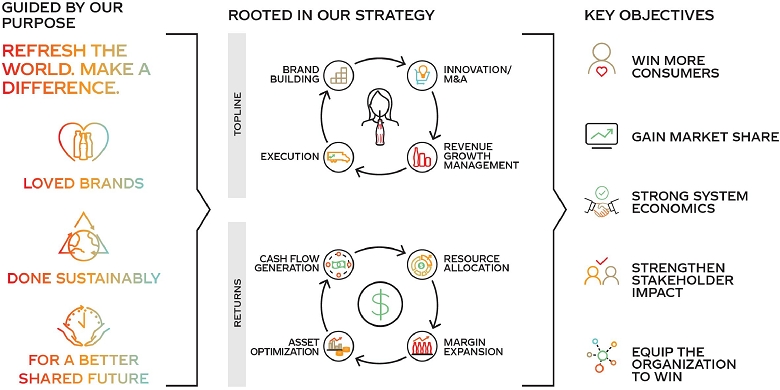

Grounded in Our Purpose

Challenging times can challenge convictions, especially if they are weakly grounded or unclear. For us, our convictions are clear, and they are grounded in our purpose. |

Our purpose is to refresh the world and make a difference. This simple idea – one we trace to the very origins of the business in 1886 – is core to how we pursue our objectives. Our purpose is a compass in challenging times.

Our Company and its brands have always been held to high expectations, both by ourselves and by the many stakeholders who touch our business. We’ve worked to become and remain a valued member of the communities where we operate.

Our commitment to being purpose-driven has been a part of our ethos for 135 years. In 2020, our purpose was as important as ever.

Last year was, infamously, a year defined by the pandemic. But COVID-19 was one of many impactful challenges. Our system faced natural disasters, fires, floods, hurricanes and recurring, tragic social justice issues.

I’d like to recognize and thank our people for maintaining the continuity of our business. Together, they moved quickly to ensure we fostered a safe environment. Across the globe, we were well-positioned to respond quickly with humanitarian aid and local partnerships, as well as increase our advocacy for diversity, equity and inclusion in our Company and the communities where we operate.

|

| 2 | THE COCA-COLA COMPANY Letter from our Chairman and Chief Executive Officer |

Accelerating Our Transformation

A year ago in this same space, I wrote about our journey to evolve as a total beverage company. We made great progress in 2019, and 2020 started with continued momentum.

If 2020 reminded us of anything, it’s that uncertainty is always lurking. The pandemic also helped us realize we could be much bolder in our efforts to change. Far from derailing us, the pandemic was a catalyst in setting five key objectives that we continue to pursue:

• Win more consumers

• Gain market share

• Maintain strong system economics

• Strengthen stakeholder impact

• Equip the organization to win

The beverage business remains very attractive, and we are confident in the long-term growth opportunity for our industry. Our objective is to outpace competitors in capturing that growth. And that requires us to do business differently.

Looking back over Coca-Cola’s long history, you can see how the Company’s namesake beverage came to be present in virtually every corner of the world. It’s a remarkable story, and many leaders deserve recognition for building and evolving the Company.

Today, the challenge continues – to reshape the organization for the future.

|

The hallmark of our strategy, which we put in motion in 2020, is creating a more networked organization that combines the power of scale with the deep knowledge required to win in markets locally. Our networked organization is coming together and is already changing the way we work. Our actions are freeing up time, resources and energy for growth. This also creates accountability and faster execution on the front lines of our business, closest to consumers.

Portfolio for the Future

Coca-Cola started with a single product in a single package. We grew to become a total beverage company, with #1 value share positions in four out of five nonalcoholic beverage categories.

Our focus for the future is positioning our portfolio for success and identifying the right brands that will drive quality leadership and help us achieve our Beverages for Life vision.

We’re intently focused on the consumer. We can’t be married to the past; we need to always use a fresh set of eyes and challenge ourselves on the best ways to meet the needs of consumers.

We’ve also undertaken a global initiative to improve our marketing efficiency and effectiveness. By improving our processes, eliminating duplication and optimizing spending, we will increase our effectiveness and fuel reinvestment in our brands. This will help us develop the discipline to converge around ideas that will generate scale and grow market share. |

Our Place in the World

Our Company’s purpose also puts sustainability at the center. Sustainability is not an add-on to our business – it is essential to how we create value.

We arrived at our sustainability goals with input from many stakeholders, including investors, customers, consumers, communities, non-governmental organizations, bottling partners and employees.

Water is essential to our products, business, supply chain and the communities in which we operate, as well as the natural ecosystems on which we depend. We are proud to have met our pioneering goal to replenish 100% of the water we use in our beverages. We achieved this in 2015, five years ahead of schedule. We have met or exceeded this target every year since.

We’ve developed a 2030 water strategy with our bottlers to sharpen the focus on our business growth agenda, increase impact and create value. Through our new strategy, we will innovate for impact where it matters most while maintaining a 100% or greater global water replenishment rate.

We’ve also been taking actions to change the recipes of our beverages to reduce added sugar and offer smaller portion sizes. We’re innovating and bringing drinks with additional benefits to market and promoting low- and no-calorie options.

|

2021 PROXY STATEMENT Letter from our Chairman and Chief Executive Officer |

3 |

In packaging, our World Without Waste strategy focuses on three pillars: design, collect and partner. We strive to make packaging part of the circular economy. Our goal is to create a closed-loop system, extracting the maximum value from materials and products and then recover and recycle them. For example, we’re offering packages made of 100% recycled PET in more than 25 markets, with more to come. And we’re reducing our use of virgin PET.

In climate, we set a science-based target to reduce absolute greenhouse gas emissions 25% by 2030 as compared to a 2015 baseline, in line with the Paris Agreement goals.

Finally, we have reached our goal of empowering over five million women through our 5by20 program, creating shared value for families, communities and our business.

Diversity and Corporate Governance

I’ll close by reiterating that a diverse and inclusive workplace is both the right thing to do and a strategic business priority. Diversity fosters creativity, innovation and connection to the communities we serve.

The events of 2020 show us again that there’s no place in our world for racism. We have a duty to strive for greater justice and equity within our own Company as well as the communities where we operate. Our pledge is that we will do our part to listen, lead, invest and advocate.

|

Our aspiration is to mirror the diversity of communities everywhere we operate around the world. The more we reflect the communities we serve, the better we will anticipate consumer needs and reach our growth aspirations. In the United States, our ambition is to align our race and ethnicity representation to census data across all job levels. We are advancing Black representation in leadership roles and implementing inclusion training and pipeline development programs. And we aim to have the Company be 50% led by women globally by 2030.

We’re also committed to disclosing our progress. Beginning this year, we’ll publicly share data about our Company’s diversity in our 2020 Business & Sustainability Report.

Let me close by recognizing my fellow Board members, especially our Lead Independent Director, Maria Elena Lagomasino. Our entire Board is actively engaged with me as partners to ensure the Company is strategically positioned to grow.

We value your investment in our Company. I again thank you for the trust you place in us in overseeing your interests in our great business.

James Quincey Chairman and Chief Executive Officer

|

“The beverage business remains very attractive, and we are confident in the long-term growth opportunity for our industry. Our objective is to outpace competitors in capturing that growth. And that requires us to do business differently.”

|

NOTICE OF 2021 ANNUAL MEETING

OF SHAREOWNERS

| Meeting Information | ||||

|

DATE AND TIME |  |

VIRTUAL MEETING LOCATION | |

| Tuesday, April 20, 2021 8:30 a.m. Eastern Time |

The 2021 Annual Meeting will be held exclusively online. Visit www.meetingcenter.io/262997645 to attend the meeting and enter your control number and the password COCA2021. | |||

|

RECORD DATE |  |

ANNUAL MEETING WEBSITE | |

| Holders of record of our Common Stock as of February 19, 2021 are entitled to notice of, and to vote at, the meeting. | Access links to vote in advance, listen to video messages from certain of our Directors, submit questions in advance of the meeting and learn more about our Company at www.coca-colacompany.com/annual-meeting-of-shareowners. | |||

| Items of Business | Our Board’s Recommendation |

Page | |||

| COMPANY PROPOSALS | |||||

| 1 | Elect as Directors the 12 Director nominees named in the attached Proxy Statement to serve until the 2022 Annual Meeting of Shareowners. |  |

FOR each Director Nominee | 15 | |

| 2 | Conduct an advisory vote to approve executive compensation. |  |

FOR | 45 | |

| 3 | Ratify the appointment of Ernst & Young LLP as Independent Auditors of the Company to serve for the 2021 fiscal year. |  |

FOR | 84 | |

| SHAREOWNER PROPOSAL | |||||

| 4 | Vote on a shareowner proposal on sugar and public health, if properly presented at the meeting. |  |

AGAINST | 87 | |

Shareowners will also transact such other business as may properly come before the meeting and at any adjournments or postponements of the meeting.

Your vote is important to us. Whether or not you plan to participate in the 2021 Annual Meeting, we urge you to vote and submit your proxy in advance of the meeting by one of the methods described in this Proxy Statement.

The 2021 Annual Meeting will be held entirely online due to the COVID-19 pandemic and to support the health and wellness of our shareowners, employees, Directors and officers. While you will not be able to attend the meeting at a physical location, we are committed to ensuring that shareowners will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend the meeting online, vote your shares electronically and submit questions in advance of and during the virtual meeting. We are excited to embrace the latest technology to provide expanded access and improved communication, allowing shareowners to participate from any location around the world, at no cost to them.

To attend the 2021 Annual Meeting, examine our list of shareowners, vote and submit your questions during the 2021 Annual Meeting, visit www.meetingcenter.io/262997645. You will need to enter the meeting password, COCA2021, and the 15-digit control number included on your Notice of Internet Availability of Proxy Materials, on your proxy card (if you received a printed copy of the proxy materials), or on the instructions that accompanied your proxy materials. If you are the beneficial owner of shares held in “street name” (that is, you hold your shares through an intermediary such as a bank, broker or other nominee), you must register in advance. For more information on how to attend the 2021 Annual Meeting, please see Annex A of the Proxy Statement beginning on page 90.

We are making the Proxy Statement and the form of proxy first available on or about March 4, 2021.

March 4, 2021

By Order of the Board of Directors

Jennifer D. Manning

Associate General Counsel and Corporate Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2021 ANNUAL MEETING OF SHAREOWNERS TO BE HELD ON APRIL 20, 2021.

The Notice of Annual Meeting, Proxy Statement and Annual Report on Form 10-K for the year ended December 31, 2020 are available at www.edocumentview.com/coca-cola.

Advance Voting Methods Please vote using one of the following advance voting methods. Make sure to have your proxy card or voting instruction form in hand and follow the instructions. | ||

SHAREOWNERS OF RECORD (shares registered on the books of the Company via Computershare) | ||

|

Internet www.investorvote. com/coca-cola | |

|

Telephone Call 1-800-652-

| |

|

Sign, date and return your proxy card

| |

BENEFICIAL OWNERS (shares held through your bank or brokerage account)

| ||

|

Internet www.proxyvote.com | |

|

Telephone Call 1-800-454-8683 or the telephone number on your voting instruction form

| |

|

Sign, date and return your voting instruction form

| |

Not all beneficial owners may vote at the web address and phone number provided above. If your control number is not recognized, please refer to your voting instruction form for specific voting instructions.

| ||

5

REFRESH THE WORLD. MAKE A DIFFERENCE.

Our Company

The Coca-Cola Company (the “Company”) is a total beverage company with products sold in more than 200 countries and territories. Our Company’s purpose is to refresh the world and make a difference. Our brands include:

|

|

|

| |||

| SPARKLING SOFT DRINKS Coca-Cola, Diet Coke/Coca-Cola Light, Coca-Cola Zero Sugar, Fanta, Fresca, Schweppes*, Sprite, Thums Up | WATER, ENHANCED WATER AND SPORTS DRINKS Aquarius, Ciel, Dasani, glacéau smartwater, glacéau vitaminwater, Ice Dew, I LOHAS, Powerade, Topo Chico | JUICE, DAIRY AND PLANT-BASED BEVERAGES AdeS, Del Valle, fairlife, innocent, Minute Maid, Minute Maid Pulpy, Simply |

TEA AND COFFEE Ayataka, Costa, doğadan, FUZE TEA, Georgia, Gold Peak, HONEST TEA, Kochakaden |

| * | Schweppes is owned by the Company in certain countries outside the United States. |

THE COCA-COLA SYSTEM

We are a global business that operates on a local scale, in every community where we do business. We are able to create global reach with local focus because of the strength of the Coca-Cola system, which comprises our Company and our approximately 225 bottling partners worldwide.

OUR GLOBAL REACH

Beverage products bearing our trademarks, sold in the United States since 1886, are now sold in more than 200 countries and territories.

| • | Our network of independent bottling partners, distributors, wholesalers and retailers, as well as our consolidated bottling and distribution operations — is the world’s largest nonalcoholic beverage distribution system. |

| • | Consumers enjoy finished beverage products bearing trademarks owned by or licensed to us at a rate of 1.9 billion servings a day. |

LEARN MORE ABOUT OUR COMPANY

You can learn more about the Company by visiting our website, www.coca-colacompany.com.

We also encourage you to read our latest Form 10-K, available at www.coca-colacompany.com/annual-meeting-of-shareowners.

The Company’s principal executive offices are located at One Coca-Cola Plaza, Atlanta, Georgia 30313.

| 6 | THE COCA-COLA COMPANY Refresh the World. Make a Difference. |

2020 Financial Highlights

| REVENUE | OPERATING INCOME | EARNINGS PER SHARE | CASH FLOW | ||||

| PERFORMANCE | PERFORMANCE | ||||||

| (11)% | (9)% | (11)% | 0% | $1.79 | $1.95 | $9.8 | $8.7 |

| Reported Net Operating Revenue | Organic Revenues (Non-GAAP) | Reported Operating Income | Comparable Currency Neutral Operating Income (Non-GAAP) | Reported EPS | Comparable EPS (Non-GAAP) | BILLION Cash from Operations

|

BILLION Free Cash Flow (Non-GAAP) |

Organic revenues is a non-GAAP financial measure that excludes or has otherwise been adjusted for the impact of acquisitions, divestitures and structural changes, as applicable, and the impact of changes in foreign currency exchange rates. Comparable currency neutral operating income is a non-GAAP financial measure that excludes or has otherwise been adjusted for items impacting comparability and the impact of changes in foreign currency exchange rates. Comparable EPS is a non-GAAP financial measure that excludes or has otherwise been adjusted for items impacting comparability. Free cash flow is a non-GAAP financial measure that represents net cash provided by operating activities less purchases of property, plant and equipment. See Annex C for a reconciliation of non-GAAP financial measures to our results as reported under accounting principles generally accepted in the United States (“GAAP”).

2020 Business Highlights

Throughout 2020, the effects of the COVID-19 pandemic and the related actions by governments around the world to attempt to contain the spread of the virus impacted our business. In particular, the outbreak and preventive measures taken to contain COVID-19 negatively impacted our unit case volume and our price, product and geographic mix in all of our operating segments, primarily due to unfavorable channel and product mix as consumer demand shifted to more at-home versus away-from-home consumption. The challenges posed by the global pandemic were significant, but our Company proved resilient, acting with agility to adapt our business and accelerate our strategic transformation. Important highlights from the year include:

|

BUILDING A NETWORKED ORGANIZATION | In August 2020, the Company announced strategic steps to transform our organizational structure to better enable us to capture growth in the fast, changing marketplace. The Company is building a networked global organization designed to combine the power of scale with deep knowledge required to win locally. We created nine operating units under our existing geographic segments, five global marketing category leadership teams, and a new Platform Services organization to drive greater standardization and simplification, with technology and data at the forefront. Approximately 47% of positions changed in the organizational refresh process, excluding the Bottling Investments and Global Ventures operating segments. | |

|

OPTIMIZED BRAND PORTFOLIO | We conducted a portfolio rationalization process with the objective of reducing our product offerings to a tailored collection of global, regional and local brands with the potential for greater growth. As a result, we streamlined our portfolio from approximately 400 to 200 master brands. | |

|

BUILDING LOVED BRANDS | During 2020, the Company prioritized our core brands. We gained underlying market share in both at-home and away-from-home channels. We undertook a global initiative to improve marketing efficiency and effectiveness, with a goal of eliminating duplication and optimizing spending to increase effectiveness and fuel reinvestment in our brands. We also created a framework for more disciplined innovation, focusing on scalable initiatives with defined criteria for success. We chose to lead with big global bets, while also continuing to support and nurture regional plays and pursue intelligent local experimentation. | |

|

DIGITAL EXECUTION | We have been digitizing our organization for several years, but the global pandemic expedited the ongoing shift to a digital world. We took actions across the globe to step up execution. In the United States, we innovated with touchless Freestyle equipment. We also leveraged existing pockets of excellence in e-commerce by adding outlets and expanding our myCoke B2B platform to new markets. We increased the presence of our multi-platform venture Wabi, which connects our system and other consumer product companies to store owners and consumers through an ecosystem of digital apps. Wabi is now available in 23 cities across five continents. | |

|

ENHANCED SYSTEM COLLABORATION | The health of our bottling system is crucial to our success. During 2020, we worked closely with our bottling partners through the crisis, including global and regional system meetings with leadership. We shared best practices and collaborated more closely across our supply chain. We captured efficiencies, enhanced execution across channels and leveraged digital data. | |

|

PROGRESS TOWARD A BETTER SHARED FUTURE | In 2020, we remained grounded in our environmental, social and governance (“ESG”) work, which creates value for a broad spectrum of stakeholders. We joined several multi-stakeholder initiatives, including the Water Resilience Coalition, a CEO-led initiative to reduce water stress by 2050. We contributed to COVID-19 relief around the world and continued to focus on racial equity, including the introduction of our global social justice framework, as described below. We accomplished our goal to empower five million women by 2020, creating shared value for these women, their families and communities, while growing our business through their involvement in both retail and distribution businesses. |

2021 PROXY STATEMENT Refresh the World. Make a Difference. |

7 |

Emerging Stronger from the COVID-19 Pandemic

We recognize the human tragedy of the COVID-19 pandemic. Our foremost priority during the pandemic has been the health, safety and security of our employees and the employees of our supplier and bottling partners, our customers, and the communities where we live and operate. Our approach is grounded in our Company’s purpose, which ensures that we continuously strive to make a difference for people in our communities and in our workplaces.

|

PEOPLE |

We have focused on ensuring a safe environment for employees and supporting employees as they balance life challenges resulting from the pandemic. Since March 2020, the majority of office-based employees have worked remotely, and we have suspended almost all travel.

To ensure we can continue to make the beverages our consumers desire, our production and distribution facilities have operated throughout the pandemic. We have adjusted their ways of working to protect everyone’s safety and well-being, including additional cleaning and sanitation routines, providing personal protective equipment, creating electronic health attestation forms, reducing person-to-person interactions and implementing the use of split shifts. We have reinforced hygiene and exposure guidelines with employees, in line with guidance from local health officials.

|

COMMUNITY |

The Coca-Cola system, including The Coca-Cola Foundation, has provided more than $90 million to date to support COVID-19 relief efforts in communities around the world, benefitting more than 25 million people through 125 organizations in 118 countries and territories. We took immediate actions to address health and other urgent needs, and we are continuing to support the recovery by investing in our communities.

HEALTH SUPPORT AND PERSONAL PROTECTIVE EQUIPMENT

• Nearly $14 million provided in support of global COVID-19 relief efforts to Red Cross National Societies around the world, impacting 7.5 million people by providing hospitals with critical medical equipment and supplies and supporting community relief programs targeting the vulnerable.

• In Ghana, we worked with Plan International to provide an uninterrupted supply of water and access to liquid soap. 8,000 people received soap, face masks and hand sanitizer, and three districts now have an uninterrupted supply of water in schools, health centers and public areas.

|

• Concentrate plants in Brazil, Ireland, Japan, Puerto Rico and Swaziland and bottlers in countries including Uganda, Ethiopia, Germany, Kenya, South Africa, Turkey, Belgium and the United States produced and/or bottled sanitizer in collaboration with local health agencies and other partners.

• The Coca-Cola Company’s North America business unit partnered with MakersRespond.org to donate more than 100,000 pounds of plastic, along with logistics and supply chain support, to make 126 million plastic face shields. The plastic shields were donated to hospitals, first responders, state

|

governments and community programs in more than 25 U.S. states.

• In India, Bangladesh, Nepal and Sri Lanka we supported front-line workers with COVID-19 response personal protective equipment kits. So far, the Company’s $10 million support has impacted over one million people and more than 80 hospitals and health care facilities.

To learn more about our support for local communities during the pandemic, visit www.coca-colacompany.com/news/ coronavirus-local-actions.

|

|

BUSINESS |

During times of crisis, business continuity and adapting to the needs of our customers are critical. We deployed global and regional teams to monitor the rapidly evolving situation in each of our local markets and recommended risk mitigation actions. We have developed system-wide knowledge-sharing routines and processes, which include the management of any supply chain challenges. We are moving with speed to best serve our customers impacted by COVID-19. In partnership with our bottlers and retail customers, we are working to ensure adequate inventory levels in key channels while prioritizing core brands, key packages and consumer affordability. We are increasing investments in e-commerce to support retailer and meal delivery services, shifting toward package sizes that are fit-for-purpose for online sales, and shifting more consumer and trade promotions to digital.

|

The Board and its committees have been actively overseeing the Company’s response to and risk management of the ongoing COVID-19 pandemic. See page 26 for information regarding the Board’s oversight of COVID-19. |

| 8 | THE COCA-COLA COMPANY Refresh the World. Make a Difference. |

Human Capital

Our people and culture agendas are critical business priorities, and we strive to be a global employer of choice that attracts high-performing talent with the passion, skills and mindsets to drive us on our journey to refresh the world and make a difference. We are committed to building an equitable and inclusive culture that inspires and supports the growth of our employees, serves our communities and shapes a more sustainable business.

OUR HUMAN CAPITAL PILLARS

|

CULTURE AND ENGAGEMENT

We are taking deliberate action to foster a growth culture that is grounded in our Company purpose: to refresh the world and make a difference. We strive to act with a growth mindset, take an expansive approach to what’s possible and believe in continuous learning to improve our business and ourselves. We focus on four key growth behaviors – being curious, empowered, inclusive and agile – and value how we work as much as what we achieve. We believe our culture enables our Company strategy and shapes employee experiences. | |

|

LEADERSHIP, TALENT AND DEVELOPMENT

Our strategy is anchored in promoting the right internal talent and hiring the right external talent for career opportunities across our networked organization. We are focused on hiring and developing talent that mirrors the markets we serve, and investing in inspirational leadership, learning opportunities and capabilities that equip our global workforce with the skills they need while improving engagement and retention. We expect our leaders to be role models and lead in a way that enables our organization to achieve success and win in the future. We recognize that one size does not fit all, and we are committed to creating an employee experience that is locally relevant and also provides the global breadth of learning and growth that our employees expect and deserve. | |

|

DIVERSITY, EQUITY AND INCLUSION

We believe that a diverse, equitable and inclusive workplace that mirrors the markets we serve is a strategic business priority that is critical to the Company’s success. We take a comprehensive view of diversity and inclusion across different races, ethnicities, tribes, religions, socioeconomic backgrounds, generations, abilities and expressions of gender and sexual identity. We are continuing to put our resources and energy into strategies and initiatives to create a more equitable environment. Guided by our purpose, we have developed a global social justice plan that addresses the important role we play in engaging stakeholders, employees and other business leaders. | |

|

HUMAN RIGHTS

Respect for human rights is a fundamental value of our Company. We strive to respect and promote human rights in accordance with the United Nations Guiding Principles on Business and Human Rights in our relationships with our employees, suppliers and independent bottlers. Our aim is to help increase the enjoyment of human rights within the communities in which we operate. | |

|

BUSINESS INTEGRITY

Our Codes of Business Conduct are grounded in our commitment to do the right thing. They serve as the foundation of our approach to ethics and compliance, and our anti-corruption compliance program is focused on conducting business in a fair, ethical and legal manner. |

| 2020 NOTABLE ACCOLADES |

Ranked 12th on FORTUNE’s annual ranking of the World’s Most Admired Companies, marking the 13th consecutive year in the top 20

Included in the Bloomberg 2020 Gender-Equality Index as a company committed to supporting gender equality through policy development, representation and transparency

Earned a 100% score on the Human Rights Campaign’s Corporate Equality Index for the 14th consecutive year

Ranked 5th on Forbes America’s Best Employers for Women 2020

Recognized by Disability Equality Index as one of the Best Places to Work for Disability Inclusion

Listed in LATINA Style’s 2020 Top 50 Best Companies for Latinas to Work in the U.S.

Named Top Ten Company on As You Sow’s combined scorecards that benchmark public disclosures of racial justice and workplace diversity, equity and inclusion

|

Our people and culture agendas are also key priorities of the Board. Through the Talent and Compensation Committee, the Board provides oversight of the Company’s policies and strategies relating to talent, leadership and culture, including diversity, equity and inclusion. See page 26 for information regarding the Board’s oversight of Human Capital. |

2021 PROXY STATEMENT Refresh the World. Make a Difference. |

9 |

SPOTLIGHT ON DIVERSITY, EQUITY AND INCLUSION

The events of 2020 made it clear there is much more work to do, both inside and outside our Company, to address social and cultural inequities. Throughout the year, we provided opportunities for our employees to make a difference – by offering Election Day as an additional one-time paid holiday in the United States as well as by advocating and supporting the passage of hate crime legislation. In addition, we increased our global social justice efforts, primarily focusing on racial equity. In the United States, we started implementing a multi-faceted racial equity plan, which set ten-year employee representation goals that reflect the country’s racial and ethnic diversity. In Brazil, the Company convened a coalition of nearly a dozen companies focused on creating concrete actions to advance social justice and racial equity. In Europe, we established an external anti-racism advisory panel with ten racial equity experts to help develop an action plan.

|

|

|

|

| SOCIAL JUSTICE FRAMEWORK |

DISCLOSING PROGRESS |

HIRING, RECRUITING & DEVELOPMENT |

STRONG EQUAL OPPORTUNITY PROGRAMS |

• Four pillars:

ü Listening – engagement with employees and stakeholders

ü Leading – policies and communications that address inequities

ü Investing – talent investments, volunteerism and community giving

ü Advocating – convening power to make a difference

• Strong leadership commitment to diversity, equity and inclusion

• Five-year commitment to increase spending with Black-owned businesses in the U.S. by at least $500 million

|

2030 aspirations:

• 50% led by women globally

• Mirror U.S. census data* at all job grade levels for roles in the U.S.

13% Black

18% Hispanic

6% Asian

• Publish diversity representation and EEO-1 data in our 2020 Business & Sustainability Report

|

• Updated recruiting and hiring strategies, deploying tools to remove bias

• Enhanced Global Women’s Leadership Council’s sponsorship program for female talent

• Accelerated deployment of digital tools for learning and development

• Launched multi-year global diversity, equity and inclusion education plan

3 Leadership Councils internal Diversity

8 Resource internal Business Groups

|

• Conducted pay equity analyses in the U.S. for many years and extended analysis in 2019 for gender globally

• Conduct adverse impact analyses on pay to ensure equitable treatment and practices

|

| * | Our 2030 aspirations will be updated to reflect new U.S. census data when available. |

| 10 | THE COCA-COLA COMPANY Refresh the World. Make a Difference. |

In everything we do, we aim to create a more sustainable business and better shared future that make a difference in people’s lives, communities and the planet. We recognize that the sustainability of our business is directly linked to the sustainability of the communities we serve, and that’s why our approach is guided by our purpose: to refresh the world and make a difference.

Working collaboratively with our bottling partners and stakeholders at every stage of our value chain, we look to integrate sustainability and ESG considerations into our daily actions. For example, we share best practices and knowledge across the Coca-Cola system to build business resiliency and better manage water resources. From ingredient sourcing to packaging recovery to women’s economic empowerment, we strive to create shared opportunities through growth in every corner of the world, with an ongoing focus on building inclusion and increasing people’s access to equal opportunities.

We have a responsibility to use water respectfully and efficiently. For us, that means being water balanced by replenishing to communities and nature more water than we use in the manufacture of our beverages and improving water security where it is needed most.

We’re listening to consumers and understand that people around the world have an increased interest in managing the food and beverages they consume. Within our portfolio of growth brands, we’re taking action to reduce added sugar by offering consumers more choices with less sugar, reducing packaging sizes, and promoting our low- and no-calorie beverages, all while providing clear nutrition information so our consumers can make informed choices.

Food and beverage packaging is an important part of our modern lives, yet the world has a packaging waste problem. Our vision is to make packaging part of a circular economy, and our World Without Waste initiative is a clear strategy with commitments to recover a bottle or can for every one we sell by 2030 – and then to recycle and reuse. To support these efforts, the Coca-Cola system has set a goal to reduce virgin PET plastic usage by a cumulative 3 million metric tons by 2025, based on the projected growth of the system’s virgin PET use.

We’re also taking action against climate change by setting a Coca-Cola system science-based target to reduce greenhouse gas emissions 25% across the entire value chain by 2030 as compared to a 2015 baseline. We support a vision to be net zero carbon by 2050, and our science-based target is a critical milestone that supports this longer-term ambition.

To learn more about the Company’s sustainability efforts, including our comprehensive sustainability commitments, please view our current Business & Sustainability Report on the Company’s website, by visiting www.coca-colacompany.com/sustainable-business.

|

WATER STEWARDSHIP | We strive to replenish water back to nature and communities, improve efficiency and treat wastewater to high standards. | |

|

SUGAR REDUCTION | We are offering more choices with less sugar, reducing packaging sizes and providing clear nutrition information. | |

|

WORLD WITHOUT WASTE | Our vision is to make packaging part of a circular economy. | |

|

CLIMATE | We look for ways to reduce our carbon footprint across the Coca-Cola value chain. | |

|

SUSTAINABLE AGRICULTURE | Our goal is to source all of our priority ingredients sustainably. | |

|

SHARED FUTURE | We aim to improve people’s lives and create a better shared future for our communities and the planet. |

|

The Board, through the ESG and Public Policy Committee, oversees the Company’s sustainability strategies and initiatives, including the Company’s short and long-term goals. See page 26 for information regarding the Board’s oversight of sustainability. |

11

VOTING ROADMAP

|

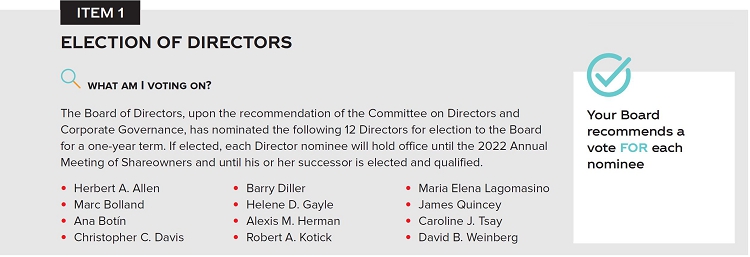

ITEM 1

|

ELECTION OF DIRECTORS

The Board of Directors and the Committee on Directors and Corporate Governance believe that the 12 Director nominees possess the necessary qualifications and experiences to provide quality advice and counsel to the Company’s management and effectively oversee the business and the long-term interests of shareowners. |

Our Board recommends a vote FOR each Director nominee | |||

|

See page 15 for further information | ||||

ITEM 2 |

ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

The Company seeks a non-binding advisory vote to approve the compensation of its Named Executive Officers as described in the Compensation Discussion and Analysis beginning on page 46 and the Compensation Tables beginning on page 66. |

Our Board recommends a vote FOR this item | |||

|

See page 45 for further information | ||||

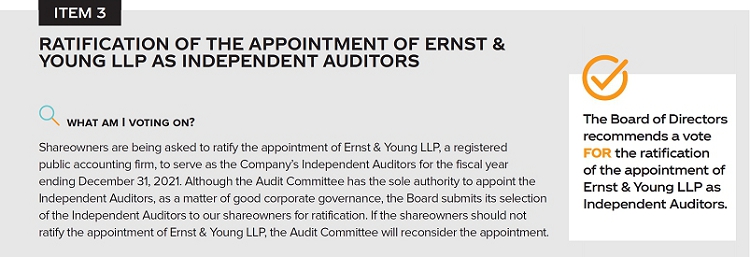

ITEM 3 |

RATIFICATION OF APPOINTMENT OF ERNST & YOUNG LLP AS INDEPENDENT AUDITORS

The Board of Directors and the Audit Committee believe that retention of Ernst & Young LLP to serve as the Independent Auditors for the fiscal year ending December 31, 2021 is in the best interest of the Company and its shareowners. As a matter of good corporate governance, shareowners are being asked to ratify the Audit Committee’s selection of the Independent Auditors. |

| |||

|

See page 84 for further information | ||||

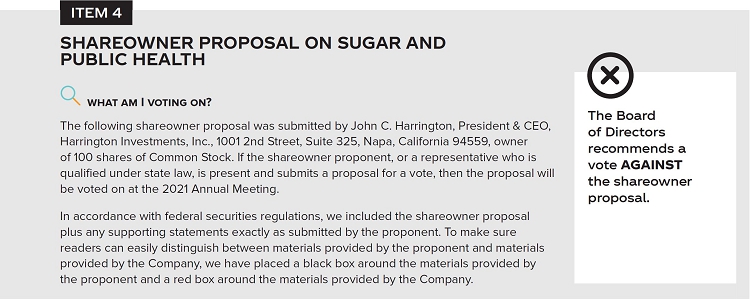

ITEM 4 |

SHAREOWNER PROPOSAL

Vote on a shareowner proposal on sugar and public health, if properly presented at the 2021 Annual Meeting of Shareowners. |

Our Board recommends a vote AGAINST the shareowner proposal

| |||

|

See page 87 for further information | ||||

| 12 | THE COCA-COLA COMPANY Voting Roadmap |

2021 PROXY STATEMENT Voting Roadmap |

13 |

| 14 | THE COCA-COLA COMPANY Voting Roadmap |

Compensation Highlights

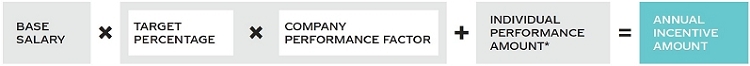

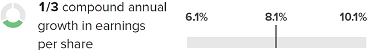

|

EXECUTIVE PAY ACTIONS IN RESPONSE TO COVID-19 |

Given the timing of our fiscal year, the Talent and Compensation Committee approved the annual and long-term incentive plan designs, including setting rigorous performance metrics and targets, in February 2020, prior to the identification of COVID-19 as a pandemic by the World Health Organization with significant public health and global economic implications. The Talent and Compensation Committee monitored the impact of COVID-19 throughout the remainder of the year, holding regular meetings with its independent compensation consultant, Meridian Compensation Partners, LLC (“Meridian”). In February 2021, the Talent and Compensation Committee considered management’s performance in light of COVID-19, taking into account performance against the pre-established targets, performance against peers, overall organizational health, and leadership in the face of unexpected challenges. The Talent and Compensation Committee determined to take the following actions, which are summarized below and explained in more detail in the Compensation Discussion and Analysis beginning on page 46.

| Annual Incentive | Long-Term Incentive | 2021 Compensation Programs |

| While the Company entered 2020 with solid momentum, coming off of strong results in 2019, the unexpected and unprecedented impacts of the COVID-19 pandemic resulted in the minimum threshold level of performance not being achieved with respect to the 2020 annual incentive performance measures applicable to the Named Executive Officers. Accordingly, there was no payout under the Company’s Performance Incentive Plan. After review, the Talent and Compensation Committee approved a special one-time incentive payment to the senior executives, including the Named Executive Officers, equating to 30% of their annual target bonus amount that had been set in February 2020 under the Performance Incentive Plan, consistent with the maximum amount typically designated for individual performance contributions. The Talent and Compensation Committee determined this was appropriate based on improved performance trends in the second half of the year, the resilience of leaders in the face of the COVID-19 pandemic, and strategic efforts to drive the reorganization of the Company. See page 55 for details describing leadership accomplishments for 2020. The Talent and Compensation Committee also considered the fact that discretionary incentive payments were made to non-executive employees under a one-time broad-based program intended to reward performance during the pandemic. | The effects of the pandemic also impacted the performance measures in the outstanding performance share unit programs. Results for the 2018-2020 performance period were certified at 54% but were trending to pay near 115% in early 2020, prior to the impact of COVID-19. Results for the 2019-2021 and 2020-2022 performance periods are currently both trending below target. After review, the Talent and Compensation Committee determined not to adjust or reset performance measures in any of the performance share unit programs despite the negative and unexpected impact of the pandemic on the Company’s business performance. | The Company is continuing with its current incentive programs for Named Executive Officers in 2021. In addition, in February 2021, the Talent and Compensation Committee approved a special emerging stronger performance share unit award to approximately 1,000 employees, including the Named Executive Officers, designed to motivate and reward employees to continue to drive Company performance, emerge stronger from the pandemic and accelerate the Company’s transition to become a networked global organization. The one-time special award comprises less than 15% of the Company’s total annual long-term award incentive. The ultimate value, if any, of the special award is contingent upon the achievement of an earnings per share performance measure that rewards pre-COVID-19 level results over a two-year performance period, and it includes a relative total shareowner return modifier. |

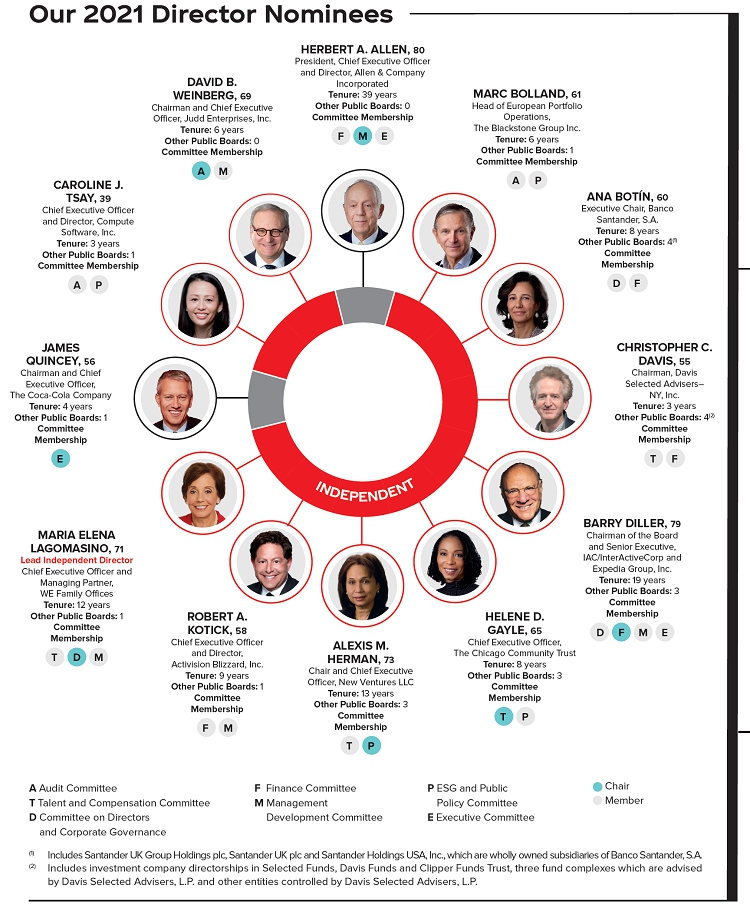

GOVERNANCE

All nominees are independent under the New York Stock Exchange (“NYSE”) corporate governance rules, except Herbert A. Allen and James Quincey (see Director Independence and Related Person Transactions beginning on page 39).

We have no reason to believe that any of the nominees will be unable or unwilling to serve if elected. However, if any nominee should become unable for any reason or unwilling for good cause to serve, proxies may be voted for another person nominated as a substitute by the Board, or the Board may reduce the number of Directors.

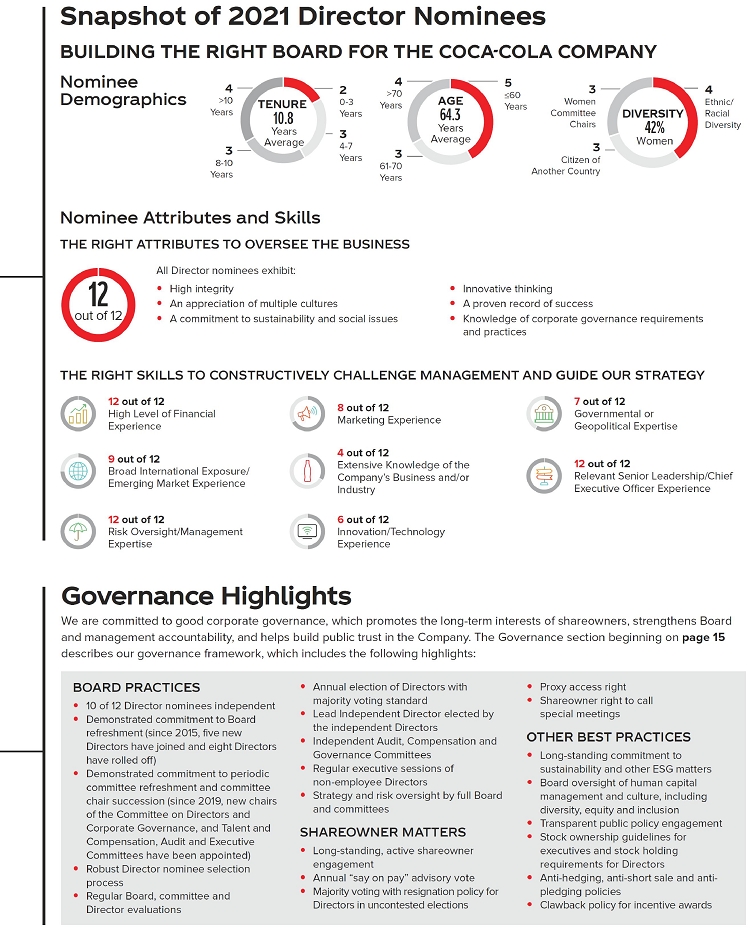

The Board and the Committee on Directors and Corporate Governance believe that there are general qualifications that all Directors must exhibit and other key qualifications and experiences that should be represented on the Board as a whole but not necessarily by each individual Director.

QUALIFICATIONS REQUIRED OF ALL DIRECTORS

The Board and the Committee on Directors and Corporate Governance require that each Director be a recognized person of high integrity with a proven record of success in his or her field and be able to devote the time and effort necessary to fulfill his or her responsibilities to the Company. Each Director must demonstrate innovative thinking, familiarity with and respect for corporate governance requirements and practices, an appreciation of multiple cultures and a commitment to sustainability and to dealing responsibly with social issues. In addition, potential Director candidates are interviewed to assess intangible qualities, including the individual’s ability to ask difficult questions and, simultaneously, to work collegially.

CONSIDERATION OF DIVERSITY

The Board does not have a specific diversity policy but fully appreciates the value of Board diversity. Diversity is important because having a variety of points of view improves the quality of dialogue, contributes to a more effective decision-making process and enhances overall culture in the boardroom.

In evaluating candidates for Board membership, the Board and the Committee on Directors and Corporate Governance consider many factors based on the specific needs of the business and what is in the best interests of the Company’s shareowners. This includes diversity of professional experience, race, ethnicity, gender, age and cultural background. In addition, the Board and the Committee on Directors and Corporate Governance focus on how the experiences and skill sets of each Director nominee complement those of fellow Director nominees to create a balanced Board with diverse viewpoints and deep expertise.

| 16 | THE COCA-COLA COMPANY Governance |

KEY QUALIFICATIONS AND EXPERIENCES

TO BE REPRESENTED

ON THE BOARD

The Board has identified key qualifications and experiences that are important to be represented on the Board as a whole, in light of the Company’s business strategy and expected future business needs. The table below summarizes how these key qualifications and experiences are linked to our Company’s business.

| Business Characteristics | Key Qualifications and Experiences | ||

| The Company’s business is multifaceted and involves complex financial transactions in many countries and in many currencies. |  |

High level of financial experience | |

|

Relevant senior leadership/Chief Executive Officer experience | ||

| Marketing and innovation are core focuses of the Company’s business, and the Company seeks to develop and deploy the world’s most effective marketing and innovative products and technology. |  |

Marketing experience | |

|

Innovation/technology experience | ||

| The Company’s business is truly global and multicultural, with its products sold in more than 200 countries and territories around the world. |  |

Broad international exposure/emerging market experience | |

| The Company’s business requires compliance with a variety of regulatory requirements across a number of countries and relationships with various governmental entities and non-governmental organizations. |  |

Governmental or geopolitical expertise | |

| The Company’s business is a complicated global enterprise, and most of the Company’s products are manufactured and sold by bottling partners around the world. |  |

Extensive knowledge of the Company’s business and/or industry | |

| The Board’s responsibilities include understanding and overseeing the various risks facing the Company and ensuring that appropriate policies and procedures are in place to effectively manage risk. |  |

Risk oversight/management expertise | |

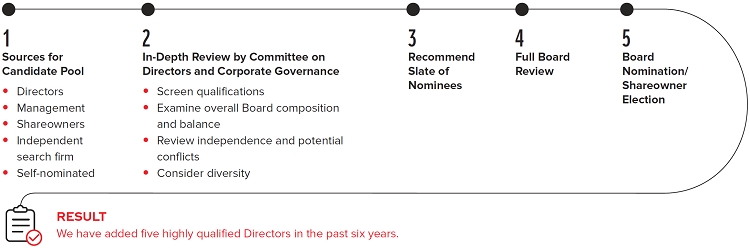

The Committee on Directors and Corporate Governance is responsible for recommending to the Board a slate of nominees for election at each Annual Meeting of Shareowners. The Committee on Directors and Corporate Governance considers a wide range of factors when assessing potential Director nominees. This assessment includes a review of the potential nominee’s judgment, experiences, independence, understanding of the Company’s business or other related industries and such other factors as the Committee concludes are pertinent in light of the current needs of the Board. A potential nominee’s qualifications are considered to determine whether they meet the qualifications required of all Directors and the key qualifications and experiences to be represented on the Board, as described above. Further, the Committee on Directors and Corporate Governance assesses how each potential nominee would impact the skills and experiences represented on the Board as a whole in the context of the Board’s overall composition and the Company’s current and future needs.

2021 PROXY STATEMENT Governance |

17 |

BOARD COMPOSITION AND REFRESHMENT

When recommending to the Board the slate of Director nominees for election at the Annual Meeting of Shareowners, the Committee on Directors and Corporate Governance strives to maintain an appropriate balance of tenure, turnover, diversity and skills on the Board.

The Board believes that refreshment, including periodic committee rotation, is important to help ensure that Board composition is aligned with the needs of the Company and the Board as our business evolves over time, and that fresh viewpoints and perspectives are regularly considered. The Board also believes that over time Directors develop an understanding of the Company and an ability to work effectively as a group. Because this provides significant value, a degree of continuity year-over-year is beneficial to shareowners and generally should be expected.

Directors are elected each year, at the Annual Meeting of Shareowners, to hold office until the next Annual Meeting of Shareowners and until their successors are elected and qualified. Because term limits could cause the loss of experience or expertise important to the optimal operation of the Board, there are no absolute limits on the length of time that a Director may serve, but the Committee on Directors and Corporate Governance and the Board consider the tenure of Directors as one of several factors in nomination decisions. In addition, the Committee on Directors and Corporate Governance evaluates the qualifications and performance of each incumbent Director before recommending the nomination of that Director for an additional term. Furthermore, pursuant to our Corporate Governance Guidelines, Directors whose job responsibilities change or who reach the age of 74 are asked to submit a letter of resignation to the Board. These letters are considered by the Board and, if applicable, annually thereafter. In 2020, the Committee on Directors and Corporate Governance reviewed the Director nominees who were 74 years of age or older and determined to recommend them for reelection based on their skills, qualifications and experiences.

SHAREOWNER-RECOMMENDED DIRECTOR CANDIDATES

Shareowners who would like the Committee on Directors and Corporate Governance to consider their recommendations for nominees for the position of Director should submit their recommendations in writing by mail to the Committee on Directors and Corporate Governance in care of the Office of the Secretary, The Coca-Cola Company, P.O. Box 1734, Atlanta, Georgia 30301 or by e-mail to asktheboard@coca-cola.com. Recommendations by shareowners that are made in accordance with these procedures will receive the same consideration by the Committee on Directors and Corporate Governance as other suggested nominees.

SHAREOWNER-NOMINATED DIRECTOR CANDIDATES

We have a “Proxy Access for Director Nominations” by-law. The proxy access by-law permits a shareowner, or a group of up to 20 shareowners, owning 3% or more of the Company’s outstanding Common Stock continuously for at least three years to nominate and include in the Company’s proxy materials Director nominees constituting up to two individuals or 20% of the Board (whichever is greater), provided that the shareowner(s) and the nominee(s) satisfy the requirements specified in Article I, Section 12 of our By-Laws. See question 30 on page 97 for more information.

MAJORITY VOTING STANDARD

Our By-Laws provide that, in an election of Directors where the number of nominees does not exceed the number of Directors to be elected, each Director must receive the majority of the votes cast with respect to that Director. If a Director does not receive a majority vote, he or she has agreed that he or she would submit a letter of resignation to the Board. The Committee on Directors and Corporate Governance would make a recommendation to the Board on whether to accept or reject the resignation, or whether other action should be taken. The Board would act on the resignation taking into account the recommendation of the Committee on Directors and Corporate Governance, which would include consideration of the vote and any relevant input from shareowners. The Board would publicly disclose its decision and its rationale within 100 days of the certification of the election results. The Director who tenders his or her resignation would not participate in the decisions of the Committee on Directors and Corporate Governance or the Board that concern the resignation.

| 18 | THE COCA-COLA COMPANY Governance |

Biographical Information About Our Director Nominees

Included in each Director nominee’s biography that follows is a description of the five key qualifications and experiences of such nominee. Many of our Director nominees have more than five qualifications, and the aggregate number for all Director nominees is reflected on page 13. The Board and the Committee on Directors and Corporate Governance believe that the combination of the various qualifications and experiences of the Director nominees would contribute to an effective and well-functioning Board and that, individually and as a whole, the Director nominees possess the necessary qualifications to provide effective oversight of the business and quality advice and counsel to the Company’s management.

| ||

Herbert A. Allen |

||

|

Age: 80 Director since: 1982

Committees: • Finance • Management Development (Chair) • Executive |

PUBLIC BOARD MEMBERSHIPS

Current Public Company Boards: None

Previous Public Company Boards (Past Five Years): None |

| CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

|

|

High Level of Financial Experience Extensive experience in venture capital, underwriting, mergers and acquisitions, private placements and money management services at Allen & Company Incorporated. Supervises Allen & Company Incorporated’s principal financial and accounting officers on all matters related to the firm’s financial position and results of operations and the presentation of its financial statements. |

|

Relevant Senior Leadership/Chief Executive Officer Experience President and Chief Executive Officer of Allen & Company Incorporated. | |

|

Marketing Experience Significant marketing experience through ownership of a controlling interest and management of Columbia Pictures from 1973 to 1982 and through a nine-year public company directorship at Convera Corporation. | |

|

Extensive Knowledge of the Company’s Business and/or Industry Director of the Company since 1982, and through Allen & Company Incorporated, has served as financial advisor to the Company and its bottling partners on numerous transactions. | |

|

Risk Oversight/Management Expertise Extensive experience managing risk as President and Chief Executive Officer of Allen & Company Incorporated, including overseeing and advising on principal investments, investing in companies with an international and emerging market presence, public and private capital markets transactions and merger and acquisition transactions. | |

| ||

| Marc Bolland INDEPENDENT | ||

|

Age: 61 Director since: 2015

Committees: • Audit • ESG and Public Policy |

PUBLIC BOARD MEMBERSHIPS

Current Public Company Boards:

Previous Public Company Boards (Past Five Years): International Consolidated Airlines Group, S.A. (2016-2020); |

| CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

|

|

High Level of Financial Experience Extensive operational and financial experience as Chief Executive Officer of Marks & Spencer Group p.l.c., Chief Executive Officer of WM Morrison Supermarkets PLC, Chief Operating Officer of Heineken N.V. and Head of European Portfolio Operations of The Blackstone Group Inc., all public companies. |

|

Relevant Senior Leadership/Chief Executive Officer Experience Served as Chief Executive Officer of Marks & Spencer Group p.l.c. As Chief Executive Officer of WM Morrison Supermarkets PLC, successfully led the development and implementation of its long-term strategy, turning around the business. | |

|

Marketing Experience Extensive brand marketing and retail expertise as Chief Executive Officer of Marks & Spencer Group p.l.c. and WM Morrison Supermarkets PLC, as well as serving as Chief Operating Officer and head of Global Marketing for Heineken N.V., where he was responsible for brand and marketing strategies. | |

|

Broad International Exposure/Emerging Market Experience Served as lead non-executive director of the UK Department for International Development from 2018-2020, led international expansion of Marks & Spencer Group p.l.c., held several international management positions while at Heineken N.V., and is the founder of the Movement to Work charity, which provided nearly 100,000 underprivileged young people with work experience and jobs. | |

|

Risk Oversight/Management Expertise Extensive experience overseeing risk as Chief Executive Officer of Marks & Spencer Group p.l.c. and WM Morrison Supermarkets PLC, as Chief Operating Officer of Heineken N.V. and as a Director of International Consolidated Airlines Group, S.A., which offers international and domestic air passenger and cargo transportation services. Additional risk management experience as head of The Blackstone Group Inc.’s European Portfolio Operations, as Chairman of The Blackstone Group International Partners LLP, a subsidiary, which acts as a sub-advisor to Blackstone U.S. affiliates in relation to the investment and re-investment of Europe, Middle East and Africa-based assets of Blackstone funds. | |

2021 PROXY STATEMENT Governance |

19 |

| ||

|

Ana Botín INDEPENDENT |

||

|

Age: 60 Director since: 2013

Committees: • Directors and Corporate Governance • Finance |

PUBLIC BOARD MEMBERSHIPS

Current Public Company Boards: Banco Santander, S.A. (since 1989); Santander UK plc (since 2010); Santander UK Group Holdings plc (since 2014) and Santander Holdings USA, Inc. (since October 2019), all of which are wholly owned subsidiaries of Banco Santander, S.A.

Previous Public Company Boards (Past Five Years): None |

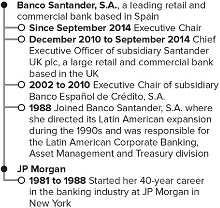

| CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

|

|

High Level of Financial Experience Internationally recognized expert in the investment banking industry with knowledge of global macroeconomic issues. Over 40 years of experience in investment and commercial banking. |

|

Relevant Senior Leadership/Chief Executive Officer Experience Executive Chair of Banco Santander, S.A. since September 2014 and Chief Executive Officer of Santander UK plc from 2010 to September 2014. | |

|

Broad International Exposure/Emerging Market Experience Executive Chair of Banco Santander, S.A., a global financial institution with operations in Europe, North America, Latin America and Asia. Board member of the Institute of International Finance, a global association of the financial industry. Co-founder and Chair of Fundación Empresa y Crecimiento, which finances small and medium-sized companies in Latin America. Founder and President of Fundación Empieza Por Educar, the Spanish member of the global Teach for All network. | |

|

Governmental or Geopolitical Expertise Extensive experience with the regulatory framework applicable to banking institutions throughout the globe during her 32-year tenure with Banco Santander, S.A. | |

|

Risk Oversight/Management Expertise Extensive experience from her work with Banco Santander, S.A., Santander UK plc and Banco Español de Crédito, S.A. in the oversight and management of risks associated with retail and commercial banking activities. Experience with the regulated insurance industry as director of Assicurazioni Generali S.p.A., a global insurance company based in Italy, from 2004 to 2011. | |

| ||

| Christopher C. Davis INDEPENDENT | ||

|

Age: 55 Director since: 2018

Committees: • Talent and Compensation • Finance |

PUBLIC BOARD MEMBERSHIPS

Current Public Company Boards: Graham Holdings Company (since 2006); Selected Funds (consisting of two portfolios) (since 1998); Davis Funds (consisting of 13 portfolios) (since 1997); Clipper Funds Trust (consisting of one portfolio) (Trustee since 2014)

Previous Public Company Boards (Past Five Years): None |

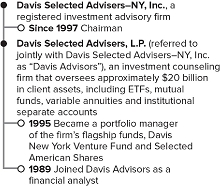

| CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

|

|

High Level of Financial Experience More than 30 years of experience in investment management and securities research at Davis Advisors. Also serves as a portfolio manager for the Davis Large Cap Value Portfolios and a member of the research team for other portfolios. |

|

Relevant Senior Leadership/Chief Executive Officer Experience Serves as Chairman of Davis Selected Advisers–NY, Inc., and as a Director and officer of several mutual funds advised by Davis Advisors, as well as other entities controlled by Davis Advisors. | |

|

Marketing Experience Under the leadership of Mr. Davis, Davis Advisors is widely recognized as a premier investment manager serving individual investors worldwide, identifying investment opportunities both within and outside the United States in developed and developing markets and providing investors access to these investment opportunities. | |

|

Broad International Exposure/Emerging Market Experience Under the leadership of Mr. Davis, Davis Advisors seeks investment growth opportunities and diversification potential that international companies in both developed and developing markets provide. | |

|

Risk Oversight/Management Expertise Extensive experience evaluating strategic investments and transactions and managing risk against the volatility of equity markets during his more than 30-year career at Davis Advisors. Serves on the Audit Committee and as lead independent director of Graham Holdings Company. | |

| 20 | THE COCA-COLA COMPANY Governance |

| ||

| Barry Diller INDEPENDENT | ||

|

Age: 79 Director since: 2002

Committees: • Directors and Corporate Governance • Finance (Chair) • Management Development • Executive |

PUBLIC BOARD MEMBERSHIPS

Current Public Company Boards: MGM Resorts International (since 2020); Expedia Group, Inc. (since 2005) and IAC/InterActiveCorp (since 1995)

Previous Public Company Boards (Past Five Years): Graham Holdings Company (2013-2017) |

| CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

|

|

High Level of Financial Experience Extensive experience in financings, mergers, acquisitions, investments and strategic transactions, including transactions with Silver King Broadcasting, QVC, Inc., Ticketmaster Entertainment, Inc. and Home Shopping Network, Inc. Served on the Finance Committee of Graham Holdings Company. |

|

Relevant Senior Leadership/Chief Executive Officer Experience Serves as Chairman and Senior Executive of IAC/InterActiveCorp. Served as Chief Executive Officer of Fox, Inc. from 1984 to 1992, responsible for the creation of Fox Broadcasting Company, and Fox’s motion picture operations. Prior to Fox, served for ten years as Chief Executive Officer of Paramount Pictures Corporation. | |

|

Marketing Experience Serves as Chairman and Senior Executive at IAC/InterActiveCorp, with widely known consumer brands such as HomeAdvisor, Vimeo, Dictionary.com, The Daily Beast and Investopedia, and at Expedia Group, Inc., which markets a variety of leisure and business travel products. | |

|

Innovation/Technology Experience Extensive experience in the media and Internet sectors, including experience at IAC/InterActiveCorp, with businesses in the marketing and technology industries, at Expedia Group, Inc., which empowers travelers through technology with tools to efficiently research, plan, book and experience travel, and at TripAdvisor, Inc., which operates the flagship TripAdvisor-branded websites and numerous other travel brands. | |

|

Broad International Exposure/Emerging Market Experience Service at IAC/InterActiveCorp, a leading media and Internet company focused on the areas of search and applications, dating, education and fitness businesses, media and e-commerce, and at online travel companies Expedia Group, Inc. and TripAdvisor Inc. Served as a member of the Council on Foreign Relations. | |

| ||

| Helene D. Gayle INDEPENDENT | ||

|

Age: 65 Director since: 2013

Committees: • Talent and Compensation (Chair) • ESG and Public Policy |

PUBLIC BOARD MEMBERSHIPS

Current Public Company Boards: Palo Alto Networks, Inc. (since February 2021); GoHealth, Inc. (since 2020); and Colgate-Palmolive Company (since 2010)

Previous Public Company Boards (Past Five Years): None |

| CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

|

|

Relevant Senior Leadership/Chief Executive Officer Experience Served as Chief Executive Officer of The Chicago Community Trust, former Chief Executive Officer of McKinsey Social Initiative and former President and Chief Executive Officer of CARE USA. |

|

Innovation/Technology Experience Significant experience using and developing and applying innovative approaches, solutions and technologies in her work with McKinsey Social Initiative, CARE USA, the CDC and the Bill & Melinda Gates Foundation. | |

|

Broad International Exposure/Emerging Market Experience Implemented the McKinsey Social Initiative’s Generation program. Experience managing international operations at CARE USA. Helped develop global health initiatives in leadership roles at the CDC and the Bill & Melinda Gates Foundation. Serves on the Board of Trustees of the Center for Strategic and International Studies and the Brookings Institution. Member of the National Academy of Medicine and of the Council on Foreign Relations. | |

|

Governmental or Geopolitical Expertise Extensive leadership experience in the global public health and development fields. Served as Chair of the Obama administration’s Presidential Advisory Council on HIV/AIDS. Member of the U.S. Department of State’s Advisory Committee on International Economic Policy and the Secretary of State’s Advisory Committee on Public-Private Partnerships. Served on the President’s Commission on White House Fellowships. Achieved the rank of Assistant Surgeon General and Rear Admiral in the U.S. Public Health Service. Serves as a Director of New America Foundation and ONE. | |

|

Risk Oversight/Management Expertise Extensive risk oversight and management experience with the delivery of emergency relief and long-term international development projects in the global public health field. Director of the Federal Reserve Bank of Chicago, which participates in the formulation of monetary policy, one of 12 regional reserve banks across the United States that, together with the Board of Governors in Washington, D.C., serves as the central bank for the United States. | |

2021 PROXY STATEMENT Governance |

21 |

| ||

| Alexis M. Herman INDEPENDENT | ||

|

Age: 73 Director since: 2007

Committees: • Talent and Compensation • ESG and Public Policy (Chair) |

PUBLIC BOARD MEMBERSHIPS

Current Public Company Boards: Cummins Inc. (since 2001), Entergy Corporation (since 2003) and MGM Resorts International (since 2002)

Previous Public Company Boards (Past Five Years): None |

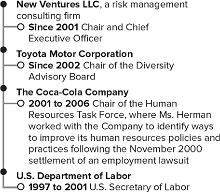

| CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

|

|

High Level of Financial Experience Significant financial experience as Chief Executive Officer of New Ventures LLC and as Chair of the Working Party for the Role of Women in the Economy for the Organisation for Economic Co-operation and Development (“OECD”), an intergovernmental economic organization. Additional financial experience through former service on the Audit Committee of MGM Resorts International, a global hospitality company. |

|

Relevant Senior Leadership/Chief Executive Officer Experience Chief Executive Officer of New Ventures LLC. Former U.S. Secretary of Labor from 1997 to 2001. | |

|

Broad International Exposure/Emerging Market Experience Director of Cummins Inc., a global power leader that serves customers in more than 190 countries and territories. Serves as Chair on Toyota’s Diversity Advisory Board. Served as Chair of the Working Party for the Role of Women in the Economy for the OECD. | |

|

Governmental or Geopolitical Expertise Former U.S. Secretary of Labor. Former White House Assistant to President Clinton and Director of the White House Office of Public Liaison. Served as Director of the Labor Department’s Women’s Bureau under President Jimmy Carter. Former Chief of Staff and former Vice Chair of the Democratic National Committee. Served as a Trustee of the Clinton Bush Haiti Fund and as Chair of the Working Party for the Role of Women in the Economy for the OECD. Serves on the Corporate Social Responsibility Committee for MGM Resorts International. | |

|

Risk Oversight/Management Expertise Significant expertise in management and oversight of labor and human relations risks, including handling the United Parcel Service workers’ strike in 1997 while U.S. Secretary of Labor. Chair of the Company’s Human Resources Task Force following the November 2000 settlement of an employment lawsuit. Serves as Lead Director and is a member of the Finance Committee of Cummins Inc. and served as Chair of the Business Advisory Board at Sodexo, Inc. | |

| ||

| Robert A. Kotick INDEPENDENT | ||

|

Age: 58 Director since: 2012

Committees: • Finance • Management Development |

PUBLIC BOARD MEMBERSHIPS

Current Public Company Boards: Activision Blizzard, Inc. (since 1991)

Previous Public Company Boards (Past Five Years): None |

| CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

|

|

High Level of Financial Experience Over 29 years of experience as Chief Executive Officer of Activision Blizzard, Inc. and its predecessor, including managing complex international operations and financial transactions. |

|

Relevant Senior Leadership/Chief Executive Officer Experience Served as Chief Executive Officer of Activision Blizzard, Inc.’s predecessor for over 17 years and has served as Chief Executive Officer of Activision Blizzard, Inc. since 2008. | |

|

Marketing Experience Significant marketing experience with Activision Blizzard, Inc. and its predecessor, bringing extensive insight about key demographic groups and utilization of technology and social media in marketing. | |

|

Innovation/Technology Experience Chief Executive Officer of Activision Blizzard, Inc., responsible for some of the most successful entertainment franchises, including Call of Duty®, Candy Crush™, Hearthstone®, Overwatch®, Skylanders® and World of Warcraft®. | |

|

Risk Oversight/Management Expertise Extensive experience overseeing risk as Chief Executive Officer of Activision Blizzard, Inc., including developing new intellectual properties and investments in complementary business opportunities. | |

| 22 | THE COCA-COLA COMPANY Governance |

| ||

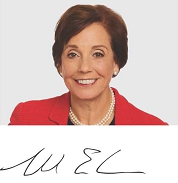

| Maria Elena Lagomasino INDEPENDENT | ||

|

Age: 71 Director since: 2008 Lead Independent Director since: 2019

Committees: • Talent and Compensation • Directors and Corporate Governance (Chair) • Management Development |

PUBLIC BOARD MEMBERSHIPS

Current Public Company Boards: The Walt Disney Company (since 2015)

Previous Public Company Boards (Past Five Years): Avon Products, Inc. (2000-2016) |

| CAREER HIGHLIGHTS | KEY QUALIFICATIONS AND EXPERIENCES | |

|

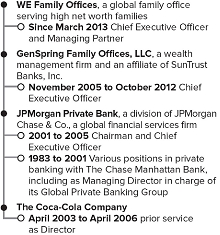

|