DEF 14A: Definitive proxy statements

Published on March 17, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

_______________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ |

No fee required. |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

Table of Contents

2 |

||||

3 |

||||

4 |

||||

7 |

||||

8 |

||||

8 |

35 |

|||

11 |

36 |

|||

12 |

37 |

|||

15 |

41 |

|||

26 |

||||

43 |

||||

43 |

||||

44 |

||||

45 |

||||

45 |

64 |

|||

46 |

72 |

|||

47 |

77 |

|||

63 |

78 |

|||

63 |

79 |

|||

83 |

||||

83 |

ITEM 3 Ratification of the Appointment of Ernst & Young LLP as Independent Auditors |

86 |

||

89 |

||||

ITEM 4 Shareowner Proposal Regarding an Assessment of Non-Sugar Sweeteners |

90 |

ITEM 7 Shareowner Proposal Regarding DEI Goals in Executive Pay |

97 |

|

93 |

ITEM 8 Shareowner Proposal Regarding a Report on Brand Image Impacts |

99 |

||

ITEM 6 Shareowner Proposal Regarding Creation of an Improper Influence Board Committee |

95 |

ITEM 9 Shareowner Proposal Regarding a Report on Civil Liberties in Advertising Services |

101 |

|

103 |

||||

103 |

113 |

|||

110 |

||||

|

Please see Questions and Answers in Annex A beginning on page 103 for important information about the 2025 Annual Meeting of Shareowners (the “2025 Annual Meeting”), proxy materials, voting, Company documents, communications, and the deadlines to submit shareowner proposals and Director nominees for the 2026 Annual Meeting of Shareowners. Additional questions may be directed to Shareowner Services at (404) 676-2777 or shareownerservices@coca-cola.com. |

Links to websites included in this Proxy Statement are provided solely for convenience purposes. Content on the websites, including content on our Company website, is not, and shall not be deemed to be, part of this Proxy Statement or incorporated herein or into any of our other filings with the Securities and Exchange Commission (the “SEC”).

This Proxy Statement contains information that may constitute “forward-looking statements.” Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which generally are not historical in nature. The absence of these words or similar expressions, however, does not mean that a statement is not forward-looking. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future, including statements regarding general views about future operating results, are forward-looking statements. Management believes that these forward-looking statements are reasonable as and when made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Our Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause our Company’s actual results to differ materially from historical experience and from our present expectations or projections. These risks and uncertainties include, but are not limited to, those described in Part I, “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024 (the “Form 10-K”) and those described from time to time in our future reports filed with the SEC.

Notice of 2025

Annual Meeting of Shareowners

DATE & TIME |

VIRTUAL MEETING LOCATION |

ANNUAL MEETING WEBSITE |

RECORD DATE |

|||

|

Wednesday, April 30, 2025, 8:30 a.m. Eastern Time |

The 2025 Annual Meeting of Shareowners will be held exclusively online. Visit meetnow.global/KO2025 to attend the meeting. |

Access links to vote in advance, submit questions in advance of the meeting and learn more about our Company at www.coca-colacompany.com/annual-meeting-of-shareowners. |

Holders of record of our Common Stock as of March 3, 2025 are entitled to notice of, and to vote at, the meeting. |

|

Voting Methods | ||||

|

Your vote is important to us. Whether or not you plan to participate in the 2025 Annual Meeting, we urge you to vote and submit your proxy in advance of the meeting using one of the below advance voting methods. Make sure to have your proxy card or voting instruction form in hand and follow the instructions. Shareowners may also vote during the meeting by accessing the virtual meeting according to the instructions in question 2 on page 103 of the attached Proxy Statement.

| ||||

Advance Voting methods |

Shareowners of Record |

|||

|

Internet www.investorvote.com/ |

Phone Call 1-800-652-VOTE or the telephone number on your proxy card |

Sign, date and return your proxy card |

||

|

Beneficial Owners (shares held through your bank, |

||||

|

Internet www.proxyvote.com |

Phone Call 1-800-454-8683 or the telephone number on your voting instruction form |

Sign, date and return your voting instruction form |

||

Not all beneficial owners may vote at the web address and phone number provided above. If your control number is not recognized, please refer to your voting instruction form for specific voting instructions. |

||||

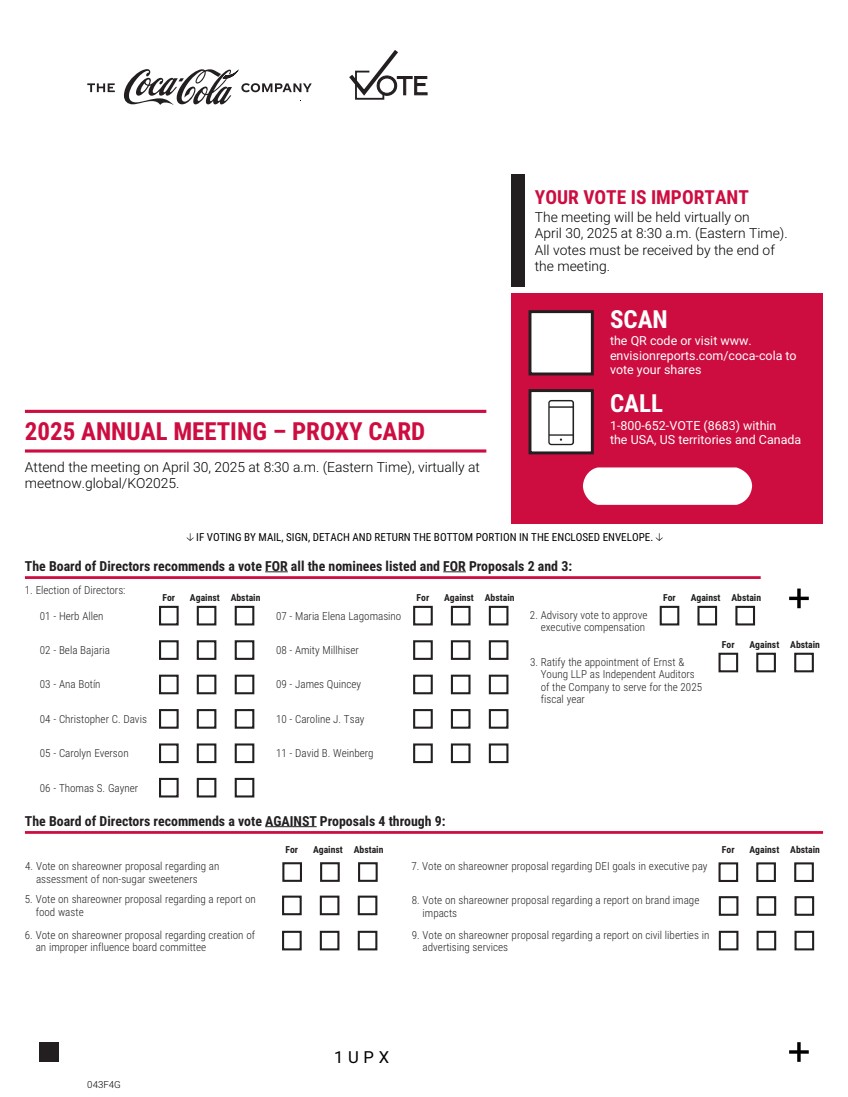

Items of Business |

Our Board’s |

Page |

||

Company Proposals |

||||

1 |

Elect as Directors the 11 Director nominees named in the attached Proxy Statement to serve until the 2026 Annual Meeting of Shareowners. |

|

FOR each Director Nominee |

8 |

2 |

Conduct an advisory vote to approve executive compensation. |

|

FOR |

45 |

3 |

Ratify the appointment of Ernst & Young LLP as Independent Auditors of the Company to serve for the 2025 fiscal year. |

|

FOR |

86 |

Shareowner Proposals |

||||

4 |

Vote on a shareowner proposal regarding an assessment of non-sugar sweeteners. |

|

AGAINST |

90 |

5 |

Vote on a shareowner proposal regarding a report on food waste. |

|

AGAINST |

93 |

6 |

Vote on a shareowner proposal regarding creation of an improper influence board committee. |

|

AGAINST |

95 |

7 |

Vote on a shareowner proposal regarding DEI goals in executive pay. |

|

AGAINST |

97 |

8 |

Vote on a shareowner proposal regarding a report on brand image impacts. |

|

AGAINST |

99 |

9 |

Vote on a shareowner proposal regarding a report on civil liberties in advertising services. |

|

AGAINST |

101 |

|

Shareowners will also transact such other business as may properly come before the meeting and at any adjournments or postponements of the meeting. | ||||

The 2025 Annual Meeting will be held exclusively online via live webcast. Our virtual format leverages the latest technology to provide expanded access to shareowners, while providing shareowners the same rights and opportunities as they would have at an in-person meeting. For the past several years, we have received consistent positive feedback regarding our virtual format. This format allows shareowners to attend a greater number of companies’ annual meetings, from any location around the world, at no cost to them. While you will not be able to attend the meeting at a physical location, as a shareowner of The Coca-Cola Company, you will be able to attend the meeting online, vote your shares electronically and submit questions during the meeting.

To attend the 2025 Annual Meeting, visit meetnow.global/KO2025. For more information on how to participate in the 2025 Annual Meeting, please see Annex A of the attached Proxy Statement beginning on page 103.

An electronic list of shareowners of record as of the record date will be available for inspection by shareowners for any purpose germane to the meeting from April 18 through April 29, 2025. To access the electronic list during this time, please send your request, along with proof of your Company share ownership, by email to shareownerservices@coca-cola.com. You will receive confirmation of your request and instructions on how to view the electronic list. Please see question 23 on page 108 of the attached Proxy Statement for more information.

We are making the Proxy Statement and the form of proxy first available on or about March 17, 2025.

By Order of the Board of Directors

|

JENNIFER D. MANNING Corporate Secretary and Senior Vice President, Associate General Counsel March 17, 2025 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2025 ANNUAL MEETING OF SHAREOWNERS TO BE HELD ON APRIL 30, 2025: |

The Notice of Annual Meeting, Proxy Statement and Annual Report on Form 10-K for the year ended December 31, 2024 are available free of charge at www.edocumentview.com/coca-cola. |

Letter from

Our Chairman and Chief Executive Officer

TO MY FELLOW SHAREOWNERS:

|

Coca-Cola was created in 1886 by a man who wanted to offer a cold, carbonated soft drink to refresh Atlantans. Almost immediately, competitors emerged, attempting to copy Coca-Cola’s name, formula and success. Today, more than 138 years later, Coca-Cola is the pause that still refreshes. But what has become The Coca-Cola Company is much more than just that. Now, it’s approximately 200 brands, served 2.2 billion times a day across more than 200 countries and territories. Our purpose goes beyond making delicious beverages. We’re dedicated to making a meaningful difference in the world. Evolution and innovation take time and commitment. They include successes and failures. And none of it can happen without people believing in the business. So, on behalf of my thousands of colleagues around the world, thank you for your continued investment and trust in The Coca-Cola Company. Reflecting on the past year, I’m pleased to report strong growth and sustained momentum, despite various external challenges like inflation, currency fluctuations and geopolitical issues. We remained resilient by focusing on elements within our control, and we continued our multi-year evolution as a total beverage company. Our all-weather strategy remains steadfast, aiming to drive top-line revenue and deliver robust bottom-line returns. Our system remains strong, with shared objectives and a commitment to achieve long-term growth. Our global workforce of more than 700,000 people across the Coca-Cola system is focused on serving consumers with beverages they love, through the channels they prefer, and with best-in-class marketing that reminds us all of the magic of our brands. Our relentless pursuit of growth aims to exceed the expectations of consumers, customers, communities and employees, ultimately delivering results for you, our shareowners. Looking ahead, I’m encouraged by the future growth opportunities we see around the world. We’re proud of the 138 years that have passed, and we’re just as excited about our future.

Sincerely,

JAMES QUINCEY Chairman and Chief Executive Officer The Coca-Cola Company |

The Coca-Cola Company |

3 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

Company Overview

OUR COMPANY

The Coca-Cola Company (the “Company”) is a total beverage company with products sold in more than 200 countries and territories. Our Company’s purpose is to refresh the world and make a difference. Our brands include the following:

* |

Schweppes is owned by the Company in certain countries outside the United States. |

** |

In the United States and Canada, the Company authorizes third parties to use certain Topo Chico Hard Seltzer and Simply Spiked trademarks and related intellectual property in the production, distribution, marketing and sale of Topo Chico Hard Seltzer and Simply Spiked, as applicable. |

|

Learn More About Our Company You can learn more about the Company by visiting our website, www.coca-colacompany.com. We also encourage you to read our latest Form 10-K, available at www.coca-colacompany.com/annual-meeting-of-shareowners. The Company’s principal executive offices are located at One Coca-Cola Plaza, Atlanta, Georgia 30313. |

The Coca-Cola Company |

4 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

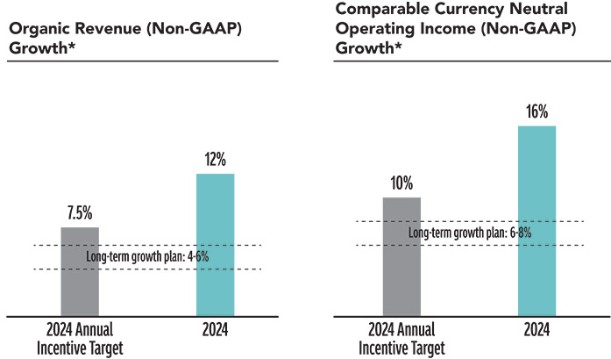

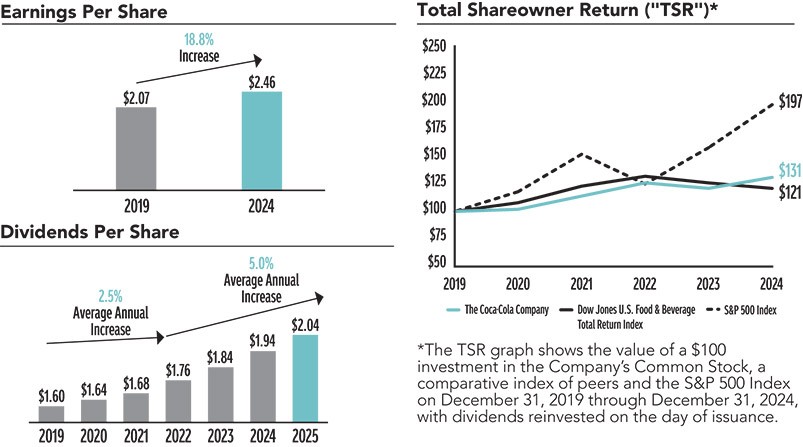

2024 FINANCIAL HIGHLIGHTS

In 2024, the Company executed on its objectives, expanded its leadership, and drove volume and revenue growth despite a dynamic operating environment. Our 2024 reported results were impacted by currency headwinds, bottler refranchising, a $3.1 billion charge related to the remaining milestone payment for our acquisition of fairlife, LLC (“fairlife”) (driven by fairlife’s strong business performance), and a $6.0 billion deposit made to the U.S. Internal Revenue Service (“IRS”) related to ongoing tax litigation. Our non-GAAP results built on momentum from recent years and outperformed our long-term growth plan. We remain committed to driving balanced growth across our total beverage portfolio and delivering on our purpose to refresh the world and make a difference.

REVENUE PERFORMANCE |

OPERATING INCOME PERFORMANCE |

|||

|

||||

3% |

12% |

-12% |

16% |

|

Reported Net Operating Revenue Growth vs. 2023 |

Organic Revenue (Non-GAAP) Growth vs. 2023 |

Reported Operating Income vs. 2023 |

Comparable Currency Neutral Operating Income (Non-GAAP) Growth vs. 2023 |

|

EARNINGS PER SHARE PERFORMANCE |

CASH FLOW |

DIVIDENDS |

||||

|

|

|||||

0% |

7% |

$6.8 BN |

$10.8 BN |

$8.4 BN |

||

Reported Earnings Per Share (“EPS”) vs. 2023 |

Comparable EPS (Non-GAAP) Growth vs. 2023 |

Reported Cash Flow from Operations |

Free Cash Flow Excluding the IRS Tax Litigation Deposit |

Returned to Shareowners in 2024 |

||

Organic revenues is a financial measure outside of generally accepted accounting principles in the United States (“GAAP”) that excludes or has otherwise been adjusted for the impact of acquisitions, divestitures and structural changes, as applicable, and the impact of fluctuations in foreign currency exchange rates. Comparable currency neutral operating income is a non-GAAP financial measure that excludes or has otherwise been adjusted for items impacting comparability and the impact of fluctuations in foreign currency exchange rates. Comparable EPS is a non-GAAP financial measure that excludes or has otherwise been adjusted for items impacting comparability. Free cash flow excluding the IRS tax litigation deposit is a non-GAAP financial measure that represents net cash provided by operating activities less purchases of property, plant and equipment and excludes the Company’s IRS tax litigation deposit that was paid in 2024. See Annex C on page 113 for reconciliations of non-GAAP financial measures to our results as reported under GAAP.

OUR STRATEGY AND 2024 BUSINESS HIGHLIGHTS

Our global franchise operating model combines the benefits of scale with deep, local market intimacy. The power of our portfolio, amplified by our system’s unique capabilities, is a clear advantage to win in the marketplace. Our mindset is to continuously improve every aspect of how we do business, and we take a consumer-centric and customer-focused viewpoint to all critical business decisions. We are focused on the following strategic priorities: shaping a portfolio of loved brands; transforming our marketing and innovation agenda; optimizing the Coca-Cola ecosystem; building talent and capabilities; and enhancing our license to operate.

The Coca-Cola Company |

5 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

Highlights from 2024 against our strategic priorities include the following:

|

|

●

Trademark Coca-Cola grew volume and gained value share, and Coca-Cola Zero Sugar grew unit case volume 9%.

●

Sparkling flavors, which consists of brands such as Sprite, Fanta and Schweppes and regional brands such as Thums Up, grew volume. Successful product launches like Sprite Chill, Sprite Winter Spiced Cranberry and Fanta Haunted Apple contributed to volume growth.

●

Juice, value-added dairy and plant-based beverages volume was even, and value share increased. Core Power and Maaza became billion-dollar brands in 2024.

●

Ayataka, Fuze Tea and Topo Chico all had strong volume performance. Outside the United States, Powerade is the leading sports beverage brand in retail value.

|

|

●

Our networked marketing model is integrating product, digital, live and retail experiences and harnessing passion points to reach consumers in personalized ways. Examples include Coca-Cola’s partnership with Marvel; long-standing partnerships with the Olympic Games and Paralympic Games; and a Fanta partnership with Warner Bros. Entertainment, Inc. for the film “Beetlejuice Beetlejuice.”

●

We are focusing on innovation that prioritizes bigger and bolder bets. In 2024, innovation contributed strongly to revenue growth, and our innovation success rates improved versus the prior year. Examples include Coca-Cola OREO Zero Sugar and new launches of Ayataka Tea and Topo Chico Sabores.

●

Our marketing and innovation transformation contributed to Trademark Coca-Cola winning Creative Brand of the Year for the first time ever at the June 2024 Cannes Lions International Festival of Creativity, where the Company won a total of 18 different awards. In addition, according to TIME, Coca-Cola, Minute Maid and fairlife were named World’s Best Brands in their respective beverage categories in 2024.

|

|

●

The Coca-Cola system’s Cross Enterprise Procurement Group (“CEPG”), which leverages the scale of the system to procure ingredients on behalf of the Company and our bottling partners, celebrated its 20th anniversary in 2024. Through CEPG, our Global Procurement team strives to be best in class for security of supply, quality, cost, service, payment terms, sustainability and innovation.

●

We continue to make progress on our refranchising journey. In 2024, we completed the refranchising of Company-owned bottling operations in the Philippines, Bangladesh and certain territories in India. Our Bottling Investments operating segment as a percent of consolidated reported net operating revenues was 13% in 2024, down from 52% in 2015.

|

|

|

●

In Fortune’s 2025 list of World’s Most Admired Companies, The Coca-Cola Company ranked #12, up three spots versus the prior year. We continue to rank first in the beverage industry.

●

Our 2024 Culture & Engagement Survey results underscore strong levels of employee pride and growth opportunities, with a strong number of respondents saying they are proud to work at The Coca-Cola Company and see good opportunity to learn and grow in their roles.

●

We announced updated voluntary environmental goals with the aim of delivering on the Company’s purpose to refresh the world and make a difference. The Company is prioritizing goals and actions that seek to improve water security in high-risk locations, reduce packaging waste and decrease emissions, and is extending the timeframe for these goals and actions to 2035.

|

The Coca-Cola Company |

6 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

Voting Roadmap

Company Proposals | |||

ITEM |

|

|

Our Board recommends a vote FOR each Director nominee The Board and the Corporate Governance and Sustainability Committee believe that the 11 Director nominees possess the necessary qualifications and experiences to provide quality advice and counsel to the Company’s management and effectively oversee the business and the long-term interests of shareowners. ► See page 8 for further information |

Election of Directors |

|||

ITEM |

|

|

Our Board recommends a vote FOR this item The Company seeks a non-binding advisory vote to approve the compensation of its Named Executive Officers as described in the Compensation Discussion and Analysis beginning on page 47 and the Compensation Tables beginning on page 64. ► See page 45 for further information |

Advisory Vote to Approve Executive Compensation |

|||

ITEM |

|

|

Our Board recommends a vote FOR this item The Board and the Audit Committee believe that the retention of Ernst & Young LLP (“EY”) to serve as the Company’s independent auditors (the “Independent Auditors”) for the fiscal year ending December 31, 2025 is in the best interests of the Company and its shareowners. As a matter of good corporate governance, shareowners are being asked to ratify the Audit Committee’s selection of the Independent Auditors. ► See page 86 for further information |

Ratification of the Appointment of Ernst & Young LLP as Independent Auditors |

|||

SHAREOWNER PROPOSALS | |||

ITEMS |

|

|

Our Board recommends a vote AGAINST each of the shareowner proposals Six proposals were submitted by shareowners, which will each be voted on if the shareowner proponent, or a representative who is qualified under state law, is present at the 2025 Annual Meeting and submits the proposal for a vote. ► See page 89 for further information |

The Coca-Cola Company |

7 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

Governance

ITEM 1:

ELECTION OF DIRECTORS

|

The Board of Directors recommends a vote FOR each nominee |

|

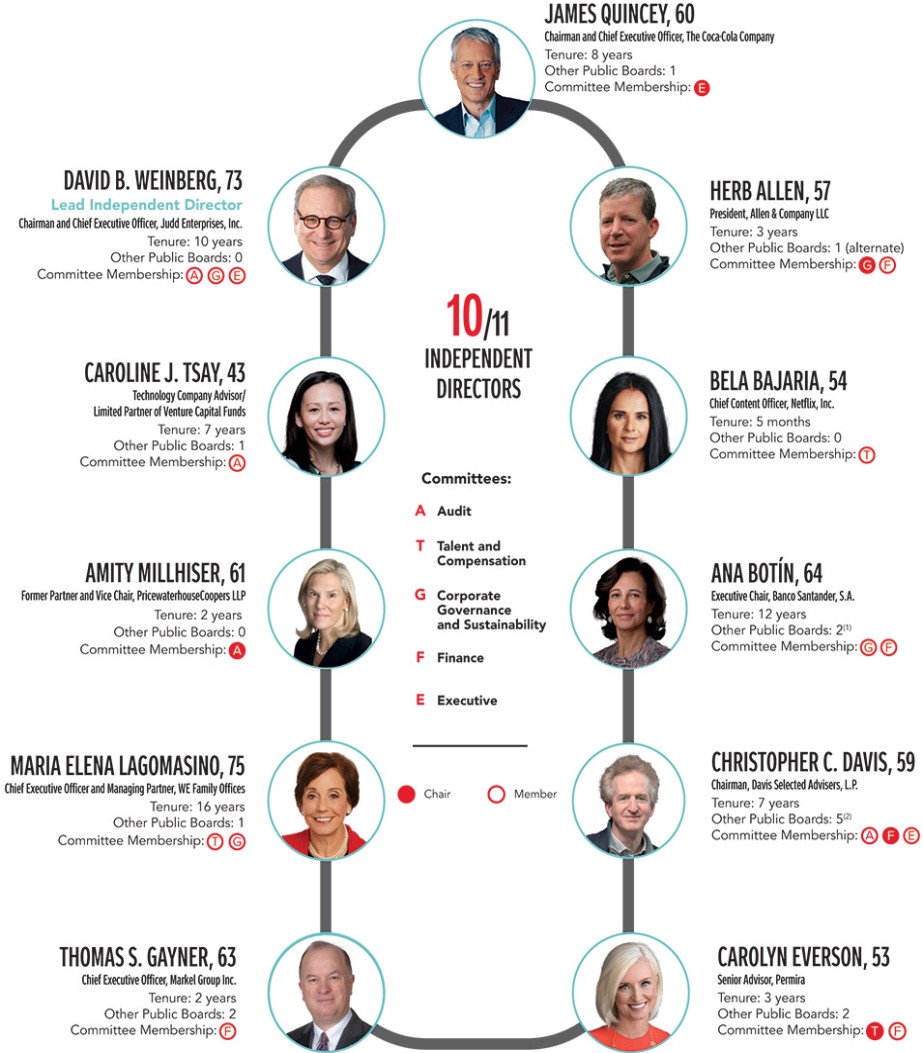

WHAT AM I VOTING ON? The Board of Directors, upon the recommendation of the Corporate Governance and Sustainability Committee, has nominated the following 11 individuals for election to the Board for a one-year term. If elected, each Director nominee will hold office until the 2026 Annual Meeting of Shareowners and until his or her successor is elected and qualified. · Herb Allen · Bela Bajaria · Ana Botín · Christopher C. Davis · Carolyn Everson · Thomas S. Gayner · Maria Elena Lagomasino · Amity Millhiser · James Quincey · Caroline J. Tsay · David B. Weinberg |

All nominees are independent under the New York Stock Exchange (“NYSE”) corporate governance rules, except for James Quincey, our Chairman and Chief Executive Officer (see Director Independence and Related Person Transactions beginning on page 41). Each of the Director nominees was elected by shareowners at the 2024 Annual Meeting of Shareowners, other than Ms. Bajaria. Ms. Bajaria was identified as a potential Director by the Corporate Governance and Sustainability Committee, which determined that she was qualified under the Committee’s criteria, and joined the Board effective October 17, 2024.

We have no reason to believe that any of the nominees will be unable or unwilling to serve if elected. However, if any nominee should become unable for any reason or unwilling for good cause to serve, proxies may be voted for another person nominated as a substitute by the Board or the Board may reduce the number of Directors.

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

OUR 2025 DIRECTOR NOMINEES

| (1) | Consists of Banco Santander, S.A. and its wholly owned subsidiary, Santander Holdings USA, Inc. |

| (2) | Includes investment company directorships in Selected Funds, Davis Funds and Clipper Funds Trust, three fund complexes which are advised by Davis Selected Advisers, L.P. and other entities controlled by Davis Selected Advisers, L.P. |

The Coca-Cola Company |

9 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

SNAPSHOT OF 2025 DIRECTOR NOMINEES

Building the Right Board for The Coca-Cola Company

Nominee Skills |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

High Level of |

Marketing |

Innovation/ |

Broad |

Sustainability |

Governmental |

Risk Oversight/ |

Extensive |

Relevant Senior |

||||||||||||||||||||

11 |

8 |

7 |

10 |

4 |

4 |

11 |

3 |

11 |

||||||||||||||||||||

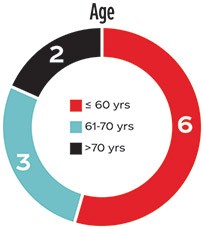

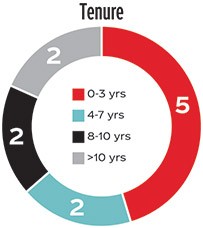

Nominee Demographics |

||||||||||||||||||||||||||||

|

AVERAGE AGE 60.7 years |

|

AVERAGE TENURE 6.3 years |

||||||||||||||||||||||||||

GOVERNANCE HIGHLIGHTS

We are committed to good corporate governance, which promotes the long-term interests of shareowners, strengthens Board and management accountability and helps build public trust in the Company. Our governance framework includes the following highlights:

BOARD PRACTICES |

SHAREOWNER MATTERS |

||

|

●

10 of 11 Director nominees independent

●

Demonstrated commitment to Board refreshment (in past five years, five new Directors have joined and seven Directors have rotated off the Board)

●

Demonstrated commitment to periodic committee refreshment and committee chair succession (in 2024, the Board appointed four new Committee Chairs and a new Lead Independent Director)

●

Robust Director nominee selection process

●

Regular Board, committee and Director evaluations

●

Market-standard Director “overboarding policy”

●

Annual election of Directors, with majority voting standard in uncontested elections

●

Lead Independent Director elected by the independent Directors, with robust duties and oversight responsibilities

●

Independent Audit, Compensation, Governance and Finance Committees

●

Regular executive sessions of non-employee Directors

●

Strategy and risk oversight by full Board and committees

●

Regular review and assessment of committee responsibilities

|

●

Long-standing, year-long active shareowner engagement

●

Annual “say-on-pay” advisory vote

●

Majority voting with resignation policy for Directors in uncontested elections

●

Shareowner proxy access right

●

Shareowner right to call special meetings

|

||

OTHER BEST PRACTICES |

|||

|

●

Long-standing commitment to, and Board oversight of, sustainability matters

●

Board oversight of human capital management, including talent, leadership and culture

●

Transparent public policy engagement

●

Robust stock ownership guidelines for executive officers and stock holding requirements for Directors

●

Clawback policy for incentive compensation

●

Global insider trading compliance policy, which includes hedging, short sale and pledging policies

|

|||

The Coca-Cola Company |

10 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

BOARD MEMBERSHIP CRITERIA

The Board and the Corporate Governance and Sustainability Committee believe that there are general qualifications that all Directors must exhibit and other key qualifications and experiences that should be represented on the Board as a whole but not necessarily by each individual Director.

Qualifications Required of All Directors

The Board and the Corporate Governance and Sustainability Committee require that each Director be a recognized person of high integrity, with a proven record of success in his or her field, and be able to devote the time and effort necessary to fulfill his or her responsibilities to the Company. Each Director must demonstrate innovative thinking, familiarity with and respect for corporate governance requirements and practices, an appreciation of multiple cultures, and a commitment to sustainability and to dealing responsibly with social issues. In addition, potential Director candidates are interviewed to assess intangible qualities, including the individual’s ability to ask difficult questions and, simultaneously, work collegially.

Key Qualifications and Experiences to be Represented on the Board

The Board has identified key qualifications and experiences that are important to have represented on the Board as a whole in light of the Company’s business strategy and expected future business needs. The below table summarizes the ways in which these key qualifications and experiences are linked to our Company’s core business needs and priorities.

CORE BUSINESS NEEDS AND PRIORITIES |

KEY QUALIFICATIONS AND EXPERIENCES |

||||

The Company’s business is multifaceted and involves complex financial transactions in many countries and in many currencies. |

|

|

High Level of Strategic and Financial Experience |

|

Relevant Senior Leadership/Chief Executive Officer Experience |

The Company seeks to develop and deploy the world’s most effective marketing to support our brands. |

|

|

Marketing Experience |

||

Innovation, technology and digitalization are critical components to enhancing connections with the Company’s customers and consumers, delivering value by better understanding their needs, tailoring portfolio offerings and improving execution and efficiency. |

|

|

Innovation/Digital and Technology Experience |

||

The Company’s business is truly global, with its products sold in more than 200 countries and territories around the world. |

|

|

Broad International Exposure/ |

||

The Company’s business requires compliance with a variety of regulatory requirements across a number of countries and requires that the Company maintain relationships with various governmental entities and non-governmental organizations. |

|

|

Governmental or Geopolitical Expertise |

||

The Company’s business is a complicated global enterprise, and most of the Company’s products are manufactured and sold by bottling partners around the world. |

|

|

Extensive Knowledge of the Company’s Business and/or Industry |

||

The Board’s responsibilities include understanding and overseeing the various risks facing the Company and ensuring that appropriate policies and procedures are in place to effectively manage risk. |

|

|

Risk Oversight/Management Expertise |

||

As a foundational step as we conduct business and develop our corporate strategy, our Company focuses on advancing high-priority sustainability initiatives. |

|

|

Sustainability Experience |

||

The Coca-Cola Company |

11 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

Experience of Director Candidates

The Board does not have a specific diversity policy but fully appreciates the value of having a range of backgrounds, experiences, skill sets and perspectives on the Board. The Board believes that having a variety of points of view improves the quality of dialogue, contributes to a more effective decision-making process and enhances overall culture in the boardroom.

In evaluating candidates for Board membership, the Board and the Corporate Governance and Sustainability Committee consider many factors based on the specific needs of the business and the best interests of the Company’s shareowners. When seeking Director candidates for consideration, the Board and the Corporate Governance and Sustainability Committee strive to develop a pool of candidates that includes a wide spectrum of professional experience, skills, perspectives, characteristics and backgrounds. In addition, throughout the process, the Board and the Corporate Governance and Sustainability Committee focus on how the experiences and skill sets of each Director nominee complement those of fellow Director nominees to create a balanced Board with a breadth of viewpoints and deep expertise.

DIRECTOR NOMINATION PROCESS

Source for Candidate Pool |

|---|

Directors |

Management |

Shareowners |

Independent search firms |

Self-nominations |

|---|

In-Depth Review by Corporate Governance and Sustainability Committee |

|---|

Screen qualifications and perform interviews |

Examine overall Board |

Review independence and |

Examine board skills, experiences and needs |

|---|

Recommendation of Slate of Nominees |

|---|

Full Board Review |

|---|

Board Nomination / Shareowner Election |

|---|

Result |

|---|

We have nominated five new highly qualified |

|---|

The Corporate Governance and Sustainability Committee is responsible for recommending to the Board a slate of nominees for election at each Annual Meeting of Shareowners. The Corporate Governance and Sustainability Committee considers a wide range of factors when assessing potential Director nominees. This assessment includes a review of each potential nominee’s judgment, skills and experiences, independence, understanding of the Company’s business or other related industries, and such other factors as the Committee concludes are pertinent in light of the current and future needs of the Board. Consideration of these qualifications helps the Committee determine whether potential nominees meet the qualifications required of all Directors and the key qualifications and experiences we aspire to have represented on the Board, as described above.

The Coca-Cola Company |

12 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

Board Composition and Refreshment

When recommending to the Board the slate of Director nominees for election at the Annual Meeting of Shareowners, the Corporate Governance and Sustainability Committee strives to maintain an appropriate balance of tenure, backgrounds, experiences, skill sets and perspectives on the Board.

The Board believes that refreshment, including periodic committee rotation, is important to help ensure that Board composition is aligned with the needs of the Company and of the Board as our business evolves over time and that fresh viewpoints and perspectives are regularly considered. The Board also believes that, because of the significant value of the Directors’ ability to develop a deep understanding of the Company and ability to work effectively as a group over time, a degree of year-over-year continuity is beneficial to shareowners and should generally be expected.

Directors are elected at the Annual Meeting of Shareowners each year, to hold office until the next Annual Meeting of Shareowners and until their successors are elected and qualified. Because term limits could cause the Board to lose experience or expertise important to its optimal operation, there are no absolute limits on the length of time that a Director may serve, but the Corporate Governance and Sustainability Committee and the Board consider the tenure of Directors as one of several factors in nomination decisions. In addition, the Corporate Governance and Sustainability Committee evaluates the qualifications and performance of each incumbent Director before recommending the nomination of that Director for an additional term. Furthermore, pursuant to our Corporate Governance Guidelines, any Director whose job responsibilities change or who reaches the age of 74 is asked to submit a letter of resignation to the Board. These letters are considered by the Board and, if applicable, annually thereafter. Any Director who has reached the age of 76 following the filing of the proxy statement for the applicable Annual Meeting of Shareowners shall not be nominated to stand for reelection at the following Annual Meeting of Shareowners, subject to any determination by the Board to waive this requirement. The Corporate Governance and Sustainability Committee has reviewed the Director nominees who were 74 years of age or older and those whose job responsibilities changed in the prior year and determined to recommend them for reelection based on their skills, qualifications and experiences.

Shareowner-Recommended Director Candidates

Shareowners who would like the Corporate Governance and Sustainability Committee to consider their recommendations for nominees for the position of Director should submit their recommendations in writing by mail to the Corporate Governance and Sustainability Committee in care of the Office of the Secretary, The Coca-Cola Company, P.O. Box 1734, Atlanta, Georgia 30301 or by email to asktheboard@coca-cola.com. Shareowner recommendations submitted in accordance with these procedures will receive the same consideration by the Corporate Governance and Sustainability Committee as other recommended nominees.

Shareowner-Nominated Director Candidates

We have a “Proxy Access for Director Nominations” by-law, which permits a shareowner, or a group of up to 20 shareowners, owning 3% or more of the Company’s outstanding Common Stock continuously for at least three years to nominate and include in the Company’s proxy materials Director nominees constituting no more than two individuals or 20% of the Board (whichever is greater), provided that the shareowner(s) and the nominee(s) satisfy the requirements specified in Article I, Section 12 of our By-Laws. See question 30 on page 109 for more information. Shareowners complying with the advance notice procedure in our By-Laws may also nominate directors before an Annual Meeting of Shareowners without such nominee being included in our proxy materials. See question 29 on page 109 for more information.

Majority Voting Standard and Director Resignation Policy

Our By-Laws provide that, in an election of Directors where the number of nominees does not exceed the number of Directors to be elected, each Director must receive the majority of the votes cast with respect to that Director. If a Director does not receive a majority vote, he or she has agreed that he or she would submit a letter of resignation to the Board. The Corporate Governance and Sustainability Committee would make a recommendation to the Board on whether to accept or reject the resignation or whether to take other action. The Board would act on the resignation, taking into account the recommendation of the Corporate Governance and Sustainability Committee, which would include consideration of the vote and any relevant input from shareowners. The Board would publicly disclose its decision and its rationale within 100 days of the certification of the election results. The Director who tenders his or her resignation would not participate in the decisions of the Corporate Governance and Sustainability Committee or the Board that concern the resignation.

The Coca-Cola Company |

13 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

Director Time Commitments and Overboarding

Our Board’s Philosophy

The Board expects every Director to sufficiently prepare for, and actively and effectively participate in, the Company’s Board and committee meetings. To help ensure this expectation is met, the Corporate Governance and Sustainability Committee (referred to as the “Governance Committee” in this section) monitors the Board as a whole and the Directors individually through robust governance processes and direct observation and experience. The Governance Committee believes consideration of both these factors is essential to recruiting and fostering an effective Board.

Many investors, corporate governance professionals, public companies, including the Company, and other stakeholders have policies governing the number of publicly traded company boards on which a director should sit. While this approach informs the Governance Committee’s perspective, the Governance Committee also believes that evaluating a Director’s effectiveness should not be solely determined by the number of boards on which he or she serves, as doing so may fail to take into consideration other important factors, including the size and complexity of the other boards on which a Director may sit, specific expertise or experiences needed to help ensure Board continuity due to Board refreshment and/or Director transition, and the Governance Committee’s observations of the Director’s capacity to manage their commitments. The Governance Committee and the Board are committed to conducting a thoughtful governance process, as further described below, in which they perform proper due diligence and exercise appropriate discretion.

Our Process

Under the Company’s Corporate Governance Guidelines, Directors should not serve on more than a total of four publicly traded company boards (including the Company’s Board). Notwithstanding the foregoing, if a Director actively serves as an executive officer (or similar position) of a publicly traded company, that Director should not serve on more than three publicly traded company boards (including the Company’s Board). If a Director serves on the board of a public subsidiary or affiliate of the company where the Director serves as an executive, the Governance Committee will consider all such service as one board.

The Governance Committee has discretion to grant exceptions to this overboarding guideline if it determines that doing so would best serve the Company and the Board’s current or future needs or if a Director’s other commitments do not impair the Director’s ability to sufficiently prepare for, and actively and effectively participate in, the Company’s Board and committee meetings. The Governance Committee intends to grant these exceptions sparingly.

The Coca-Cola Company |

14 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

BIOGRAPHICAL INFORMATION ABOUT OUR DIRECTOR NOMINEES

Included in each Director nominee’s biography that follows is a description of five key qualifications and experiences of such nominee. Many of our Director nominees have more than five qualifications, and the aggregate number for all Director nominees is reflected on page 10. The Board and the Corporate Governance and Sustainability Committee believe that the combination of the various qualifications and experiences of the Director nominees would contribute to an effective and well-functioning Board and that, individually and as a whole, the Director nominees possess the necessary qualifications to provide effective oversight of the business and quality advice and counsel to the Company’s management.

|

HERB ALLEN DIRECTOR SINCE: 2021 COMMITTEES: Corporate Governance and Sustainability (Chair); Finance |

CAREER HIGHLIGHTS |

KEY QUALIFICATIONS AND EXPERIENCES |

|

Allen & Company LLC, a private investment banking firm focused on media, entertainment, technology and other innovative industries ●

President (since 2002)

●

Executive Vice President and Managing Director of Allen & Company Incorporated, the predecessor to the investment banking business of Allen & Company LLC (1993 to 2002)

PUBLIC BOARD MEMBERSHIPS Current Public Company Boards: ●

Grupo Televisa, S.A.B. (Alternate) (since 2002)

Previous Public Company Boards (Past Five Years): ●

Coca-Cola FEMSA, S.A.B. de C.V. (Alternate) (2000 to 2022)

|

Extensive experience supervising business operations, including providing strategic and financial advisory and investment banking services to public and private companies at Allen & Company LLC. Supervises Allen & Company LLC’s principal financial and accounting officers on all matters related to the firm’s financial position and results of operations as well as the presentation of its financial statements.

President of Allen & Company LLC, a privately held investment banking firm, and its affiliate, Allen Investment Management LLC, a privately held investment advisory firm, since 2002.

Extensive entrepreneurial experience overseeing investments by Allen & Company LLC into early-stage companies, focusing on technologies, including e-commerce, data analytics, cybersecurity, artificial intelligence, biotechnology and SaaS technologies.

Considerable international experience as President of Allen & Company LLC, working with international clients on mergers and acquisitions, capital markets and other advisory assignments with a focus on European and Latin American clients.

Extensive risk and management experience as President of Allen & Company LLC, including overseeing and assessing the performance of companies and public accountants with respect to matters related to the preparation, audit and evaluation of financial statements. |

The Coca-Cola Company |

15 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

|

BELA BAJARIA DIRECTOR SINCE: 2024 COMMITTEES: Talent and Compensation |

CAREER HIGHLIGHTS |

KEY QUALIFICATIONS AND EXPERIENCES |

|

Netflix, Inc. (“Netflix”), one of the world’s leading entertainment services ●

Chief Content Officer (since January 2023)

●

Head of Global TV (October 2020 to January 2023)

●

Vice President of Content (November 2016 to October 2020)

Universal Television LLC (“Universal Television”), a U.S. television production company ●

President (June 2015 to May 2016)

●

Executive Vice President (August 2011 to June 2015)

PUBLIC BOARD MEMBERSHIPS Current Public Company Boards: ●

None

Previous Public Company Boards (Past Five Years): ●

None

|

As Chief Content Officer of Netflix, one of the world’s leading entertainment services with approximately 302 million paid memberships in over 190 countries, oversees an annual content budget of $17 billion and sits on Netflix’s 11-person leadership team, which is responsible for strategy. Prior to joining Netflix in 2016, President of Universal Television, which she rebuilt into a major studio. Senior Vice President, Cable Programming for CBS TV Studios, and Senior Vice President of Movies and Miniseries for the CBS Network prior to Universal Television.

Oversees the creation and production of Netflix’s scripted and unscripted series around the world, including coverage of NFL, boxing matches and WWE, and opened 27 country offices to launch a new strategy for local language originals. Served as Head of Global TV at Netflix from October 2020 to January 2023.

Extensive experience storytelling – understanding audiences and connecting with them, understanding pop culture, and creating content that resonates with consumers. At Netflix, responsible for producing engaging content, including the series Stranger Things, Squid Game, Bridgerton and Heeramandi, live-action anime, unscripted dating and reality TV shows, streaming live sports and events and films. At Universal Television, shepherded creative programming including Chicago Fire, The Mindy Project and Unbreakable Kimmy Schmidt. Named one of TIME’s 100 Most Influential People in 2022.

As Chief Content Officer of Netflix, responsible for the development and management of TV series and films across a wide variety of genres and languages in the 27 countries where Netflix operates. Extensive experience managing economic, reputational, regulatory, political and other risks arising from Netflix’s productions both in the U.S. and around the world.

As Chief Content Officer of Netflix, responsible for the implementation and distribution of content on digital platforms and the creation of anime adaptations. |

The Coca-Cola Company |

16 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

|

ANA BOTÍN DIRECTOR SINCE: 2013 COMMITTEES: Corporate Governance and Sustainability; Finance |

CAREER HIGHLIGHTS |

KEY QUALIFICATIONS AND EXPERIENCES |

|

Banco Santander, S.A., a leading retail and commercial bank with a global presence based in Spain ●

Executive Chair (since September 2014)

●

Chief Executive Officer of subsidiary Santander UK plc, a large retail and commercial bank based in the U.K. (December 2010 to September 2014)

●

Executive Chair of subsidiary Banco Español de Crédito, S.A. (2002 to 2010)

●

Joined Banco Santander, S.A. in 1988

J.P. Morgan, a financial services firm with operations worldwide ●

Started her career in the banking industry at J.P. Morgan in New York (1981 to 1988)

PUBLIC BOARD MEMBERSHIPS Current Public Company Boards: ●

Banco Santander, S.A. (since 1989)

●

Santander Holdings USA, Inc., a wholly owned subsidiary of Banco Santander, S.A. (since 2019)

Previous Public Company Boards (Past Five Years): ●

Santander UK plc (2010 to 2021)

●

Santander UK Group Holdings plc (2014 to 2021)

|

Internationally recognized expert in the investment banking industry with knowledge of global macroeconomic issues. Over 40 years of experience in investment and commercial banking.

Executive Chair of Banco Santander, S.A. since 2014 and Chief Executive Officer of Santander UK plc from 2010 to 2014.

Executive Chair of Banco Santander, S.A., a global financial institution with operations in Europe, North America, Latin America and Asia. Board member of the Institute of International Finance, a global association of the financial industry, since 2015 and Chair since January 2023. Co-founder and Chair of Fundación Empresa y Crecimiento, which finances small and medium-sized companies in Latin America. Founder and President of Fundación Empieza Por Educar, the Spanish member of the global Teach for All network.

Extensive experience with the regulatory framework applicable to banking institutions throughout the globe. President of the European Banking Federation from 2021 to February 2023. From 2020 to 2022, Vice Chair of the Executive Committee of the World Business Council of Sustainable Development, a CEO-led community of over 200 of the world’s leading sustainable businesses that works closely with a number of non-governmental organizations.

Extensive experience from her work with Banco Santander, S.A., Santander UK plc and Banco Español de Crédito, S.A. in the oversight and management of risk associated with retail and commercial banking activities. Since May 2023, Chair of Open Bank, S.A., one of Europe’s largest digital banks, and Open Digital Services, S.L., offering cloud-based software solutions for the financial industry. Since 2020, Chair of PagoNxt, S.L., a standalone subsidiary of Banco Santander, S.A. that manages its global payment businesses. Experience with the regulated insurance industry as director of Assicurazioni Generali S.p.A., a global insurance company based in Italy, from 2004 to 2011. |

The Coca-Cola Company |

17 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

|

CHRISTOPHER C. DAVIS DIRECTOR SINCE: 2018 COMMITTEES: Audit; Finance (Chair); Executive |

CAREER HIGHLIGHTS |

KEY QUALIFICATIONS AND EXPERIENCES |

|

Davis Selected Advisers, L.P. (referred to jointly with Davis Selected Advisers–NY, Inc., its registered investment advisory subsidiary, as “Davis Advisors”), an independent investment management firm that oversees approximately $23 billion in assets, including exchange-traded funds (ETFs), mutual funds, variable annuities and separately managed accounts ●

Chairman (since 1997)

●

Portfolio manager of the firm’s flagship funds, Davis New York Venture Fund and Selected American Shares (since 1995)

PUBLIC BOARD MEMBERSHIPS Current Public Company Boards: ●

Berkshire Hathaway Inc. (since 2021)

●

Graham Holdings Company (since 2006)

Current Boards for Registered Companies (Investment Company Act of 1940): ●

Selected Funds (consisting of two portfolios) (since 1998)

●

Davis Funds (consisting of 13 portfolios) (since 1997)

●

Trustee of Clipper Funds Trust (consisting of one portfolio) (since 2014)

Previous Public Company Boards (Past Five Years): ●

None

|

More than 30 years of experience in investment management and securities research at Davis Advisors. Also serves as a portfolio manager for the Davis Large Cap Value Portfolios and a member of the research team for other portfolios.

Serves as Chairman of Davis Advisors and as a director and officer of several mutual funds advised by Davis Advisors as well as other entities controlled by Davis Advisors.

Under the leadership of Mr. Davis, Davis Advisors is widely recognized as a premier investment manager serving individual investors worldwide, identifying investment opportunities both within and outside the United States in developed and developing markets and providing investors access to these investment opportunities.

Under the leadership of Mr. Davis, Davis Advisors seeks investment growth opportunities and diversification potential that international companies in both developed and developing markets provide.

Extensive experience evaluating strategic investments and transactions and managing risk against the volatility of equity markets during his more-than-30-year career at Davis Advisors. Serves on the Audit Committee and as lead independent director of Graham Holdings Company and serves on the Audit Committee of Berkshire Hathaway Inc.

|

The Coca-Cola Company |

18 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

|

CAROLYN EVERSON DIRECTOR SINCE: 2022 COMMITTEES: Talent and Compensation (Chair); Finance |

CAREER HIGHLIGHTS |

KEY QUALIFICATIONS AND EXPERIENCES |

|

Permira, a global investment firm ●

Senior Advisor (since January 2023)

Boston Consulting Group (“BCG”), a global consulting firm ●

Senior Advisor (since September 2023)

Instacart, a leading grocery technology company in North America ●

President (September 2021 to December 2021)

Facebook, Inc. (now Meta Platforms, Inc.) (“Facebook”), a social media and social networking service ●

Vice President, Global Business Solutions (2011 to 2021)

Microsoft Corporation (“Microsoft”), a multinational technology company ●

Vice President, Global Advertising Sales, Strategy and Marketing (2010 to 2011)

MTV Networks Company (“MTV Networks”), a television programming services company ●

Executive Vice President and Chief Operating Officer for U.S. Ad Sales (2004 to 2010)

Primedia Inc., a national TV media agency ●

Vice President and General Manager of several digital businesses (2001 to 2003)

PUBLIC BOARD MEMBERSHIPS Current Public Company Boards: ●

Under Armour, Inc. (since 2023)

●

The Walt Disney Company (since 2022)

Previous Public Company Boards ●

None

|

Extensive experience and understanding of marketing and innovation strategies, including with consumer packaged goods companies. At Instacart, oversaw its Retail, Business Development and Advertising businesses. At Facebook, led the global marketing solutions team focused on top strategic accounts and global agencies and oversaw media strategy, advertising sales and account management. At Microsoft, led the advertising business across Bing, MSN, Windows Live, Mobile, Gaming Atlas and the Microsoft Media Network. At MTV Networks, oversaw strategic planning, operations and finance for its U.S. Ad Sales. Serves as a Board member of The Walt Disney Company and Under Armour, Inc. Former director of Creative Artists Agency.

Extensive experience in senior operating roles in consumer-facing technology and media companies. At Facebook, led the company’s relationships with top marketers and agencies for its family of apps and oversaw the Creative Shop, offering creative guidance on mobile marketing. At MTV Networks, oversaw strategic planning and was responsible for its Direct Response businesses and for Generator, a cross-platform, cross-brand strategic sales and marketing group. Senior Advisor in the technology, media and telecom practice areas at BCG. Serves as a director of Unitary Ltd., a U.K.-based company building multimodal artificial intelligence to understand content in context, accurately and at scale, and as a director at Viam, Inc., a company that uses an engineering platform to leverage data, the cloud and artificial intelligence to help companies build solutions across all industries. Also serves as a director of Squarespace, Inc., a website building and hosting company.

Extensive experience leading at-scale, global consumer technology teams with a focus on growing global partnerships, global agencies and industry-leading business development. Member of the Council on Foreign Relations and member of the 2017 Class of Henry Crown Fellows within the Aspen Global Leadership Network at the Aspen Institute.

Senior Advisor at Permira, a global investment firm focused on the technology, consumer, healthcare and services sectors. Extensive experience overseeing risk associated with leading the development of business, marketing and innovation strategies at Facebook, Microsoft and MTV Networks. Serves on the Audit Committee of Under Armour, Inc.

Served as Chair of We Day, New York, which encourages and supports young people who are creating transformational social change. At Facebook, oversaw the development of an employee program that prioritized overall well-being to improve employee engagement and performance. |

The Coca-Cola Company |

19 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

|

THOMAS S. GAYNER DIRECTOR SINCE: 2023 COMMITTEES: Finance |

CAREER HIGHLIGHTS |

KEY QUALIFICATIONS AND EXPERIENCES |

|

Markel Group Inc. (“Markel”), a holding company comprised of diverse businesses, including specialty insurance, and investments ●

Chief Executive Officer (since January 2023)

●

Co-Chief Executive Officer (January 2016 to December 2022)

●

President and Chief Investment Officer (May 2010 to December 2015)

●

Chief Investment Officer (January 2001 to May 2010)

PUBLIC BOARD MEMBERSHIPS Current Public Company Boards: ●

Markel Group Inc. (since 2016)

●

Graham Holdings Company (since 2007)

Previous Public Company Boards (Past Five Years): ●

Cable One, Inc. (2015 to 2023)

●

Colfax Corporation (2008 to 2022)

Previous Boards for Registered Companies (Investment Company Act of 1940): ●

Davis Funds (consisting of 13 portfolios) (2004 to 2025)

|

Extensive experience in public company financial reporting, accounting and financial control matters and analysis and implementation of strategic investment initiatives, including allocation of capital, acquired in his various roles with Markel since 1990. Prior to joining Markel, served as a certified public accountant at PricewaterhouseCoopers LLP and as Vice President of Davenport & Company LLC of Virginia, a wealth management and financial advisory services firm. Serves as Chairman of the Audit Committee and is on the Finance Committee of Graham Holdings Company.

Significant senior leadership experience at Markel, including as Chief Executive Officer and previously as Co-Chief Executive Officer, President and Chief Investment Officer.

Oversaw the evolution of Markel to a global Fortune 500 family of companies and investments that provide diverse income streams and access to a wide range of investment opportunities.

Under the leadership of Mr. Gayner, Markel markets and underwrites specialty insurance products on a global basis.

Over 30 years of risk oversight and management experience at Markel, which markets and underwrites specialty insurance products on a risk-bearing basis. Director of Markel from 1998 to 2004, and since August 2016. Member of the Investment Advisory Committee of the Virginia Retirement System, an independent state agency, which is responsible for monitoring investments and investment opportunities and making asset allocation recommendations. Additional risk oversight experience as Chairman of the Audit Committee and member of the Finance Committee of Graham Holdings Company, and through former service on the Audit Committee of Colfax Corporation. |

The Coca-Cola Company |

20 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

|

MARIA ELENA LAGOMASINO DIRECTOR SINCE: 2008 COMMITTEES: Talent and Compensation; Corporate Governance and Sustainability |

CAREER HIGHLIGHTS |

KEY QUALIFICATIONS AND EXPERIENCES |

|

WE Family Offices, a global family office serving high-net-worth families ●

Chief Executive Officer and Managing Partner (since March 2013)

GenSpring Family Offices, LLC, a wealth management firm and an affiliate of SunTrust Banks, Inc. ●

Chief Executive Officer (2005 to 2012)

J.P. Morgan Private Bank, a division of JPMorgan Chase & Co., a global financial services firm ●

Chairman and Chief Executive Officer (2001 to 2005)

●

Various positions in private banking with The Chase Manhattan Bank, including as Managing Director in charge of its Global Private Banking Group (1983 to 2001)

The Coca-Cola Company ●

Prior service as Director (2003 to 2006)

PUBLIC BOARD MEMBERSHIPS Current Public Company Boards: ●

The Walt Disney Company (since 2015)

Previous Public Company Boards (Past Five Years): ●

None

|

Over 40 years of experience in the financial industry and a recognized leader in the wealth management industry. Chief Executive Officer and Managing Partner of WE Family Offices. Former Chief Executive Officer of GenSpring Family Offices, LLC. Founding member of the Institute for the Fiduciary Standard, a nonprofit formed in 2011 to provide research, education and advocacy regarding the fiduciary standard’s importance to investors receiving investment and financial advice.

Serves as Chief Executive Officer of WE Family Offices and served as Chief Executive Officer of GenSpring Family Offices, LLC and J.P. Morgan Private Bank.

Significant international experience in GenSpring Family Offices, LLC and J.P. Morgan Private Bank. During her tenure with The Chase Manhattan Bank, served as Managing Director of the Global Private Banking Group, Vice President of private banking in the Latin America region and head of private banking for the western hemisphere. Over 40 years of experience working with Latin America.

Experience with the regulatory framework applicable to banking institutions in Latin America during her tenure with The Chase Manhattan Bank and as Chief Executive Officer of J.P. Morgan Private Bank. Exposure to international geopolitical issues as a former board member of the Americas Society and the Cuba Study Group, as a former trustee of the National Geographic Society, and as a member of the Council on Foreign Relations.

Extensive oversight of risk associated with wealth management and investment strategies in WE Family Offices, GenSpring Family Offices, LLC and J.P. Morgan Private Bank. |

The Coca-Cola Company |

21 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

|

AMITY MILLHISER DIRECTOR SINCE: 2023 COMMITTEES: Audit (Chair) |

CAREER HIGHLIGHTS |

KEY QUALIFICATIONS AND EXPERIENCES |

|

PricewaterhouseCoopers LLP (“PwC”), an international professional services firm operating under the PwC brand ●

Vice Chair (2015 to June 2023)

●

Chief Clients Officer and Member of U.S. Leadership Team (2015 to 2020)

●

Market Managing Partner of Silicon Valley Practice (2011 to 2015)

●

Partner (1995 to June 2023)

PUBLIC BOARD MEMBERSHIPS Current Public Company Boards: ●

None

Previous Public Company Boards (Past Five Years): ●

None

|

Extensive experience as a certified public accountant. Joined PwC in 1985 in Assurance and was a partner from 1995 to June 2023. As a senior leader for over 15 years on many of PwC’s most significant clients across diverse industries, regularly engaged with members of company management, boards and audit committees on strategic, financial reporting, auditing, and regulatory and governance matters.

As Vice Chair at PwC from 2015 to June 2023, led Trust and Consulting practice development and service delivery for clients ranging from high-growth startups to market-leading multinationals. As Chief Clients Officer and member of PwC’s U.S. Leadership Team from 2015 to 2020, was responsible for markets, sectors and key clients across the U.S. firm. Market Managing Partner of PwC’s Silicon Valley practice from 2011 to 2015.

As Chief Clients Officer at PwC, launched cross-functional services including cloud and digital, transformation and cybersecurity risk. While leading PwC’s Silicon Valley practice, worked with leading technology companies as they innovated, scaled and raised capital.

Served on PwC’s Global Network Strategy Group, which defined PwC’s global strategy for 2020. While based in Switzerland for 17 years, founded PwC’s Switzerland-based Transaction Services Practice, a Center of Excellence for U.S./European cross-border deals, and worked with companies and their advisors on acquisition support, deal structuring, diligence execution, integration, complex carve-outs, divestitures, spin-offs, capital markets transactions and initial public offerings in the technology, pharmaceuticals, consumer and industrial products industries.

Extensive risk oversight and management experience associated with various leadership roles during more than 35 years of experience at PwC, including client risk management; risk/crisis management across U.S. geographies; and reputational, financial and regulatory risk management. |

The Coca-Cola Company |

22 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

|

JAMES QUINCEY DIRECTOR SINCE: 2017 CHAIRMAN SINCE: 2019 COMMITTEES: Executive (Chair) |

CAREER HIGHLIGHTS |

KEY QUALIFICATIONS AND EXPERIENCES |

|

The Coca-Cola Company ●

Chief Executive Officer (since May 2017)

●

President (August 2015 to December 2018)

●

Chief Operating Officer (August 2015 to April 2017)

●

President of the Europe Group (January 2013 to August 2015)

●

President of the Northwest Europe and Nordics business unit (October 2008 to January 2013)

●

President of the Mexico Division (December 2005 to October 2008)

●

President of the South Latin Division (December 2003 to December 2005)

●

Joined the Company as Director, Learning Strategy for the Latin America Group, and went on to serve in a series of operational roles of increasing responsibility in Latin America (1996)

PUBLIC BOARD MEMBERSHIPS Current Public Company Boards: ●

Pfizer Inc. (since 2020)

Previous Public Company Boards (Past Five Years): ●

None

|

Extensive strategic and financial experience acquired through various leadership positions in the Company, managing complex financial transactions, mergers and acquisitions, business strategy and international operations.

Chief Executive Officer of the Company since May 2017 and Chairman of the Board since April 2019. Previously served as President and Chief Operating Officer of the Company and as President of the Company’s Europe Group.

As CEO, has overseen the deployment of generative artificial intelligence technologies to supplement how the Company’s products are developed and brought to market and to help drive the Company’s marketing and digital transformation. As President of the Europe Group, implemented innovative strategies to improve the Company’s execution and brand portfolio. During his tenure in Latin America, was instrumental in developing and executing a successful brand, pack, price and channel strategy, which has now been replicated in various forms throughout the Company’s global system.

Over 25 years of Coca-Cola system experience, including extensive experience in international markets, such as Latin America and Europe. Member of the Board of Directors of the Special Olympics, the US-China Business Council, the Consumer Goods Forum and Pfizer Inc.

Since joining the Company in 1996, has held a multitude of operational roles within the Coca-Cola system, including as Chairman of the Board, Chief Executive Officer, President, and Chief Operating Officer. |

The Coca-Cola Company |

23 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

|

CAROLINE J. TSAY DIRECTOR SINCE: 2018 COMMITTEES: Audit |

CAREER HIGHLIGHTS |

KEY QUALIFICATIONS AND EXPERIENCES |

|

Technology Company Advisor/Limited Partner of Venture Capital Funds (since December 2022) Compute Software, Inc., an enterprise cloud optimization software company ●

Chief Executive Officer and Director (2017 to 2022)

Hewlett Packard Enterprise Company (“HPE”), an information technology company ●

Vice President and General Manager of Software (2013 to 2016)

Yahoo! Inc., a digital media company ●

Held several product leadership positions across the consumer search, e-commerce and advertising businesses (2007 to 2013)

PUBLIC BOARD MEMBERSHIPS Current Public Company Boards: ●

Morningstar, Inc. (since 2017)

Previous Public Company Boards (Past Five Years): ●

None

|

Provided strategic direction and managed profit and loss as Chief Executive Officer of Compute Software, Inc. and, in her position at HPE, was responsible for growing enterprise software sales.

Served as Chief Executive Officer of Compute Software, Inc. and served as Vice President and General Manager of Software at HPE.

At Compute Software, Inc., was responsible for developing an enterprise software platform for customers running on the cloud. At HPE, was responsible for engaging customers and partners through several new digital experiences, digital marketing and specialized sales models to drive growth in new customers and revenue. At Yahoo! Inc., held leadership positions across the consumer search, e-commerce and advertising businesses.

Advises technology companies. At Compute Software, Inc., was responsible for developing the artificial intelligence and decision-sciences-based software platform that dynamically optimizes cloud resource decisions and maximizes business value for companies running on the cloud. At HPE, created a new business and platform for offering customers enterprise software, including DevOps, Cybersecurity, Big Data and Application Development software. At Yahoo! Inc., was Senior Director of Product Management for Yahoo! Search and E-Commerce. Prior to Yahoo! Inc., spent three years at International Business Machines Corporation as a senior consultant focused on providing supply chain solutions to clients in the retail, high tech, and travel industries.

Extensive experience overseeing risk associated with the development and growth of enterprise software and consumer Internet businesses at Compute Software, Inc., and in her product leadership roles with HPE and Yahoo! Inc. Risk oversight experience through service on the Audit Committee of Morningstar, Inc. and as Chair of the Business Advisory Committee at Rosetta Stone Inc. Assesses risk as a limited partner of venture capital funds. |

The Coca-Cola Company |

24 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

|

DAVID B. WEINBERG DIRECTOR SINCE: 2015 COMMITTEES: Audit; Corporate Governance and Sustainability; Executive LEAD INDEPENDENT DIRECTOR SINCE: 2024 |

CAREER HIGHLIGHTS |

KEY QUALIFICATIONS AND EXPERIENCES |

|

Judd Enterprises, Inc., a private, investment management office with diverse interests in a variety of asset classes ●

Chairman and Chief Executive Officer (since 1996)

Digital Bandwidth LLC, a private, early-stage technology investing affiliate of Judd Enterprises, Inc. ●

President (since 1996)

Mayer, Brown & Platt (now Mayer Brown), a leading international law firm ●

Partner in the corporate, securities and investment management practice (1989 to 1996)

PUBLIC BOARD MEMBERSHIPS Current Public Company Boards: ●

None

Previous Public Company Boards (Past Five Years): ●

None

|

In his position at Judd Enterprises, Inc., oversees substantial assets in a wide variety of asset classes. Significant experience in reviewing financial statements as an investor and as a securities lawyer when structuring transactions. Serves on the Investment Committee of the Board of Trustees of Northwestern University.

Since 1996, has served as Chairman and Chief Executive Officer of Judd Enterprises, Inc. and President of Digital Bandwidth LLC.

Extensive entrepreneurial experience at Digital Bandwidth LLC, overseeing investments in early-stage companies focusing on technologies, including wireless networks, speech recognition, cybersecurity and radio frequency identification tags.

At Judd Enterprises, Inc., oversees international investments. As a partner of the Mayer, Brown & Platt law firm, structured cross-border investment management transactions. Serves on the Investment Committee of the Board of Trustees of Northwestern University, overseeing substantial exposure to emerging markets. Exposure to international issues as a member of the Council on Foreign Relations and the International Council of the Belfer Center for Science and International Affairs of the Kennedy School of Government at Harvard University. Served for eight years on the Board of Trustees of the Brookings Institution, a think tank whose mission includes improving governance at the global level.

Extensive risk oversight and management experience overseeing a private investment management office at Judd Enterprises, Inc. As a partner of the Mayer, Brown & Platt law firm, advised clients on a broad range of regulatory and transactional matters. Additional risk oversight experience through former service on the Executive, Audit and Finance Committees and current service on the Investment Committee of the Board of Trustees of Northwestern University. |

The Coca-Cola Company |

25 |

2025 Proxy Statement |

Company |

Voting Roadmap |

Governance |

Share Ownership |

Compensation |

Audit Matters |

Shareowner |

Annexes |

BOARD AND COMMITTEE GOVERNANCE

Role of the Board