Committed to Enduring Long-Term Growth

Executing On Our All-Weather Strategy

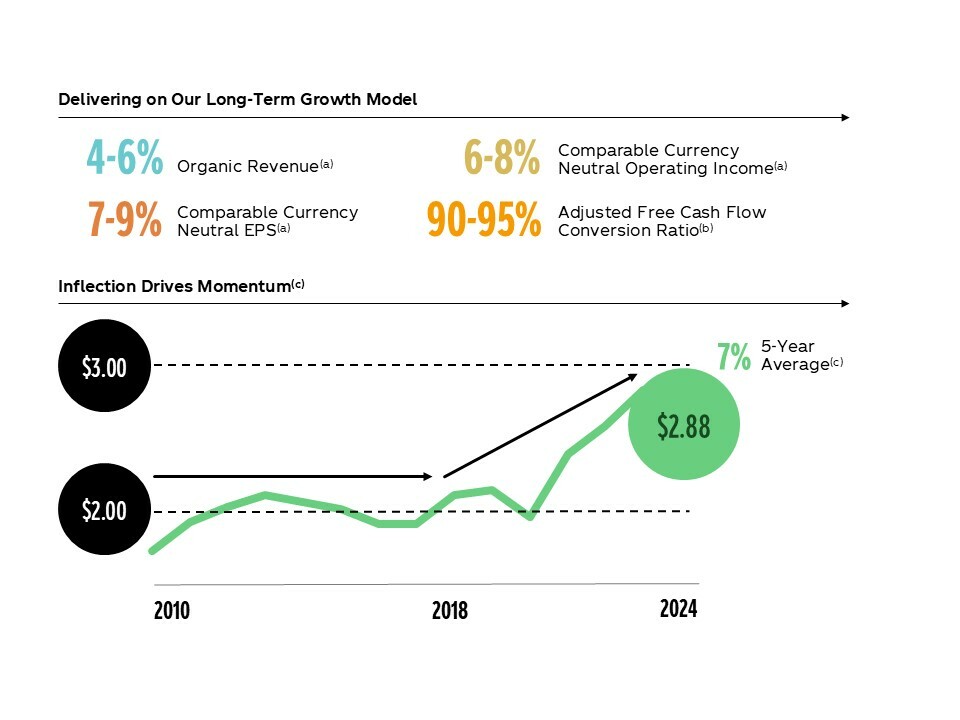

We believe we’re well positioned to deliver long-term balanced growth as several underpinnings remain constant:

- We operate in a great industry;

- We have many opportunities available to us, and we are primed to capture these and deliver sustained performance;

- Our powerful portfolio of brands, pervasive distribution system and the unwavering dedication of our system employees are clear advantages

Our ability to create enduring value over time has been a hallmark of our company since its inception, and the three strengths outlined above give us confidence in our ability to continue to do so.

Relentless Focus on Value Creation

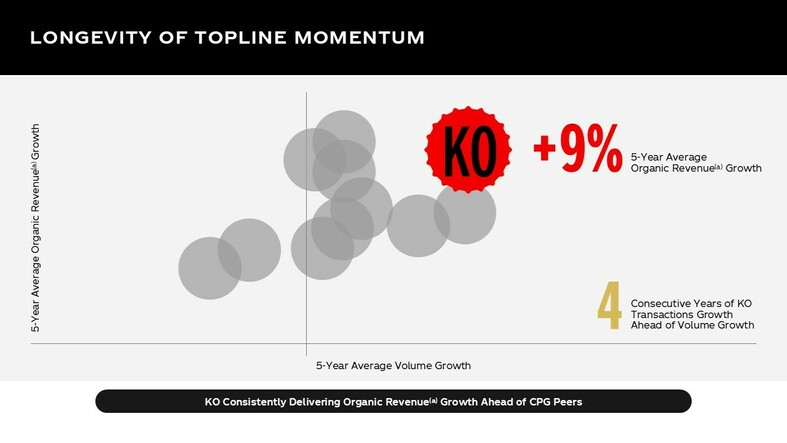

Despite what remains a dynamic operating environment, we continue to deliver consistent volume and organic revenue growth (non-GAAP). Our continued efforts to curate a powerful portfolio of growth brands are reflected in the longevity of our top-line momentum, which is above our CPG peers over the last five years. We also continue to place an emphasis on growing transactions ahead of volumes by focusing on growing sales in away-from-home channels and single-serve / immediate consumption packages.

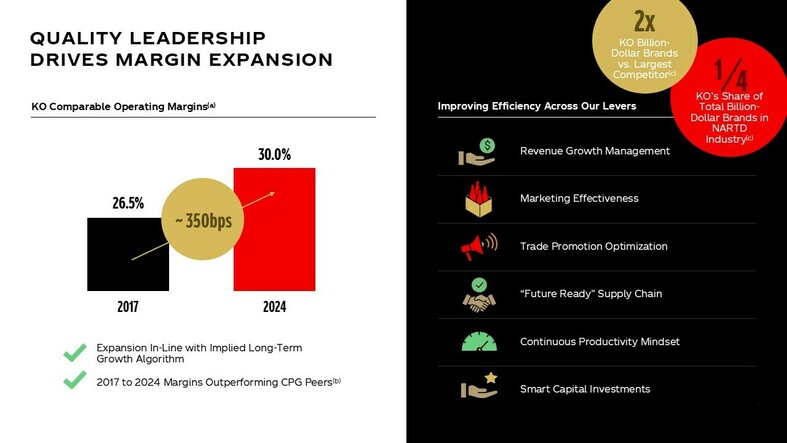

Our company has expanded margins while increasing investment in the business. Quality leadership, defined as our share position relative to competitors’ share position, is closely connected with margins. By continuing to leverage data throughout the P&L, we’re achieving greater granularity which is allowing our dollars to go further. Our global scale also affords us with a unique competitive advantage in our supply chain. As the benefits from our marketing transformation begin to take hold, we see additional effectiveness and efficiency opportunities to fuel topline growth and drive margin expansion.

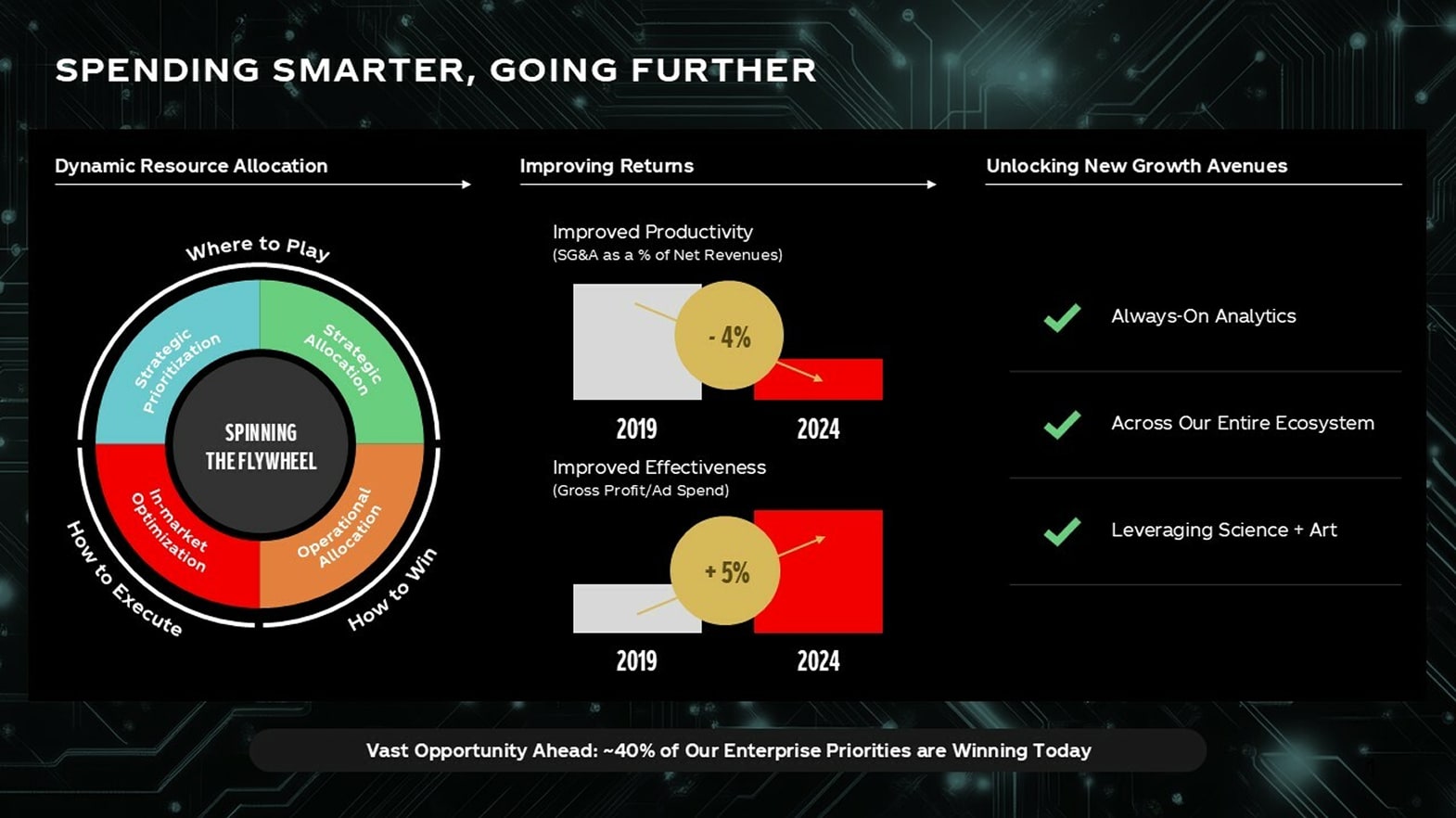

Our company's topline growth strategy is driven by dynamic resource allocation, ensuring balanced and quality growth through smarter spending. Each country-category combination in our portfolio has a specific role, and we continually track performance to optimize resource allocation. By leveraging our internally developed digital platform, we are unlocking new opportunities and delivering more meaningful outputs, leading to bigger impacts. In areas of strong leadership, we aim to grow gross profit ahead of marketing investment, while in emerging areas, we prioritize marketing investments to build leadership. Despite currently winning in only ~40% of our top priorities, the benefits from ongoing investments and increased intelligence provide significant room for improvement and further growth. This disciplined approach underscores our belief that quality leadership and strategic investment drive profitability.

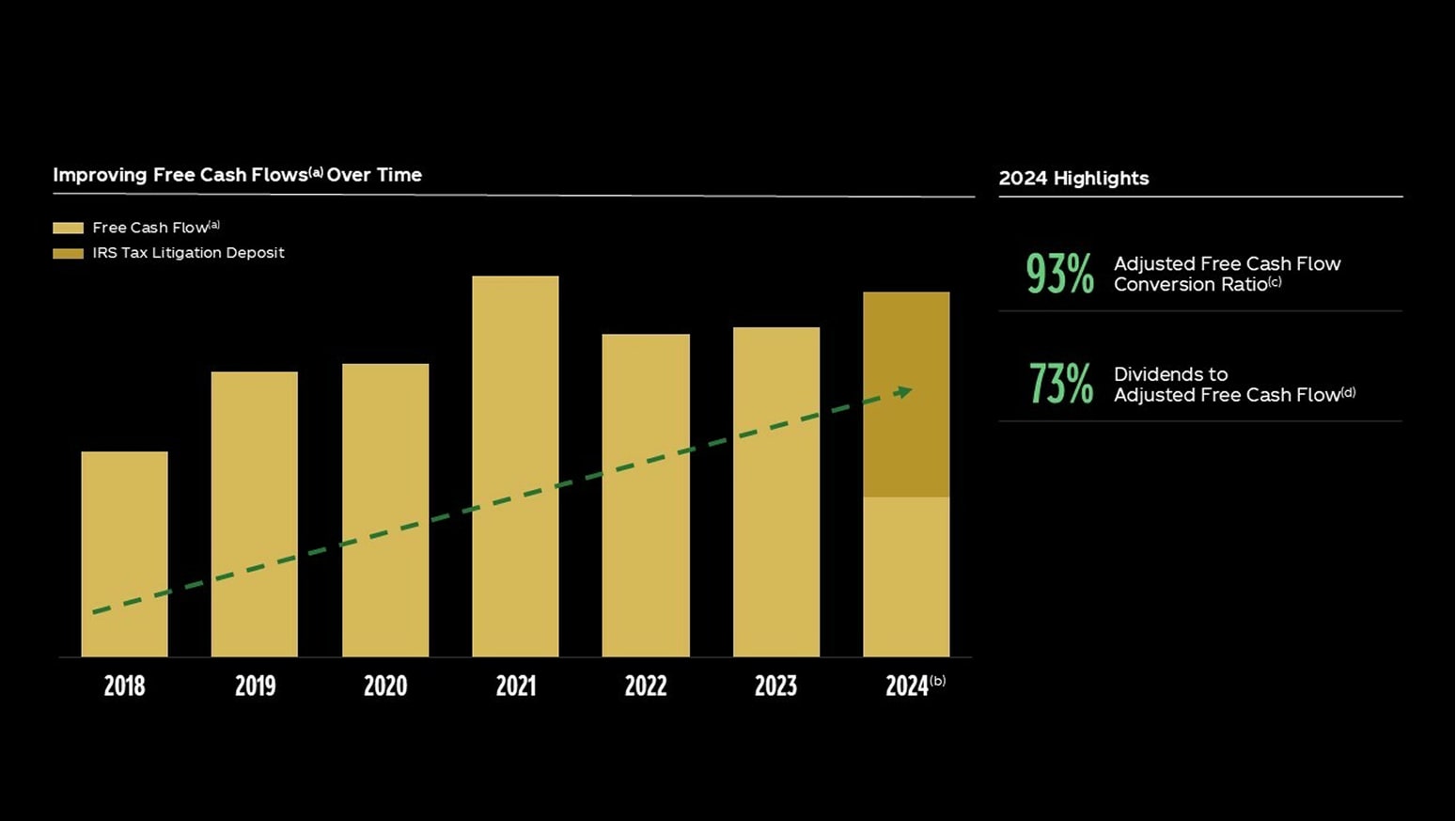

Intently Focused on the Cash Agenda

Consistently delivering on the top line has transformed our ability to sustainably deliver on the bottom line. Our focus to invest and to grow our businesses around the world can sometimes be a headwind to accruing cash, yet a mindset of scarcity has promoted a tremendous amount of creativity, enabling us to continue to invest appropriately in higher-returning areas.

As such, we have maintained our strong free cash flow trajectory by focusing on strategic investments that will further our growth and ensure long-term financial health.

(a) Free cash flow = net cash provided by operating activities less purchases of property, plant and equipment, Non-GAAP; (b) Free Cash Flow Excluding the IRS Tax Litigation Deposit = Free cash flow excluding the company’s IRS tax litigation deposit that was paid in 2024, Non-GAAP; (c) Adjusted Free Cash Flow Conversion Ratio = Free cash flow adjusted for significant cash inflows & outflows / GAAP net income adjusted for noncash/nonoperating items impacting comparability, Non-GAAP; (d) Dividends to adjusted free cash flow = dividends paid to shareowners of The Coca-Cola Company / adjusted free cash flow, Non-GAAP

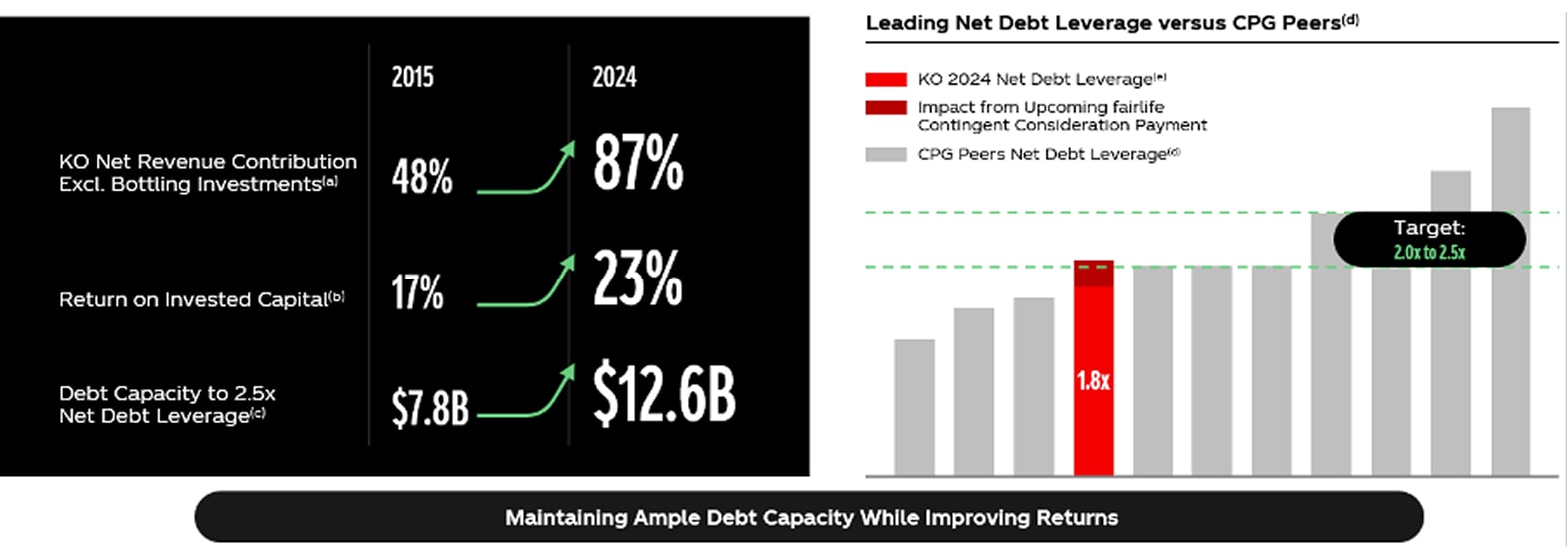

Nurturing a Fit-for-Purpose Balance Sheet

Balance sheet strength and flexibility are essential to supporting our ambitious growth agenda, and we have taken a holistic approach to optimizing our investments to drive the business. By pursuing our "asset right" agenda and making progress on our refranchising journey, we allow ourselves and our bottling partners to focus on core competencies. Our net revenue contribution excluding Bottling Investments has increased from 48% in 2015 to 87% in 2024 while our Return on Invested Capital has increased by 6 points over the same time period. This strategic approach ensures that our global franchise model remains an advantage, positioning us for long-term enduring growth.

(a) Total Net Revenue less Bottling Investments net revenues as a percentage of total Company net revenues; (b) Return on Invested Capital (ROIC) = Comparable Net Operating Profit After Tax (NOPAT) divided by two-year average of invested capital. ROIC is a non-GAAP financial measure (c) Debt Capacity = High end of target net debt leverage minus current net debt leverage multiplied by Comparable EBITDA, Non-GAAP; (d) Consumer packaged goods (CPG) repre-sents select large cap, food, household products and beverage peers. 2024 amounts are based on year-to-date Q3 except for KO, which is based on full year 2024. All data obtained from FactSet; (e) Non-GAAP

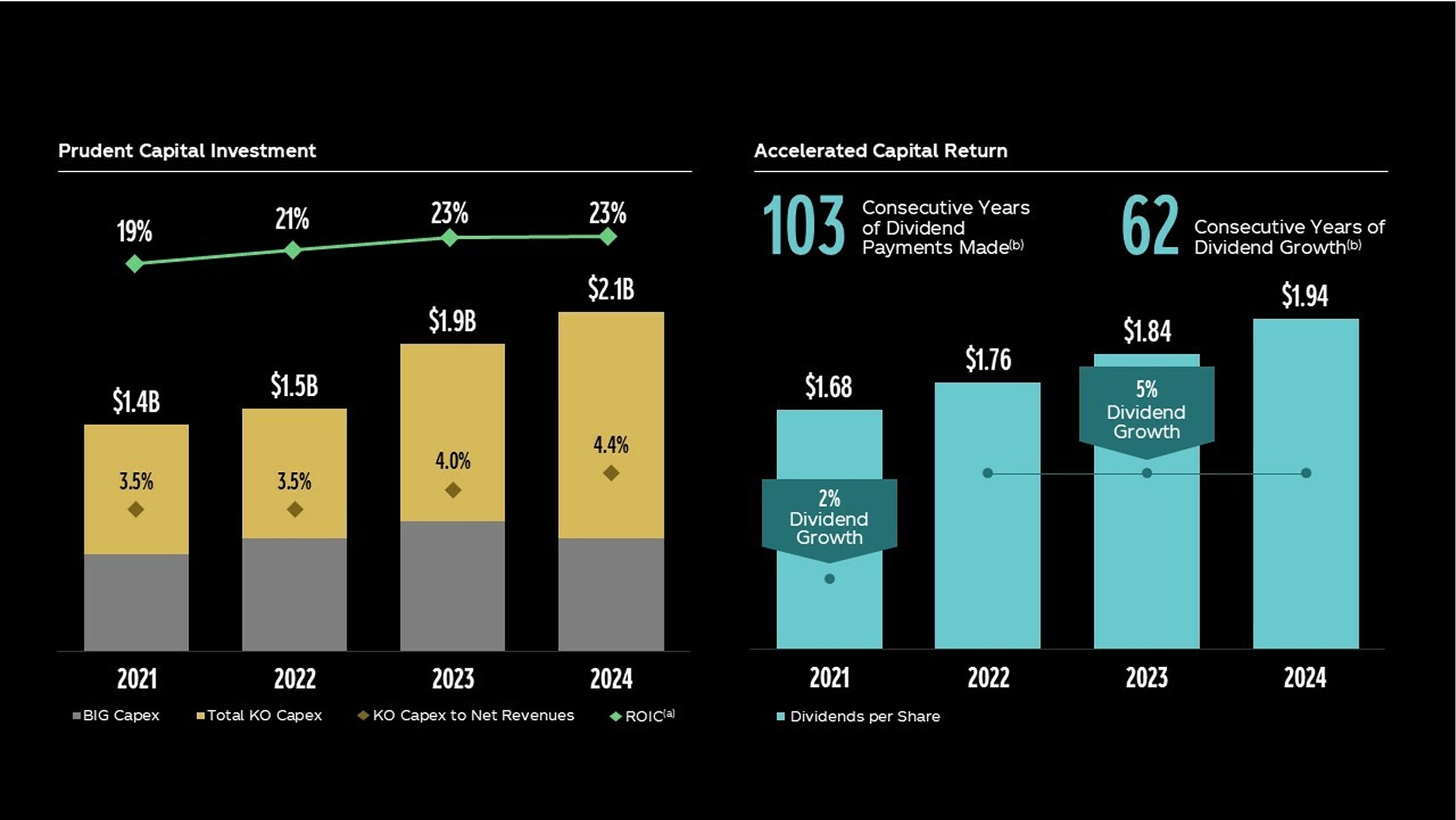

Unwavering Consistency to Reinvest in Our Business and Grow Our Dividend

Our steadfast commitment to reinvesting back into our business and returning cash to shareholders is a defining characteristic of our capital allocation strategy. As we’ve stepped-up our capital investments in recent years to support high-growth areas, we’ve simultaneously improved the return profile of our investments via an enhanced Return on Invested Capital. This has allowed us to increase our dividend growth profile from 2% in 2021 to 5% since 2022.

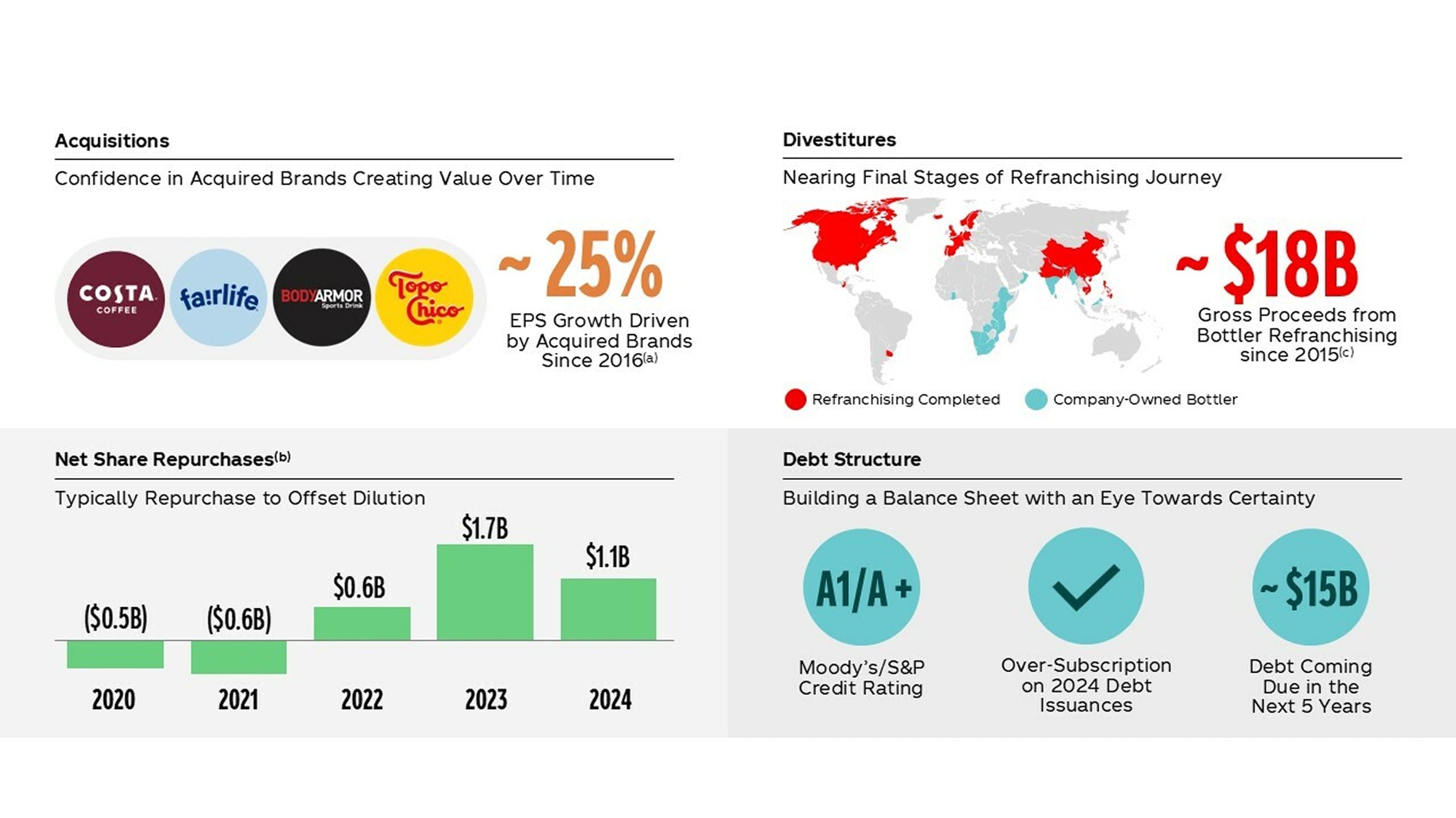

Staying Flexible and Opportunistic

In addition to our commitment to reinvest back into our business and return cash to shareholders, we also remain flexible and opportunistic with our overall capital allocation agenda. The acquisitions and divestitures that we have achieved, which include recent examples such as Costa, fairlife, BodyArmor and Topo Chico, are strengthening our company. We have also realized ~$18 billion of gross proceeds from bottler refranchisings since 2015. Recently, we have primarily been focused on repurchasing shares to offset dilution, while maintaining an optimal debt structure remains a top-priority.

Non-GAAP Reconciliations

Financial metrics referenced on this page are from The Coca-Cola Company's 2025 CAGNY Presentation. View the reconciliation of Non-GAAP Financial Measures linked below for more information.